Coffee drinkers beware: Brazil coffee harvest set to decline again

This article by Vladimir Pekic for Beverage Daily.com may be of interest to subscribers. Here is a section:

Brazilian coffee growers will collect just 44.28m sacks (60Kg) of coffer in 2015, the second lacklustre harvest in a row for the world’s largest coffee producer and exporter.

?The result was unveiled this month in the second annual coffee crop forecast for 2015 published by Brazil’s National Supply Company (Conab). The state-run institution warned that the 2015 harvest would be 2.3% lower than the 45.34m sacks harvested in 2014.

“If the latest forecast announced by Conab proves correct, this will be the third consecutive season in which coffee production in Brazil drops” warned Brazil’s Advanced Research Centre in Applied Economics (CAPEA) in a June 11 release.

Nonetheless, the international Coffee Organization said that coffee prices continued their decline even after the latest Conab forecast – as speculation over the current 2015/16 Brazilian crop suggests that the market has no immediate supply concerns. Indeed, one major trading house has already forecast a global supply surplus for 2015/16.

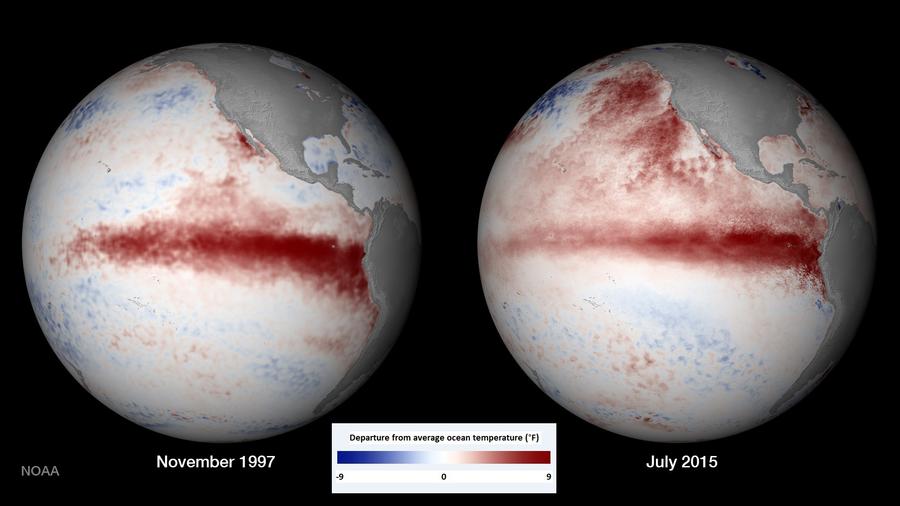

This is an El Nino year and it has certainly been hotter and muggier in Los Angeles this year than last as a result of the weather phenomenon. This graphic of Pacific Ocean temperature comparing this year to the strong 1997 event suggest that we can anticipate additional extreme weather events through the end of the year. This has the potential to act as catalyst for agricultural commodity prices so they are worth watching.

Arabica coffee rallied impressively early last year to break a two-year downtrend but was unable to sustain the move to new recovery highs in October and has since given up its entire advance to retest the 120¢ area. The downtrend has lost momentum over the last four months and prices steadied this week. However a break in the progression of lower rally highs, currently near 130¢ would be needed to signal a return to demand dominance beyond the short term.

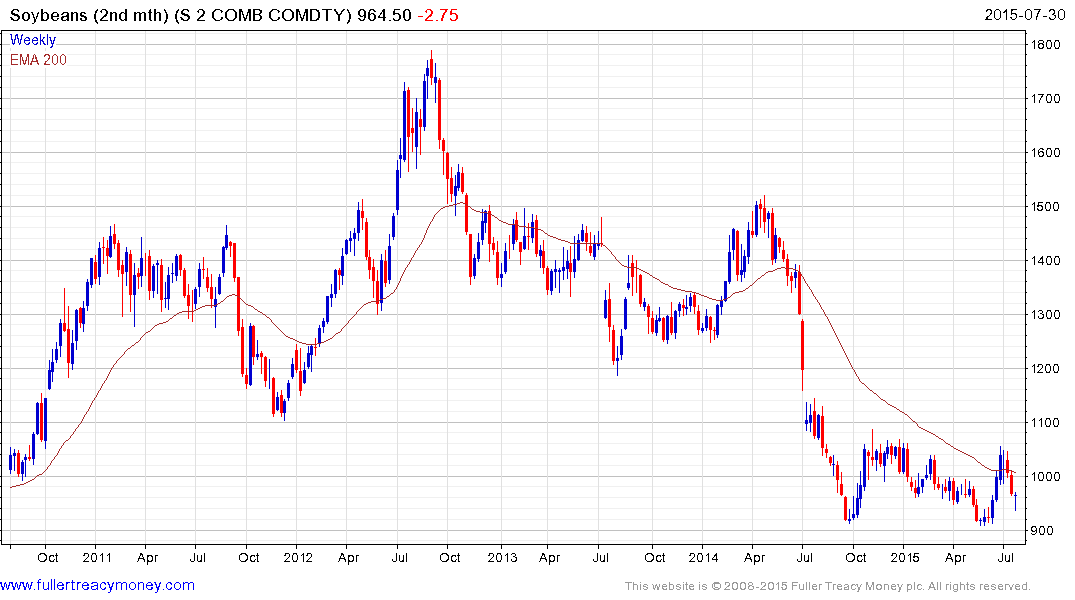

Soybeans rallied impressively in June and pulled back aggressively in July to date to retrace most of the advance. Prices have steadied this week and a sustained move to new lows would be required to check potential for an unwind of the short-term oversold condition.

Back to top