Copper May Need a Very Hot Chile to Save it From a Cool China

This note by Benjamin Dow for Bloomberg may be of interest to subscribers. Here it is in full:

Looking at LME copper's current price levels, ie near a 10-month low, it seems it would take more than the risk of labor conflict in Chile to keep the red metal from slipping further to $6,000 per tonne -- especially considering the state of the Chinese economic path, which is currently searching for answers.

Verbal intervention in the tumbling yuan and the do-or- don't nature of the deleveraging debate don't give copper longs much of a handle to grasp. In addition, there's the tense wait for the global trade-war boot to drop, and the fact that copper has risen for seven of the past ten quarters. Chilean mine strikes may have to be acrimonious and long to save Dr. Copper.

China is the world’s largest consumer of industrial resources and its markets are currently in a state of flux as measures to contain speculation are being complicated by worries about trade tariffs. Meanwhile the trend of workers demanding higher pay is not isolated to any one country so there is scope for labour disruptions but that is a not a predictable outcome.

.png)

Copper failed at the upper side of its range in June and has fallen for four consecutive weeks to break downwards. It has now broken its progression of higher reaction lows and is sustaining the move below its trend mean for the first since wince late 2016. A sustained move back above $3 is now required to question potential for a further test of underlying trading.

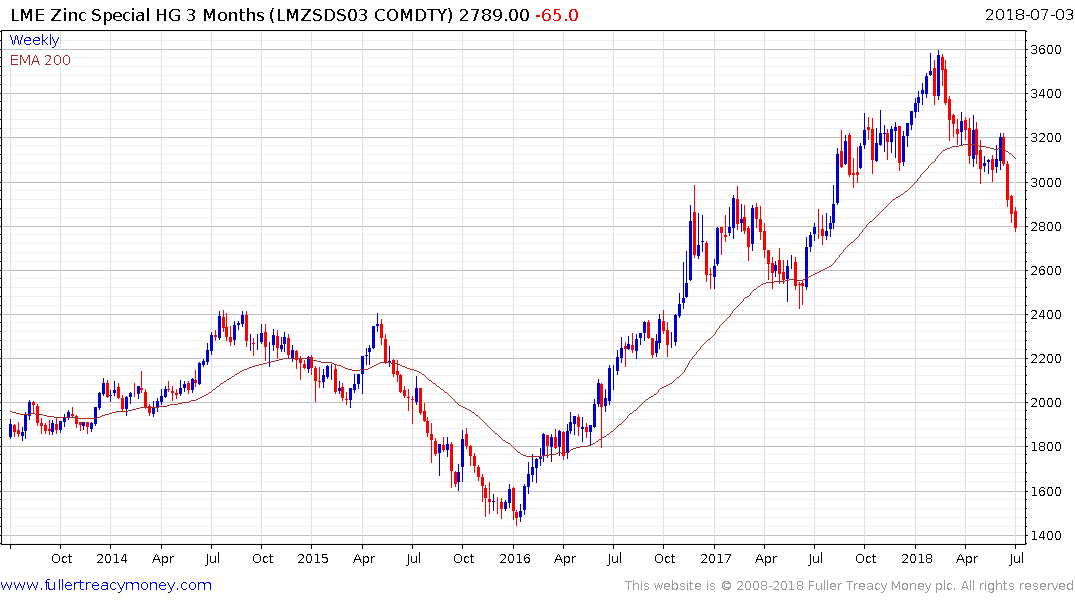

Zinc trended higher in a consistent manner until four weeks ago when it dropped to break its progression of higher reaction lows. While short-term oversold, this represents a major trend inconsistency.

The LME Metals Index dropped below its trend mean last week and has so far extended that decline this week.

.png)

The FTSE350 Mining Index failed to sustain the move above 20000 in June and is now falling back to test the medium-term progression of higher reaction lows. It needs to hold the 16600 level if medium-term scope for continued higher to lateral ranging is to be given the benefit of the doubt.

.png)

The S&P/ASX 300 Resources Index has been flattered by the weakness of the Australian Dollar but is also susceptible to a mean reversion if weakness in industrial resources prices persists.