Clueless Wall Street Is Racing to Size Up Zero-Day Options Boom

This article from Bloomberg may be of interest. Here is a section:

Discovered by retail investors as a cheap way of gambling during the meme-stock era in 2021, zero-day options got a fresh boost on index trading after firms like Cboe Global Markets Inc. last year expanded S&P 500 options expirations to cover each weekday. The offerings became an instant hit among institutions as daily reversals ruled the market, spurred by the Federal Reserve’s most aggressive monetary tightening in decades.

By the third quarter of 2022, 0DTE contracts accounted for more than 40% of the S&P 500’s total options volume, almost doubling from six months earlier, data compiled by Goldman Sachs Group Inc. show.

Behind the explosive rise, according to JPMorgan, are likely high-frequency traders — the computer-driven firms present at virtually every node of the modern equity landscape — as market makers and fast-moving seekers of an investing edge.

It’s a match made in quantitative heaven: For firms known to measure the life cycle of trades in thousandths of a second, zero-day options hold obvious benefits as tools to balance exposure and otherwise hone strategies designed to harvest fleeting profits by darting in and out of positions.

At any time the market is a centre for speculation. The pendulum of perception swings from casino conditions to conservativism as money supply ebbs and flows with the broad economic cycle.

Those making money believe they have invented a better mouse trap. Those who are outside the new market believe it is too good to be true and therefore dangerous.

The one thing I am keenly aware of is retail investors have had one up on institutions for much of the time since the financial crisis. This is very unusual. The evolution of the cryptocurrency market was pioneered by legions of retail investors all over the world. The introduction of institutional money has been a relatively recent and modest phenomenon.

Large numbers of retail investors chastened short sellers in “meme” stocks during the pandemic. The evolution of the zero-day options market with massive volume in S&P500 ETF (SPY) and Tesla options is another example of how a mob of retail investors are moving the market.

More than anything this is a reflection of how much liquidity is still in the system. My total assets of global central banks chart is contracting but is still at elevated levels. That suggests there is still ample scope for tightening of financial conditions ahead.

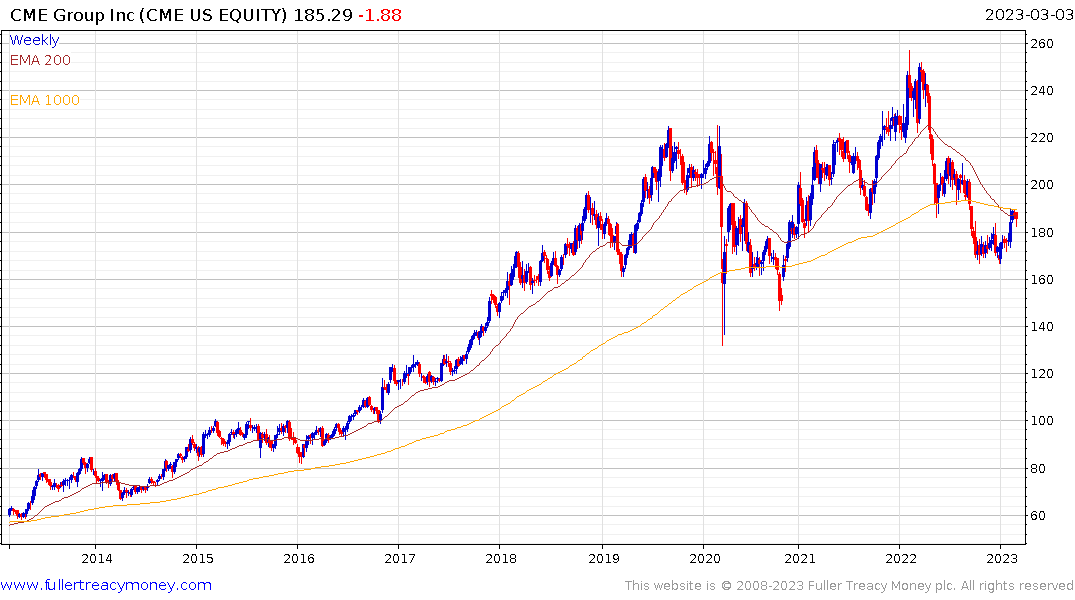

By facilitating the zero-day options market the CME should benefit from increasing volume of trade. The share has been ranging for more than two years but is currently firming from the lower side of that congestion area.

By facilitating the zero-day options market the CME should benefit from increasing volume of trade. The share has been ranging for more than two years but is currently firming from the lower side of that congestion area.