Coronavirus: The Black Swan of 2020

This note from Sequoia may be of interest to subscribers. Here is a section:

Unfortunately, because of Sequoia’s presence in many regions around the world, we are gaining first-hand knowledge of coronavirus’ effects on global business. As with all crises, there are some businesses that stand to benefit. However, many companies in frontline countries are facing challenges as a result of the virus outbreak, including:

Drop in business activity. Some companies have seen their growth rates drop sharply between December and February. Several companies that were on track are now at risk of missing their Q1–2020 plans as the effects of the virus ripple wider.

Supply chain disruptions. The unprecedented lockdown in China is directly impacting global supply chains. Hardware, direct-to-consumer, and retailing companies may need to find alternative suppliers. Pure software companies are less exposed to supply chain disruptions, but remain at risk due to cascading economic effects.

Curtailment of travel and canceled meetings. Many companies have banned all “non-essential” travel and some have banned all international travel. While travel companies are directly impacted, all companies that depend on in-person meetings to conduct sales, business development, or partnership discussions are being affected.It will take considerable time — perhaps several quarters — before we can be confident that the virus has been contained. It will take even longer for the global economy to recover its footing. Some of you may experience softening demand; some of you may face supply challenges. While the Fed and other central banks can cut interest rates, monetary policy may prove a blunt tool in alleviating the economic ramifications of a global health crisis.

The knock-on effect to consumer confidence from the coronavirus and most particularly its influence on social interaction is a wild card for the global economy. It should help to focus minds on how best to deal with the situation but the global response, so far, has been haphazard.

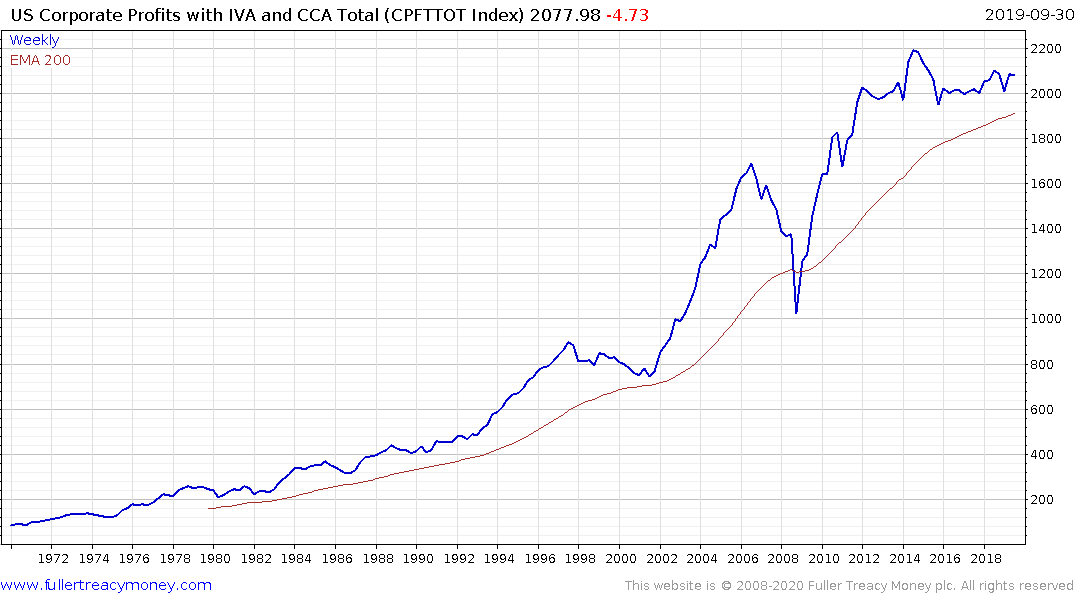

US Corporate Profits have been static for most of the last five years and that has been supported by robust consumer demand. If people delay or cancel spending plans it will have a significant effect on the velocity of money. That’s an important thing to remember because the Fed’s response to declining velocity is a kneejerk boost in supply of money.

Something I have noticed on a number of occasions over the last decade has been the tendency of dividend aristocrats to bounce once they yield 3.5%. Proctor & Gamble for example has bounced from that yield on multiple occasions since 2010. It currently yields 2.45% so there is ample scope for some yield expansion. That is equally true of McDonalds, Johnson & Johnson and other large reliable dividend paying companies.

The compression in government bond yields has helped mitigate the downward pressure on their shares for the moment. However, if the selling pressure accelerates the yield level is a handy area to consider where a potential floor might reside.

Back to top