Colombian Currency Drops to 11-Year Low as Oil Extends Decline

This article by Andrea Jaramillo for Bloomberg may be of interest to subscribers. Here it is in full:

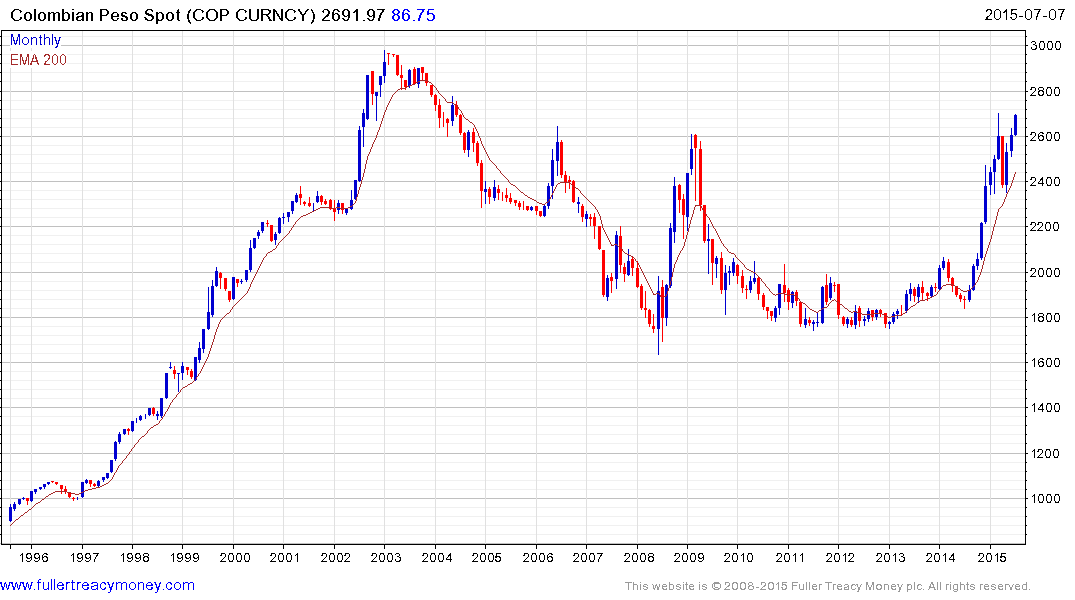

Colombia’s peso fell to its lowest since June 2004 as oil, the nation’s biggest export, plunged on concern that a slowing global economy will pare demand.

The peso slid 0.9 percent to 2,694.5 per dollar at 9:11 a.m. in Bogota, extending its decline over the past 12 months to 31 percent. That’s the worst performance after the Russian ruble among 24 emerging-market currencies tracked by Bloomberg.

Oil traded at its lowest level since April after plunging 14 percent over the past four days on concern over economic stability in Europe and China and as investors avoided risky assets amid the Greek debt crisis. The peso will extend its decline should crude fall further, according to Andres Munoz, the head currency trader at Corp. Financiera Colombiana.

“The abrupt drop in oil has investors concerned,” Munoz said in a phone interview from Bogota. “With so much nervousness concerning Greece, emerging-market currencies will continue their weakening trend.” Should the peso fall beyond 2,720 per dollar, it will weaken to 2,850, he said.

The strength of the US Dollar represents a headwind for countries reliant on attracting foreign investment or those seeking to fund expansion by borrowing Dollars. For example, between 2003 and 2008 the Colombian Peso benefitted from the commodity bull market and the migration of drug cartels to Mexico.

However in the aftermath of the credit crisis the Dollar built a base between COP1800 and 2000 before breaking out in 2014. It found support in the region of 200-day MA from May and a sustained move below the trend mean would be required to begin to question medium-term scope for additional outperformance.

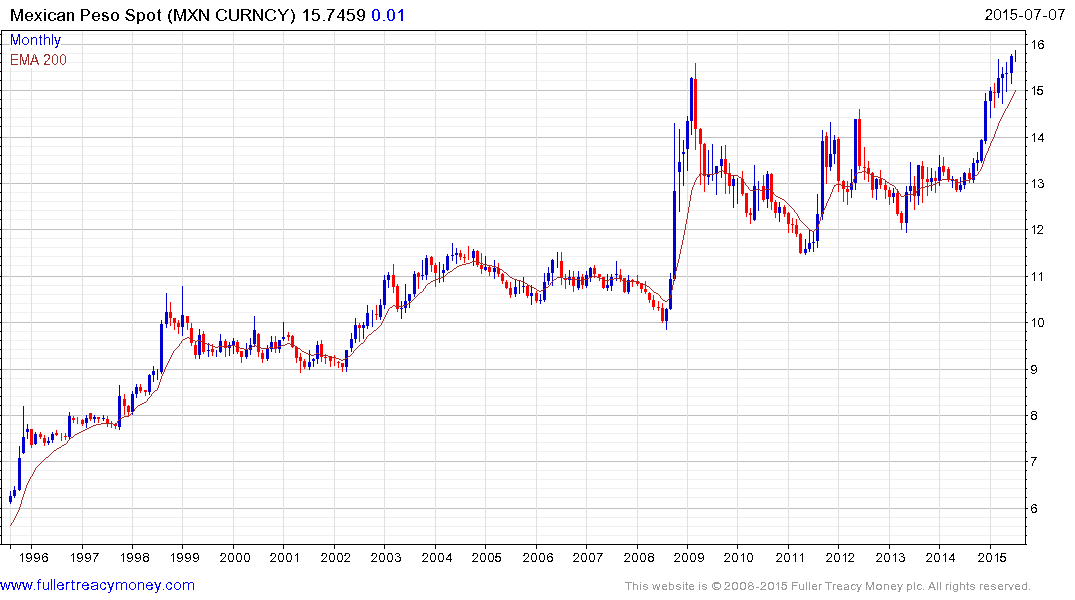

This situation is not unique to Colombia. The Chilean Peso and Peruvian Sol share similar trajectories. Meanwhile the US Dollar moved to a new all-time against the Mexican Peso last week.

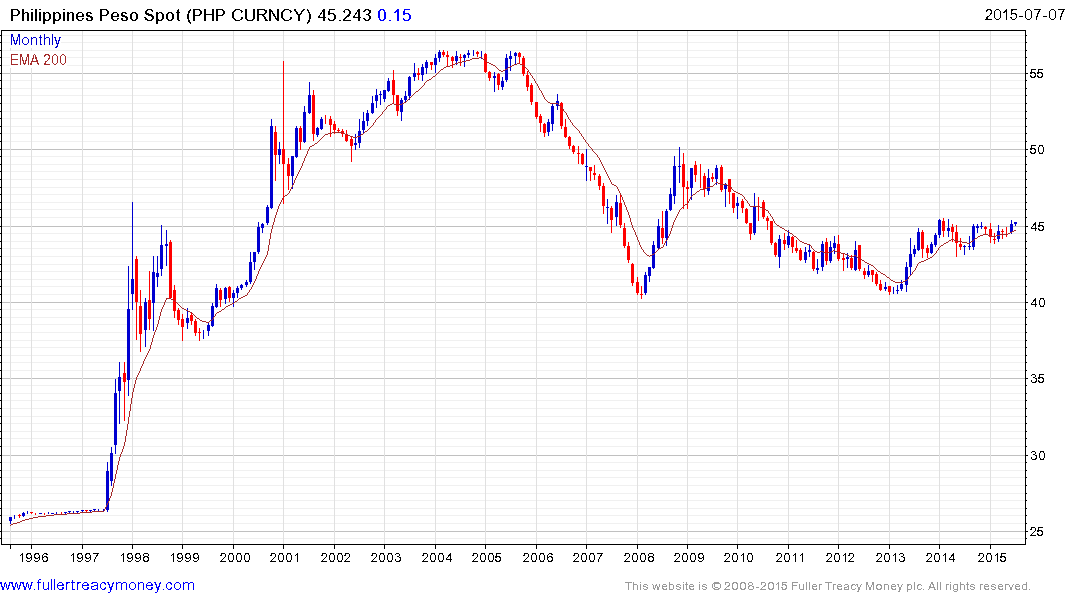

In Asia, the Dollar has first step above the base characteristics against the Philippine Peso.

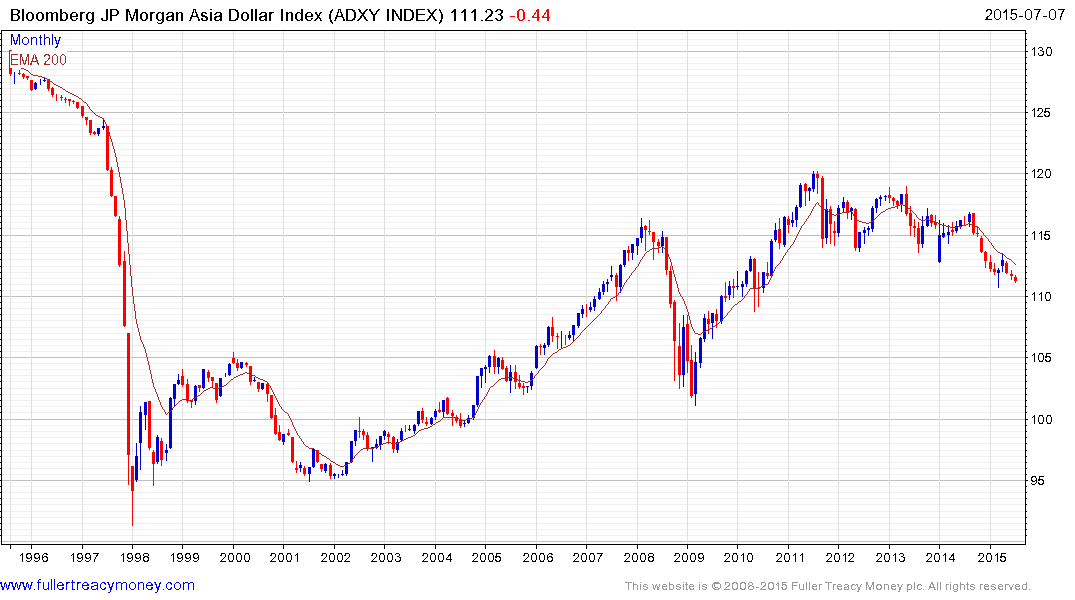

The Asia Dollar Index has fallen to retest this year’s low but a clear upward dynamic will be required to check momentum beyond a brief pause.