Commodity currencies

The decline in the Continuous Commodity Index represents a challenge for commodity producers. What has been a constantly growing source of income has morphed into a much more volatile price environment which has been deteriorating of late. As investors take stock of the implications for the respective countries, pressure has come to bear on their currencies not least because of the relative strength of the US economy and the Dollar.

The US Dollar continues to post new highs against the Ruble and while overbought there is no evidence just yet that the trend has ended.

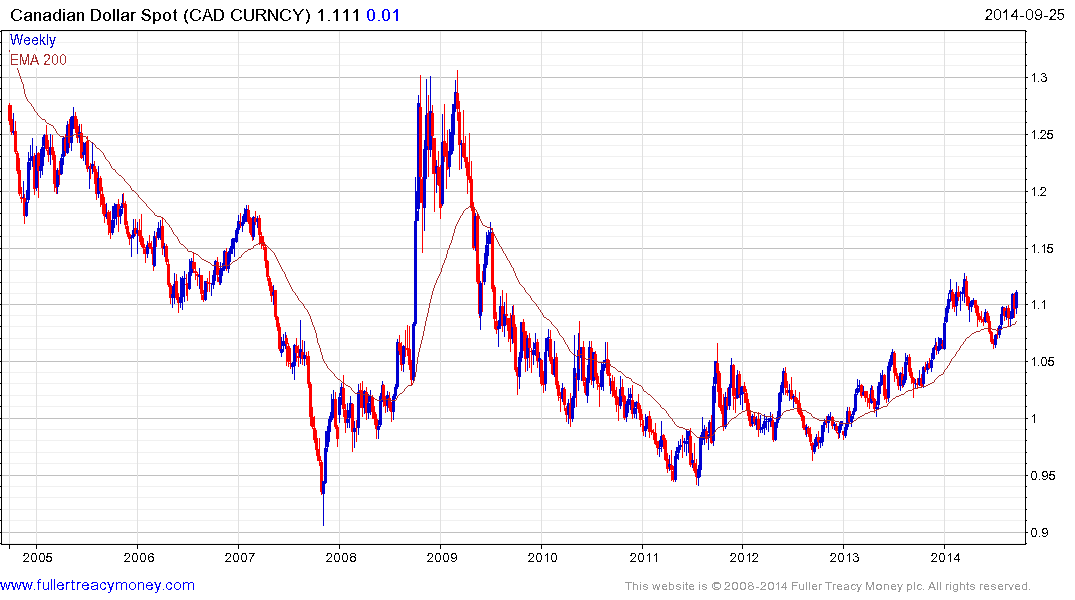

The US Dollar has first step above the base characteristics against the Canadian Dollar suggesting a medium-term demand dominant environment is unfolding.

The US Dollar continues to trend reasonably consistently against the South African Rand.

The Australian Dollar has first step below the top formation characteristics against the US Dollar and is testing the lower side of its range.

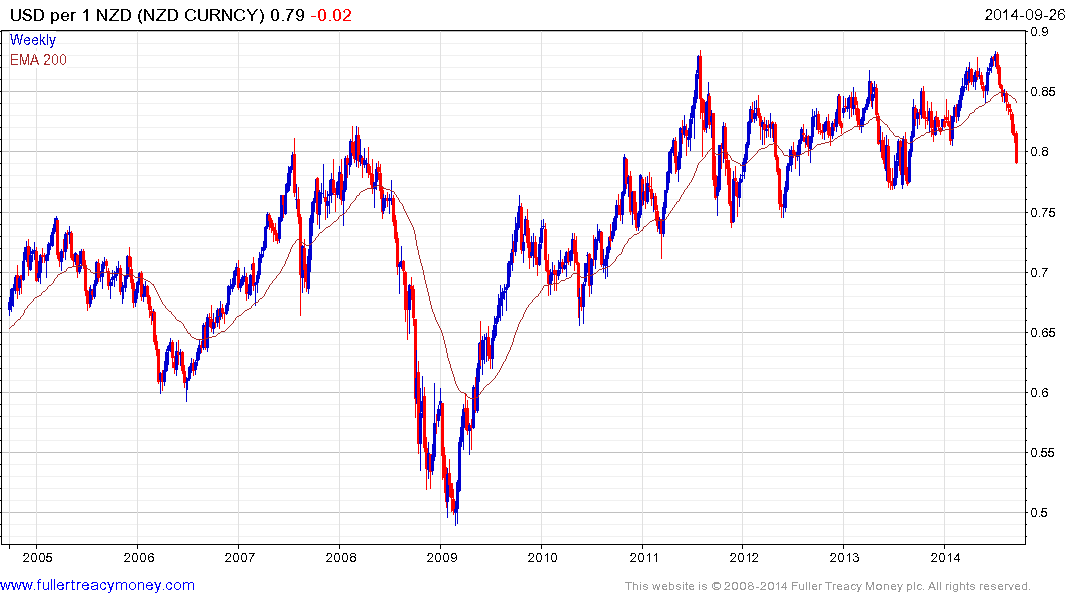

The New Zealand Dollar has fallen to test its progression of higher reaction lows and will need to find support soon to avoid a more significant deterioration.

The US Dollar has returned to test the BRL2.4 area which is where the Bank of Brazil has intervened to support the Real on previous occasions.

The Norwegian Krone might be one of the best capitalised currencies in the world but remains susceptible to selling pressure as long as traders have a bearish outlook on Brent crude.

The US Dollar is now testing an area of previous resistance against the Mexican Peso.

From the above charts we can conclude that the Dollar has already had a big move, that short-term overbought conditions are evident and that it is testing areas of previous resistance against a number of currencies. Clear countertrend dynamics will be required to begin to pressure commodity currency shorts and suggest at least some steadying.

Back to top