Construction of New U.S. Homes Declines on Plunge in South

This article by Victoria Stilwell for Bloomberg may be of interest to subscribers. Here is a section:

Construction of single-family houses declined 9 percent to a 575,000 rate, the weakest since November 2012, the report showed. The drop was influenced by a 20.1 percent plunge in the South, the biggest decrease since May 2010.

Work on multifamily homes, such as apartment buildings, fell 9.9 percent to a 318,000 rate. The figures on multi-unit construction can be volatile month to month.

Residential real estate has been slow to emerge from an early-year, winter-driven slump -- a development not lost on Yellen.

?While housing has recovered from its lows, “activity leveled off in the wake of last year’s increase in mortgage rates, and readings this year have, overall, continued to be disappointing,” Yellen said this week during her semi-annual testimony to the Senate Banking Committee.

On my daily click through of global markets I noticed lumber prices may be rolling over; having at least encountered resistance in the region of the progression of lower rally highs following a reversionary rally. Since home construction represents a significant market for the commodity the underperformance of the S&P500 Homebuilders Index is probably related.

The Index surged out of its base in 2012 and hit an accelerated peak near 700 a year ago, before experiencing a sharp pullback. It will need to hold the 550 area on the current pullback if medium-term potential for additional higher to lateral ranging is to be given the benefit of the doubt.

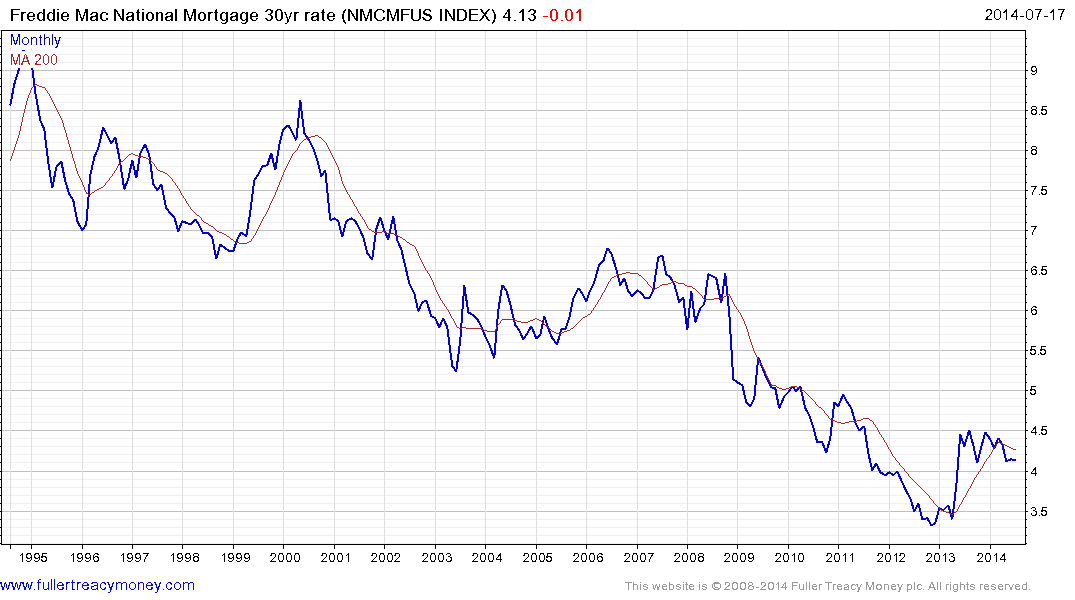

Freddie Mac National Mortgage 30yr rates are currently near 4.15% and they continue to consolidate last year’s surge. The lows near 3.3% are unlikely to be retested but a sustained move above the 200-day MA will be required to signal a return to rate expansion.

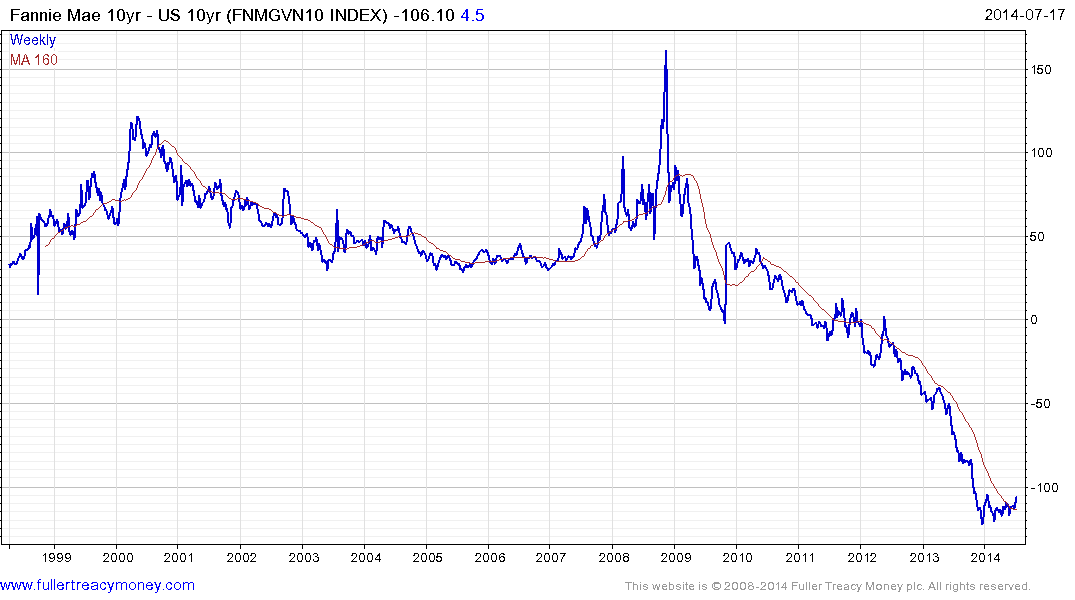

Fannie Mac 10-year spreads over Treasuries compressed steadily over the last five years but stalled last year and have held a progression of incrementally higher reaction lows since. At negative 100 basis points there is ample potential for additional expansion.

Back to top