CLSA Sees Bond Danger in Pension Switch to Stocks

This article by Finbarr Flynn for Bloomberg may be of interest to subscribers. Here is a section:

Domestic ownership of JGBs has increased to 91.6 percent at the end of March from 91.4 percent in December 2012, when Abe took office, according to BOJ data. By contrast, Japanese financial institutions and individuals were net sellers of domestic stocks in the year to March 31, while overseas buyers boosted holdings of equities on Japanese bourses to a record 30.8 percent, Tokyo Stock Exchange data show.

“Japan has increased its exposure to bonds and sold the equity to the foreigner,” in contrast to Kuroda’s prediction that local investors will shift from debt to riskier assets, according to Smith. He has been in Japan since 1987 and joined CLSA in August 2011 after working with Jardine Fleming Securities in the 1990’s and a four-year stint at hedge funds, according to biographical information provided by CLSA.

JGB yields continue to benefit from Japan’s quantitative easing as they unwind the surge that following the introduction of the policy amid continued central bank buying. If the pattern of QE in the USA and UK is any guide upward pressure on yields is unlikely unless the consistency of the policy is questioned.

Changing the composition of the pension fund’s holdings to include more equities represents a potentially potent tailwind for the stock market. In looking at Japanese funds I went to the Funds section of the Chart Library, found in the main drop down menu, clicked on Funds by Geographic Focus and selected Japan.

The UK listed iShares MSCI Japan Monthly GBP Hedged ETF continues to hold a progression of higher reaction lows and has returned to test the upper side of a yearlong range.

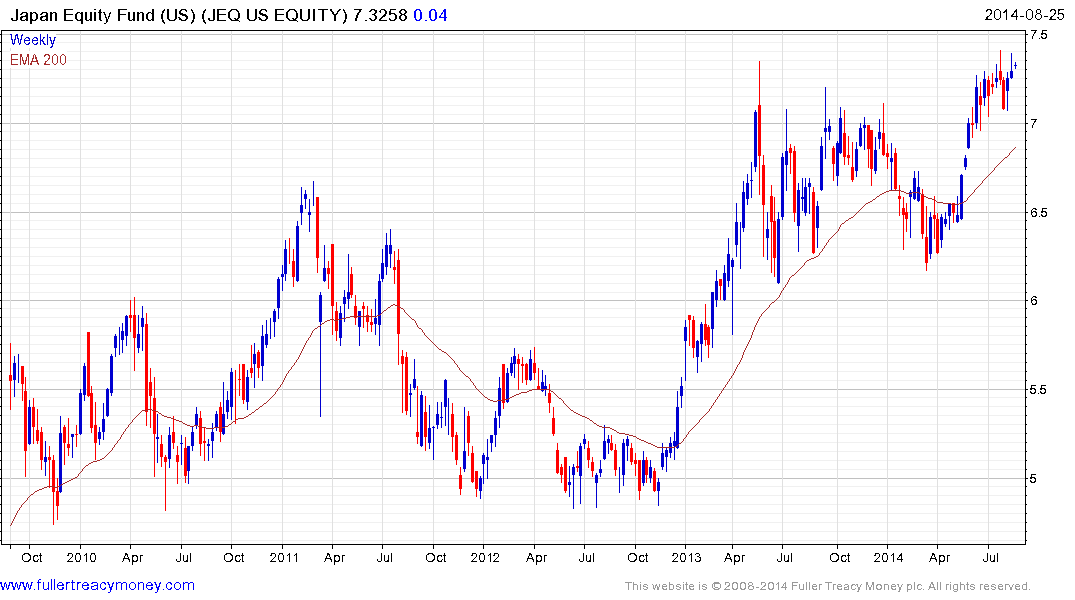

The US listed, US Dollar denominated, Aberdeen Japan Equity Fund is trading at a discount to NAV of 11.19% and has been consolidating above the $7 area for two months. A sustained move below that level would be required to question medium-term scope for continued upside.

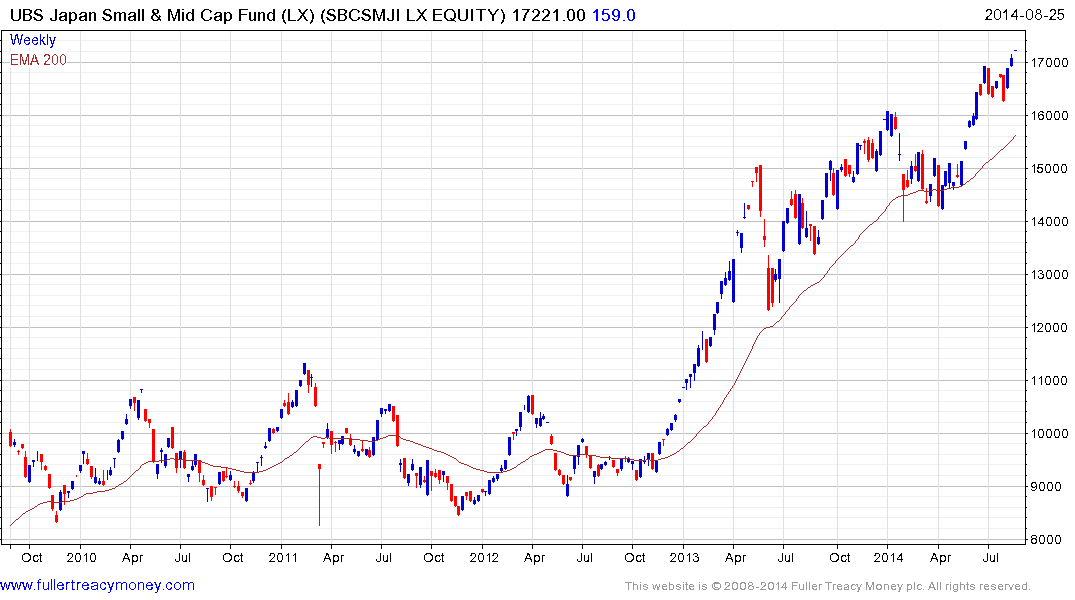

The Luxembourg listed UBS Japan Small & Mid Cap Fund is denominated in Yen and shares a reasonably similar pattern to the Topix 2nd Section Index of small caps.

Back to top