Commodities Set for Best Week Since April, Fueled by Copper, Oil

This article by Rupert Rowling and Mark Burton for Bloomberg may be of interest to subscribers. Here is a section:

After a months-long rout, commodities are starting to show signs of life.

The Bloomberg Commodities Index has climbed 2.1 percent this week, on track for the best performance since April. Copper, oil, soybeans and silver are all poised set to end the week higher, helped by a combination of tight supplies, speculation that recent losses are overdone and a weaker dollar.The gains are small, but it’s clear that the selloff that started in May has dissipated and sentiment is turning bullish. Barclays Plc said in a report today that copper has bottomed. Commodity bull Goldman Sachs Group Inc. predicted gains in raw materials through the end of the year.

“The two main factors behind commodities rising are the end of the dollar strength, with the dollar seeming to have peaked, and risk appetite rising,” said Carsten Fritsch, commodity analyst at Commerzbank AG.It’s a shift from earlier this year, when the Bloomberg Commodities Index plunged about 10 percent over three months. Copper entered a bear market in August, and assets like arabica coffee and platinum are still near decade-lows.

The Continuous Commodity index has been ranging between 400 and 450 since early 2016. Its failed upside break out in May is a good example of a rule of thumb from The Chart Seminar; when the dynamic of the failure is greater than the dynamic of the breakout, the chances are it will go back down and test the lower side of the range.

The price is now at the lower boundary and evidence is improving that a low of at least near-term and potentially medium-term significance is in the offing.

Brent Crude oil has been an exception to the selling pressure that has prevailing in the commodity sector. It is now testing the upper side of its most recent range and a sustained move below the trend mean would be required to question medium-term uptrend consistency.

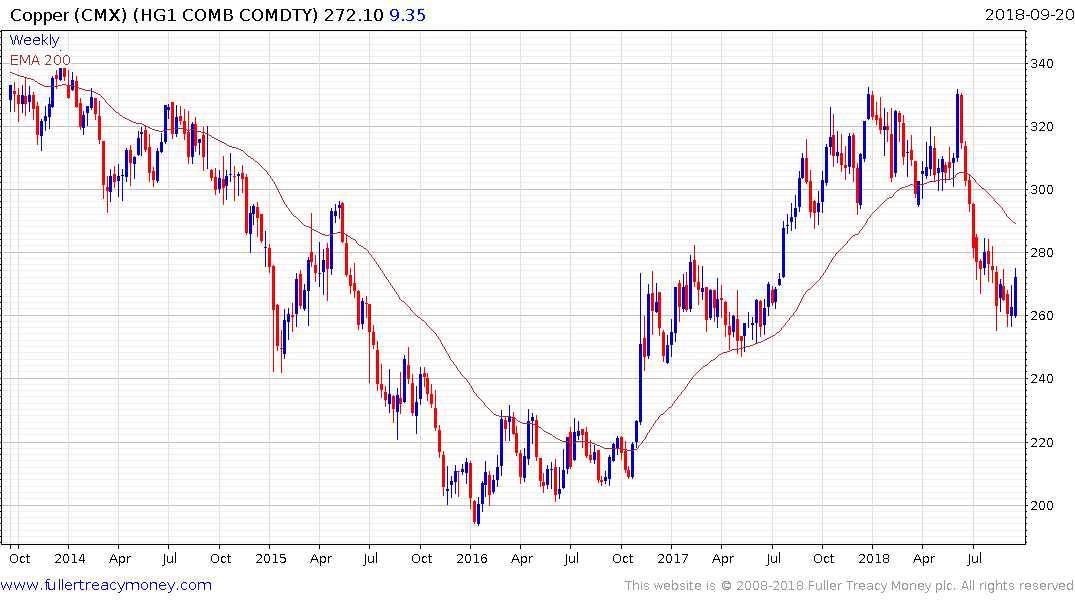

Copper has bounced emphatically this week on short covering to break its five-month downtrend. A clear downward dynamic would now be required to question potential for a further test of overhead trading.

Nickel had been the best performing industrial metal this year until it succumbed to selling pressure in June. The ETFS Nickel price found support around $12 this month and is rallying to challenge the four-month downtrend. A sustained move back above the trend mean would signal a return to medium-term demand dominance.

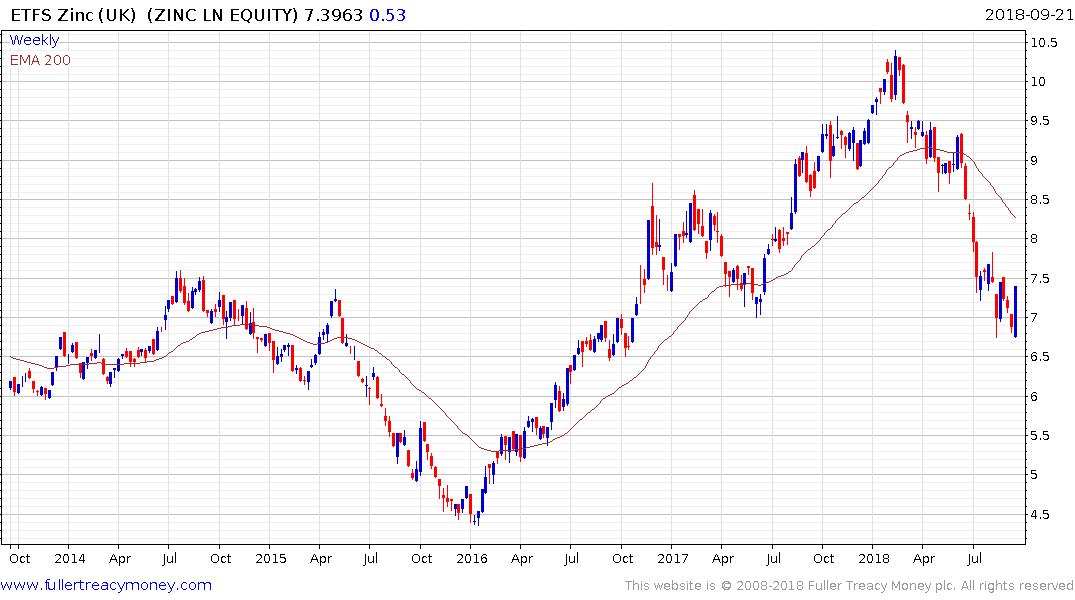

The ETFS Zinc price posted an upside weekly key reversal this week to signal a low of at least near-term significance. That’s improved the odds of a reversionary rally to unwind the oversold condition relative to the trend mean and upside follow through on Monday would confirm the signal.

The FTSE-350 Mining Index rallied emphatically this week to challenge the region of the trend mean but it needs to sustain a move above it to confirm more than a near-term low.

The S&P/ASX 300 Resources Index has bounced from the region of the trend mean and remains in a reasonably consistent medium-term uptrend.

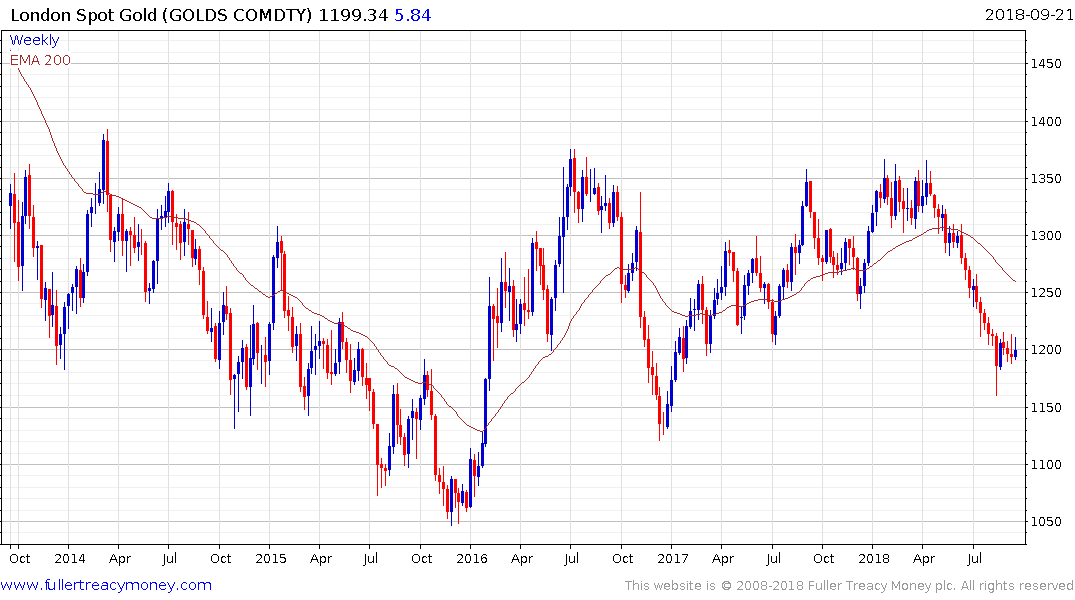

Meanwhile gold pulled back today as it continues to pause around the psychological $1200 level. It needs to break up and away from the current range to clearly signal a return to demand dominance beyond short-term steadying.