Cotton Is Set for "Epic Showdown" Between Hedge Funds and Mills

This article by Marvin G. Perez for Bloomberg may be of interest to subscribers. Here is a section:

Hedge funds are abundantly optimistic about cotton prices. But just as the excitement escalates, farmers are gearing up to increase plantings in the U.S., the world’s top exporter.

Cotton has been the recent star of the crop world, with prices heading for a third straightly monthly gain. The advance was underpinned by demand that’s poised to increase to the highest since 2008. That captured the attention of investors, who have piled into speculative wagers that futures will keep climbing. But it’s also caught the eye of American farmers who are in the midst of making planting decisions at a time when grain prices have stayed historically low.

U.S. cotton plantings this year will probably reach the highest since 2011, a Bloomberg survey showed. The rising acreage could be why commercial traders such as textile mills have taken the opposite approach of hedge funds and are holding a huge short position, or bets on falling prices.

“The market is setting up for another epic showdown between speculative longs and trade shorts, and at this point it is still anybody’s guess who will prevail,” said Peter Egli, the Chicago-based director of risk management for Plexus Cotton Ltd.

“This could turn into a drawn-out process, with prices moving in a narrow band for another two or three months before a final blow.”

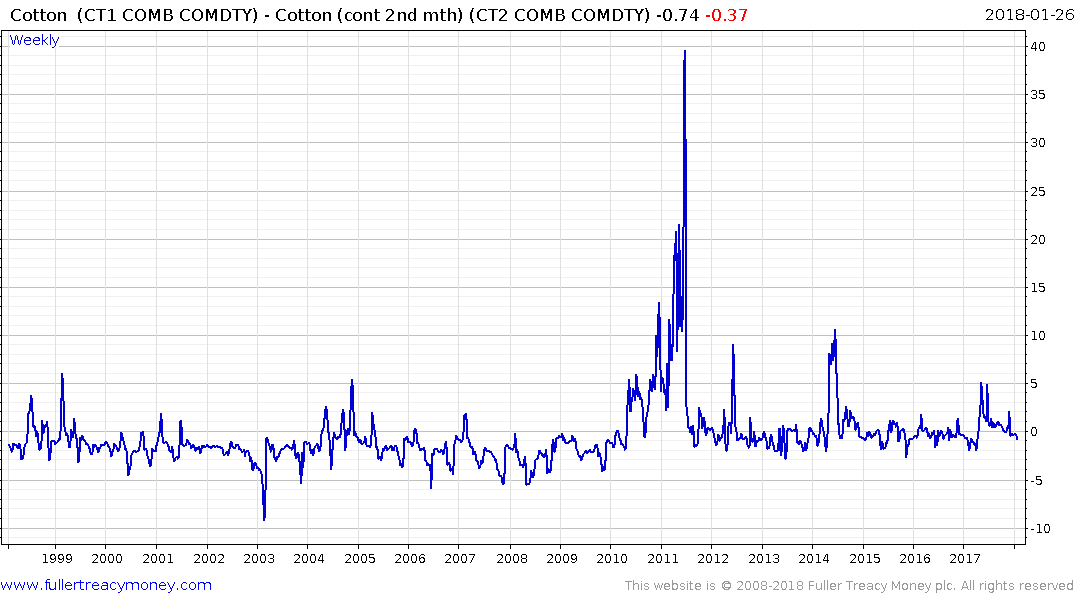

Cotton is trading in contango between the March 2018 contract and the July before moving into backwardation between October and March 2019. When we chart the spread between the front and second month contracts we get a graphic representation of the seasonality of the cotton market which tells us that backwardations in May are to be expected as the old crop expires through July and makes way for the new crop in October.

The front month price retested the 85¢ level on January 12th and is now unwinding its short-term overbought condition. Medium-term the price has been confined to a volatile range since 2012 and a sustained move above 85¢ will be required to confirm a return to medium-term demand dominance.

.png)

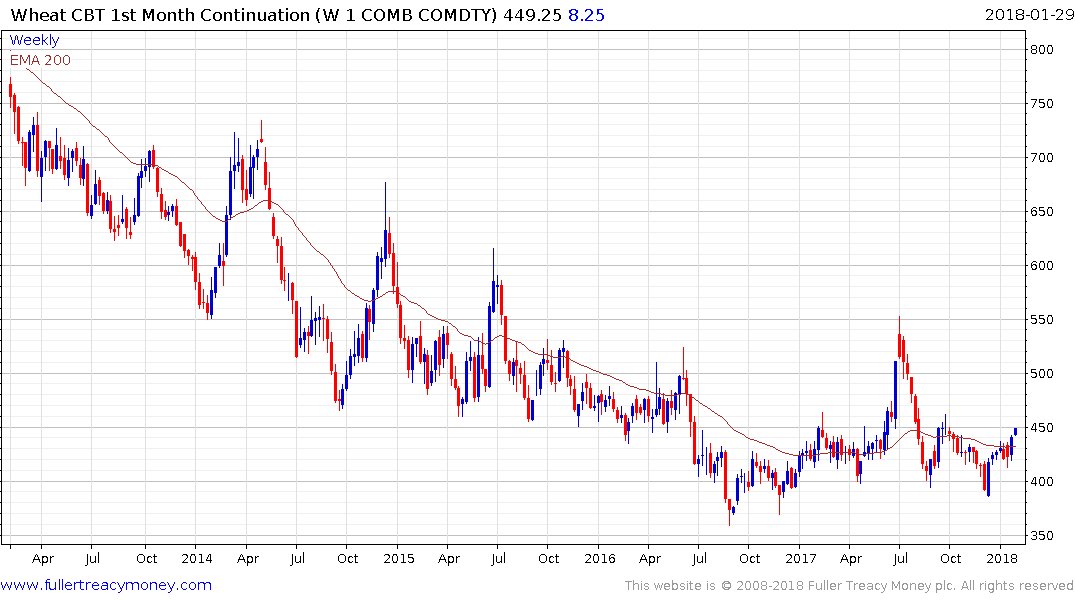

From a broader perspective, the primary agricultural commodities have so far not taken part in the recovery evident in the metals and energy markets. Corn, soybeans, wheat has been ranging in a volatile manner for two years. Sugar and arabica coffee are still searching for lows while cocoa has been ranging for a year.

.png)

This chart from OurWorldData.org highlights the fact that consumption of food commodities remains on an inexorable trend higher. So far, the world has been highly effective at meeting that rising demand but it does leave the market susceptible to supply disruptions not least due to droughts or floods. Considering the fact that food commodities have not rallied there is no supply issue right now but ranges are eventually resolved with breakouts so this is a sector to keep an eye on.

Wheat is showing initial signs of renewed strength but a sustained move above 450¢ would begin to confirm a return to demand dominance beyond the short.

Rough Rice has been ranging mostly between $9 and $13 since 2015 and is currently firming from the region of the trend mean.