Clive Hale's View from the Bridge: A paragon of virtue�

David Fuller's view So the

Greek debt problem has been solved. If Greece finds itself unable to raise money

in the bond markets, then some combination of IMF/EU funding will kick in (although

very loosely specified at this stage), but in that eventuality chaos will

already be centre stage. Greece will not be getting any favours from the EU

on the rate of interest it will have to pay (currently over 6% and nearly twice

the rate of 10 year German bunds). They would normally expect to pay less via

the IMF, but the currency devaluation lever they would normally pull is not

available in the eurozone.

The EU

leaders (and there are a confusing plethora of them) say this is a triumph for

European co-operation. But only days ago Jean-Claude Trichet, head of the European

Central Bank, said it was a "very, very bad idea" to let the IMF into

the eurozone. He has now done a volte face after Zhu Min, the vice-governor

of China's central bank, weighed in with his concerns about the lack of EU cohesion

over the issue and the implied threat that Chinese support to the eurozone sovereign

debt market would be less forthcoming.

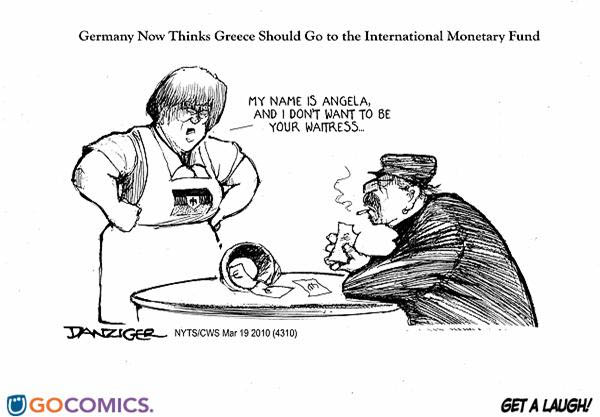

"Sauerkraut's on the menu": My thanks to Clive Hale for this accompanying

cartoon: