Copper Soars Most in 13 Months as Trading Stops on China

This article by Joe Deaux for Bloomberg may be of interest to subscribers. Here is a section:

The surge triggered a “stop spike event,” and trading halted for 10 seconds with all transactions remaining valid, Damon Leavell, a spokesman for Chicago-based CME Group Inc. (CME:US), the Comex owner, said in a telephone interview. On Dec. 24, some deals were revised following an error after prices jumped as much as 4.2 percent.

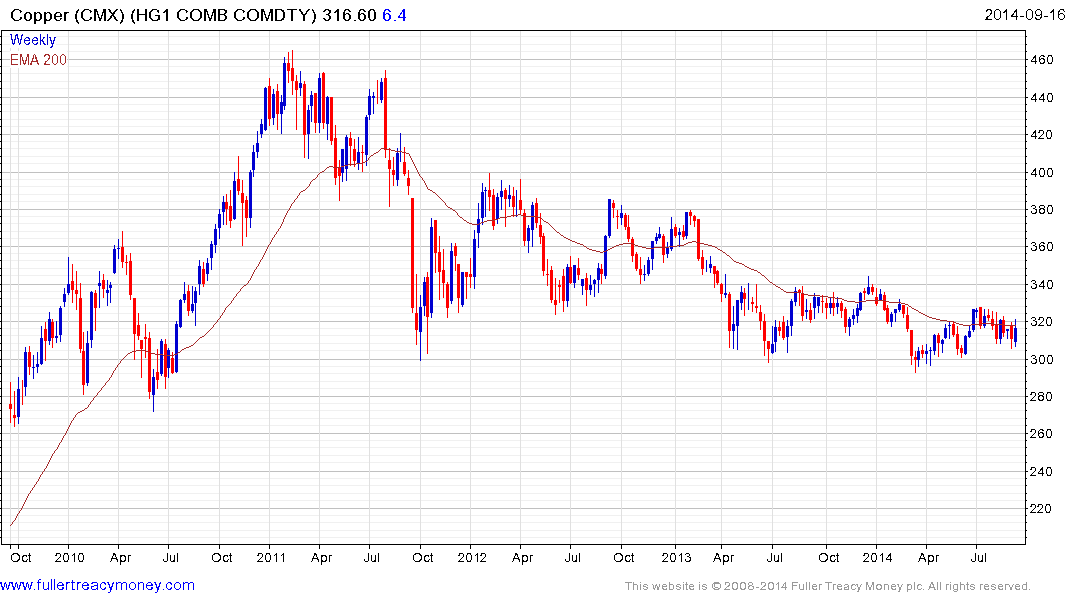

Copper has not made headlines like this for quite some time. The price broke below the psychological $3 area in March as the massive Mongolian Oyu Tolgoi mine came on line but bounced back as the Chinese inventory fraud scandal broke. Today’s limit move suggests short covering and comes in the region of the progression of higher reaction lows evident since March. A sustained move below $3.05 would be required to question medium-term scope for continued higher to lateral ranging.

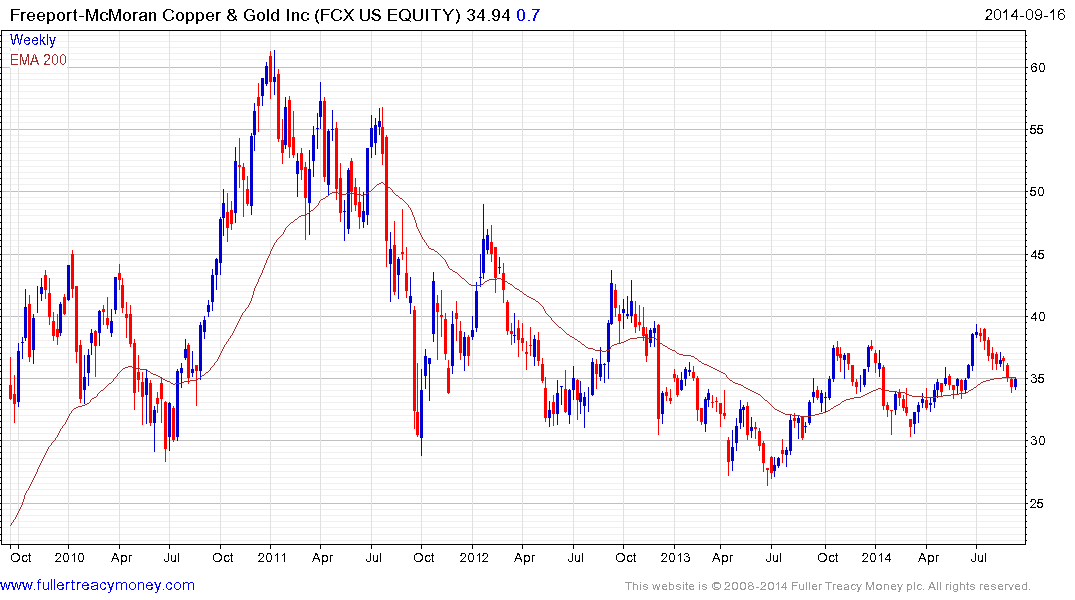

Freeport McMoRan found support today in the region of the 200-day MA and a sustained move below it would be required to question medium-term scope for continued higher to lateral ranging.

Southern Copper has a similar pattern.