Click Through

Every day I clicked through a lengthy list of charts comprising just about every country’s primary stock markets index, all traded commodities, bond futures and a large number of currency pairs. Following last night’s surprise result just about all markets pulled back while typical safe haven assets rallied in a knee-jerk fashion. Following the initial move most bounced but a small number did not. It is reasonable to assume that markets which have failed to bounce represent where investors deem there to be most risk.

The FTSE/MIB Italian Index dropped over 2000 points to break to a new reaction low and closed on the low of the day. Italian sovereign yields closed up over 10% relative to yesterday’s close but were well off the intraday peak suggesting ECB support. Nevertheless, Italy represents a potential locus for additional concerns surrounding the demands of restive populations for better solutions to national debt problems.

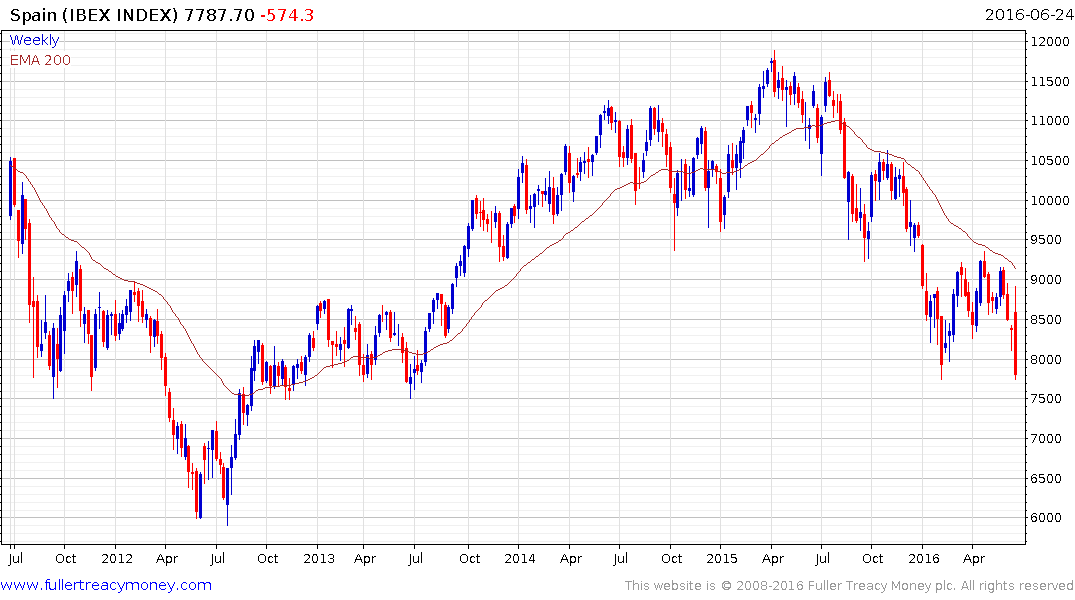

The Spanish IBEX Index also pulled back violently from the region of the trend mean to close almost at its low. A countermanding upward dynamic would be required to confirm support in the region of the February nadir.

The Euro Stoxx Banks Index dropped abruptly to close at a new reaction low and is now testing the 2012 nadir.

The Dollar closed on its intraday peak against the South Korean Won and continues to hold a medium-term progression of higher major reaction lows against. This section from a report from Deutsche Bank may help to explain this underperformance:

Asian investment in the UK has been rising steadily. South Korea has the greatest exposure to the

UK, in terms of respective total outward portfolio investments. Malaysia and the Philippines have increased the share of their direct investments to the UK. All in all, while Asia may be less trade-dependent vis-à-vis the UK, the channels of financial dependence are rather strong.

The Dollar broke out to a new high against the Chinese Renminbi and a clear downward dynamic would be required to a question potential for additional upside.

With prospects of an additional Fed rate hike being pushed progressively farther out, not to mention the potential that the Fed may have to cut rates, Hong Kong’s Hang Seng was reasonably steady.

One of the markets that has exhibited the smallest reaction to Brexit is Russia. The Ruble continues to firm and the Index has been largely rangebound since April as it consolidated above the 200-day MA. The reality of the UK leaving the EU and the prospect of continued strife for Italy, Spain and Greece couldn’t be better news for Putin or worse news for Eastern European countries within Russia’s previous sphere of influence. In the event that more referenda are called and this time within the Eurozone, Germany may find itself pivoting east in order to protect the markets for its currency.

The primary markets that finished on their lows are the S&P500, Russell 2000, Dow Jones Industrials and Nasdaq-100. Meanwhile the VIX Index of volatility regained much of its gain following a lull earlier in the session. These moves confirm resistance at the upper side of their respective ranges and clear upward dynamics will be required to signal a return to demand dominance. The size of the reactions is enough to give investors pause before rushing back in.