Commodities Quarterly: Punishing Blows

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

The fallout from the “Dieselgate” scandal is likely to accelerate the decline in market share for diesel engines in Europe. The likely increase in battery vehicles is a negative for PGM demand, especially platinum and rhodium. Palladium may however be a short-term beneficiary should gasoline cars increase their market share in Europe. Although prices are well below the marginal cost the industry has a number of barriers to exit, which means that supply rationalization will be driven by a slow starvation of capital. Although we expect this supply rationalization to take some time, we see prices recovering next year due to a high probability of strike action.

We forecast Chinese demand growth rates in the metals will slow over the next five years, approaching that of a developed country as the economy weans itself of an investment-heavy growth model. The structural slowdown has been compounded by cyclical weakness in the property sector, further depressing demand and weighing on sentiment. In many instances, the supply side has failed to respond to slowing demand growth, resulting in prices well below marginal cost, which could persist for an extended period until cuts are made. Although we expect a cyclical recovery in China, the speed at which an individual commodity responds depends on industry structure and the extent of losses.

Here is a link to the full report.

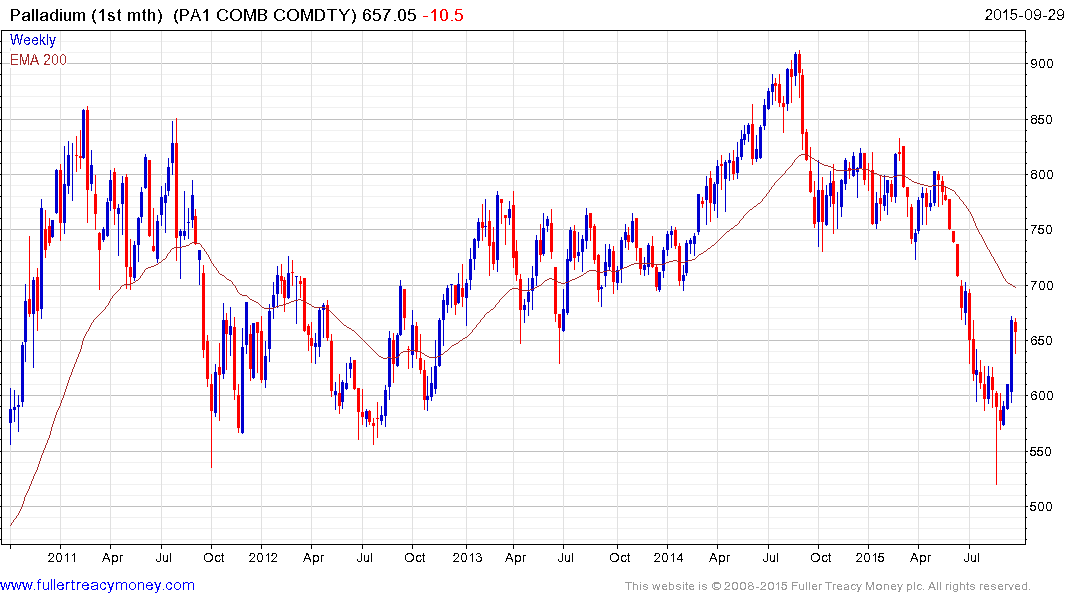

The precious metals sector has been under pressure for some time but the breaking of the Volkswagen “dieselgate” story has had a particularly strong impact on both platinum and palladium.

Platinum has been leading the sector lower and broke down again last week. A short-term oversold condition is evident with an almost 20% overextension relative to trend mean. There is potential for some steadying in this area but a break in the medium-term progression of lower rally highs, currently near $1030, would be required to question the consistency of the decline.

Palladium surged on the news and has now almost completely unwound its overextension relative to the trend mean. It has paused over the last few sessions in the region of $650 and potential for additional higher to lateral ranging can be given the benefit of the doubt provided it holds the $600 area on a pullback.