Cobalt Market report

Thanks to a subscriber for this informational report which may be of interest. Here is a section:

In 2017, lithium-ion batteries continued to be one of the main drivers for cobalt prices, as each battery contains approximately 15 kilograms of cobalt chemicals.

“What is important to realize is that China produced 80 percent of the world’s cobalt chemicals and a lot of their feedstock for that comes from concentrates from the Democratic Republic of Congo (DRC),” said Rawles. He added that any change in the country can have a real impact on prices for cobalt chemicals.

Another trend seen this year has been “a growing awareness of the different cathode technologies, such as NMC (nickel–manganese-cobalt), moving towards a less ‘cobalt-heavy’ chemistry and replacing this with nickel,” Berry explained. “While this likely means less cobalt per battery, the ramp up in gigafactory-scale capacity over the next five years likely means we’ll use much more cobalt than was forecast even a couple of years ago,” he added.

For investors interested in knowing what else happened in 2017, we’ve put together a cobalt 2017 trends article. Click here to read more. Cobalt outlook 2018: Supply and demand

Looking ahead to 2018, the dynamics between an increasing demand forecast and supply constraints are set to continue. “The dominant trends in 2018 will be tight supply and increasing demand leading to higher prices, driven by rising demand primarily from the EV industry,” Rawles said.

Here is a link to the full report.

The argument about whether electric cars are less polluting on an all-in basis is likely to continue to rage, with the crux of the argument focusing on what kind of generating capacity is used to produce electricity in any given country. However, the fact electric cars contribute to a country being less dependent on imported oil represents a powerful argument for adoption.

The technology is now sufficiently advanced to support the argument for a two-car family to have at least one electric vehicle. The big question is how low the cost of production can fall on economy of scale arguments. The number of battery factories being built will dwarf current global battery production within the next few years so batteries should get cheaper as these factories come on line. This is a prerequisite for the success of the sector since, to the best of my knowledge, all companies currently manufacturing electric only vehicles lose money on them.

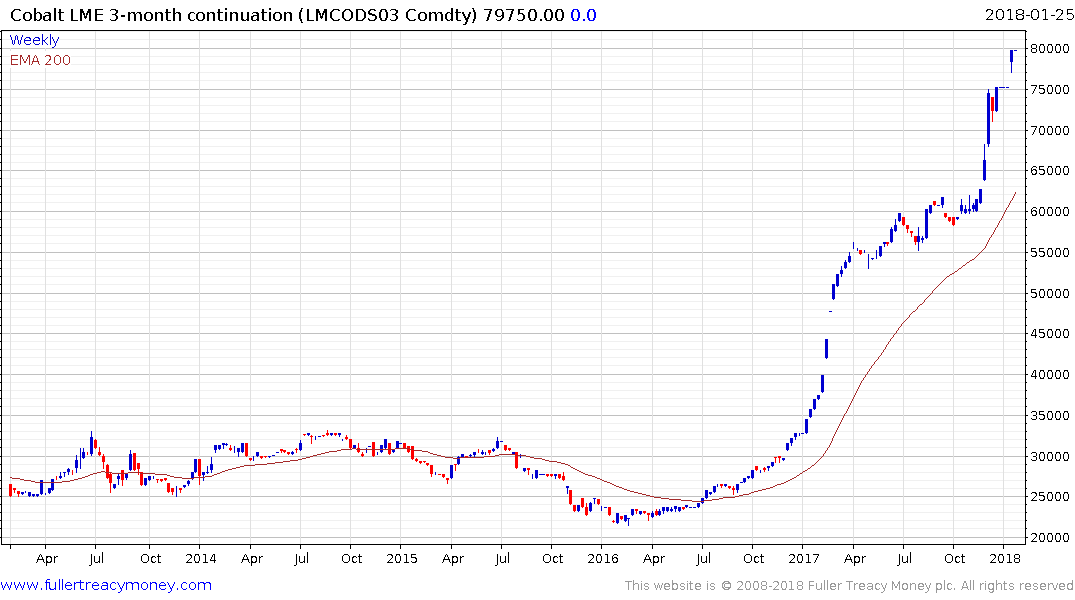

Cobalt remains in an accelerating, supply inelasticity meets rising demand, uptrend. The pace of the advance necessarily raises substitution risk on price and security of supply issues but that will take time to evolve.

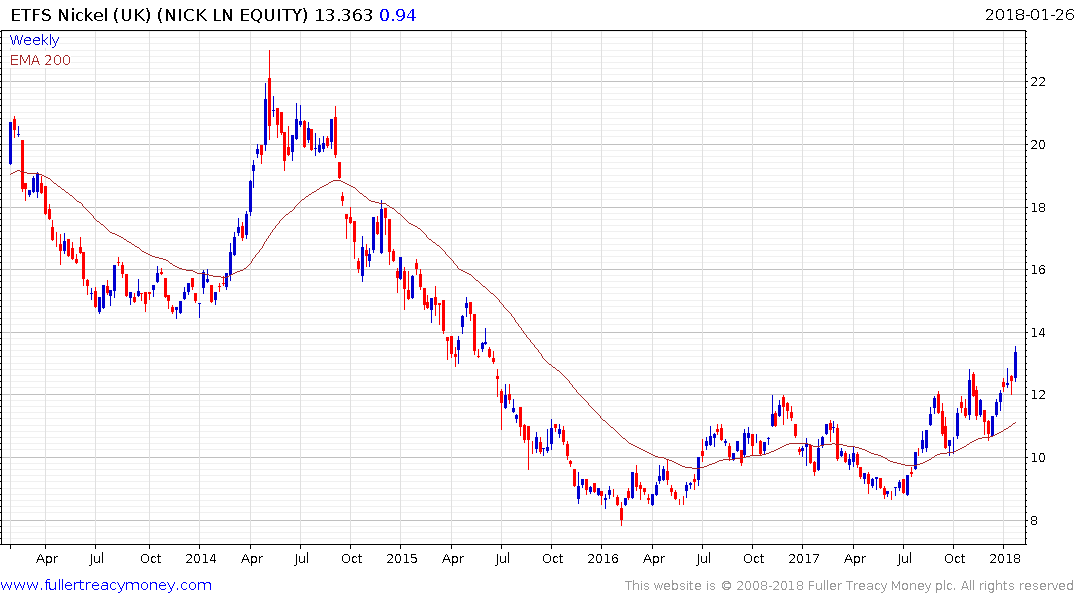

Nickel by comparison is relatively cheap and has lagged among the industrial metals over the last few years because of excess pig-nickel production in China. This is inappropriate for battery manufacturing. There is a growing argument for splitting the LME contract, so that the needs of the emerging battery sector might be better served in preference to the stainless-steel market.