Commodities

The weakness in precious metals, energy contracts and particularly soft commodities has resulted in the Continuous Commodity Index breaking below the trend mean and it is now testing the November lows above the psychological 400 level. A short-term oversold condition is now evident but upside follow through on Tuesday’s upward dynamic will be required to signal more than temporary steadying in this area.

By contrast the LME Metals Index continues to outperform and bounced last week from the region of the trend mean. A sustained move below it would be required to question medium-term scope for additional upside.

These charts demonstrate some clear delineation within the commodity complex where industrial metals, leveraged to global growth, are still firming while the switch to risk-on has affected precious metals and oversupply of grains and beans has resulted in depressed pricing for a number of key food commodities.

Robusta coffee contracts experienced a massive reaction against this prevailing uptrend last week and have steadied somewhat today but a clear loss of uptrend consistency is now evident.

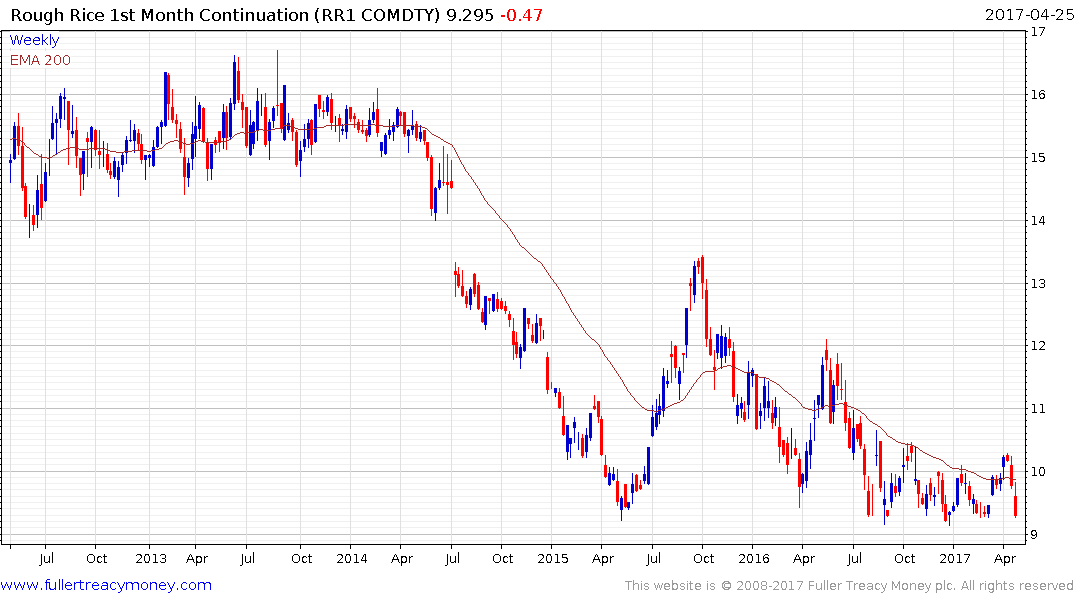

Rough Rice, encountered resistance in the region of the trend mean and pulled back sharply to test its two-year lows. A clear upward dynamic will be required to even begin to signal support in this area.

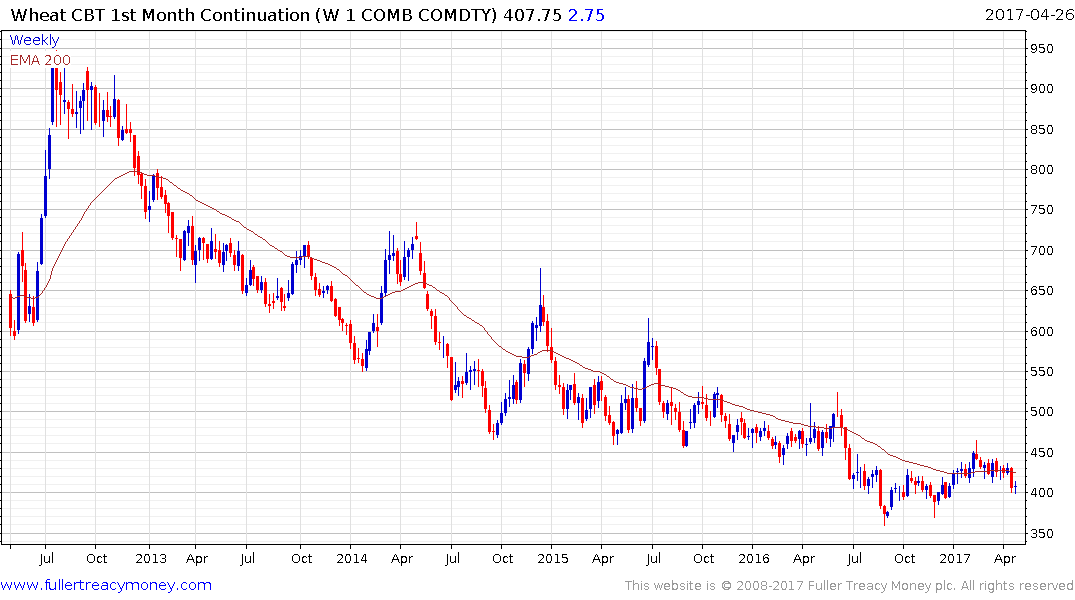

Wheat has returned to test the psychological $4 area. It posted an upside key day reversal yesterday and has held the majority of the move today. Ideally upside follow through will be required confirm support in this area.

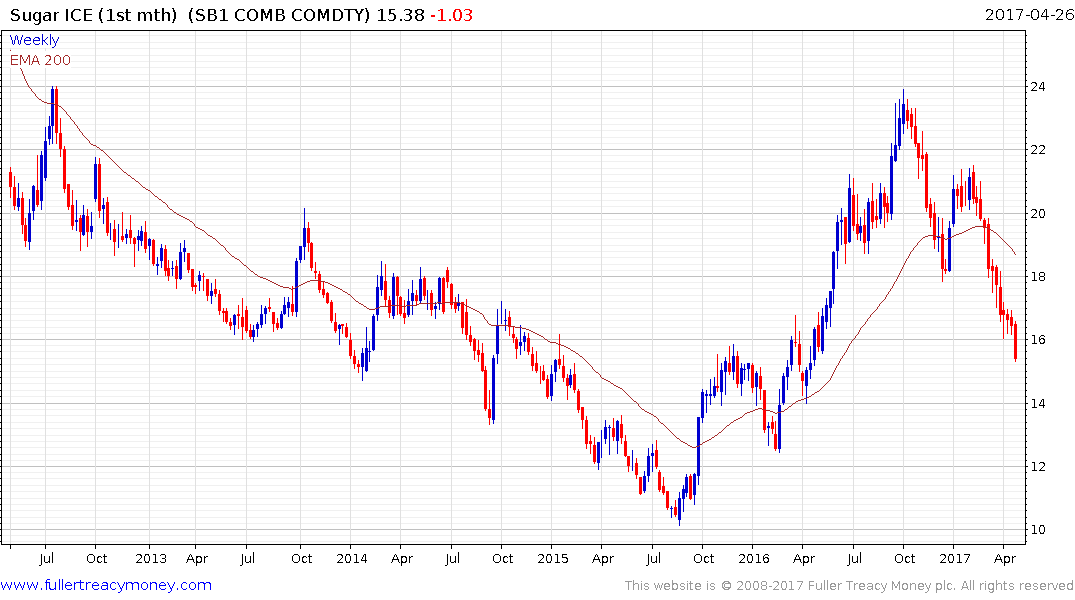

Sugar prices are accelerating lower and extended the almost three-month downtrend today. A clear upward dynamic will be required to pressure shorts and to check momentum.