Coinbase Jumps to Highest Since August on Bitcoin ETF Momentum

This article may be of interest. Here is a section:

Coinbase Global Inc. gains as much as 13% on Tuesday, trading at its highest intraday level since August and extending a rally driven by optimism over the potential US approval of a Bitcoin ETF.

Shares of the biggest US crypto exchange traded at $88.27 a share as of 2:12 p.m. in New York. The stock has more than doubled so far this year amid a broad bounce for cryptocurrency linked stocks despite regulatory challenges from a lawsuit by the US Securities and Exchange Commission.

On Tuesday, CBOE filed for amendments for five Bitcoin ETF applications, confirming that it reached an agreement with Coinbase on surveillance sharing agreements, a move to address concerns by the SEC over market manipulation. The filings previously had said that the exchange was “expecting” to enter into the agreement with Coinbase.

All ETFs need to be able to transact effectively. Considering the sums likely to been committed to ETFs in a bull market, the reliability of execution and the need for compliance with anti-money laundering regulations mean Coinbase is the only US exchange large enough to fill the role.

The share hit a new 14-month high today and a sustained move above the psychological $100 level will complete the base formation.

The share hit a new 14-month high today and a sustained move above the psychological $100 level will complete the base formation.

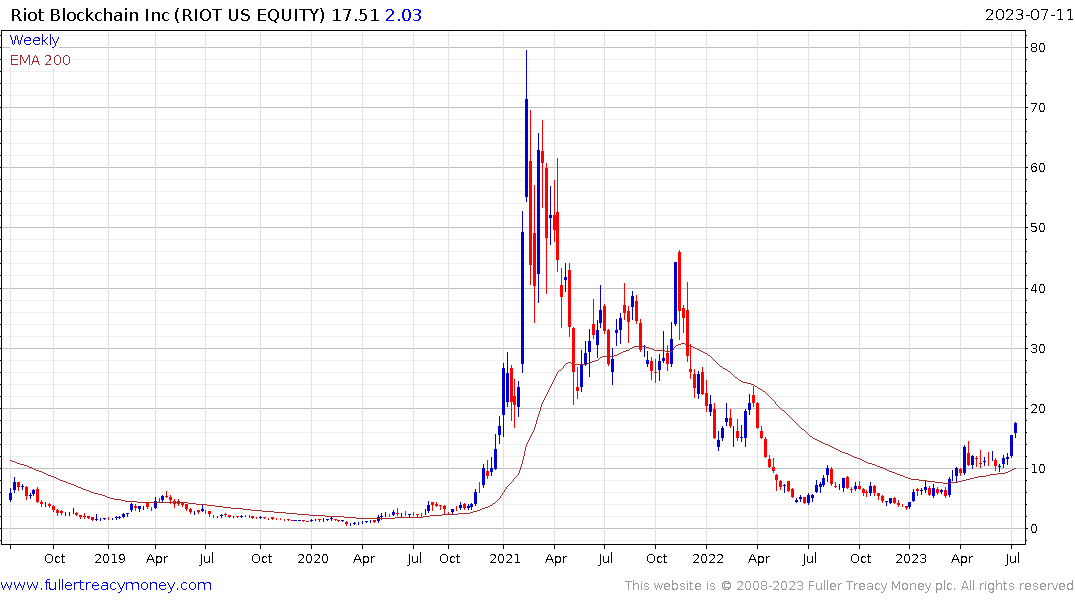

Both Riot Platforms and MicroStrategy have already completed their base formations.

Mastercard hit a new closing high today and is on the cusp of completing a more than two-year range. The firm is a global payments heavyweight and is ensuring it will have a foothold in the potential future of finance by investing a crypto validation network.