CIOs Waiting for Cloud Investments to Pay Off

This article from the Wall Street Journal may be of interest. Here is a section:

Roughly 67% of 1,000 senior technology leaders at U.S. firms across industries said they are still waiting for cloud investments to pay off, KPMG said Thursday in its annual technology survey. Why the wait? Blame insufficient skills among tech teams, added requirements, and a misalignment on expected outcomes, says Barry Brunsman, a principal in KPMG’s CIO Advisory group.

Tech leaders take note. Diane Comer, chief information and technology officer at Kaiser Permanente, said that when the healthcare provider is working on a new initiative, it will price it out and compare an on-premises solution against one in the cloud. “You really do need to not just take it for granted that cloud is where you should head,” she said.

Companies boost their valuations by making claims about the size of the total addressable market (TAM) in their corporate presentations. The logic is simple enough. We might only make a couple of hundred million today, but the size of the market is so much larger, that we can grow quickly to capture sizeable market share.

Cloud computing has made abundant use of this argument. The most common claim is every company will eventually migrate to the cloud so the runway for growth is still in its infancy. That might have been true a decade ago but the pandemic accelerated many companies’ plans. With the economy shut down and millions of workers suddenly working remotely, I believe it is reasonable to conclude if a company did not go to the cloud during the pandemic there was a good reason. That implies a smaller TAM than many believed.

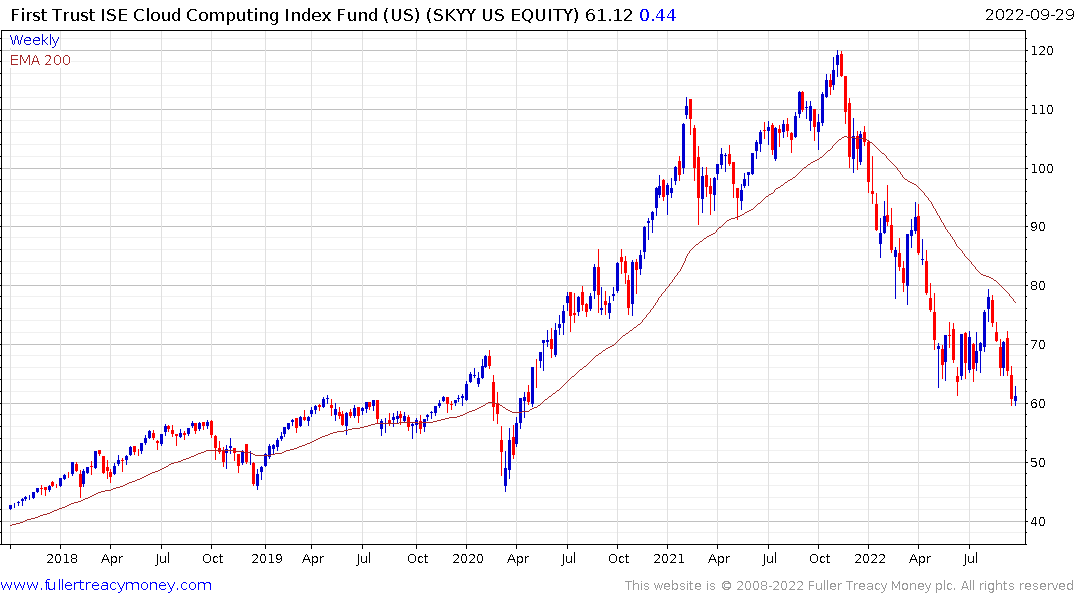

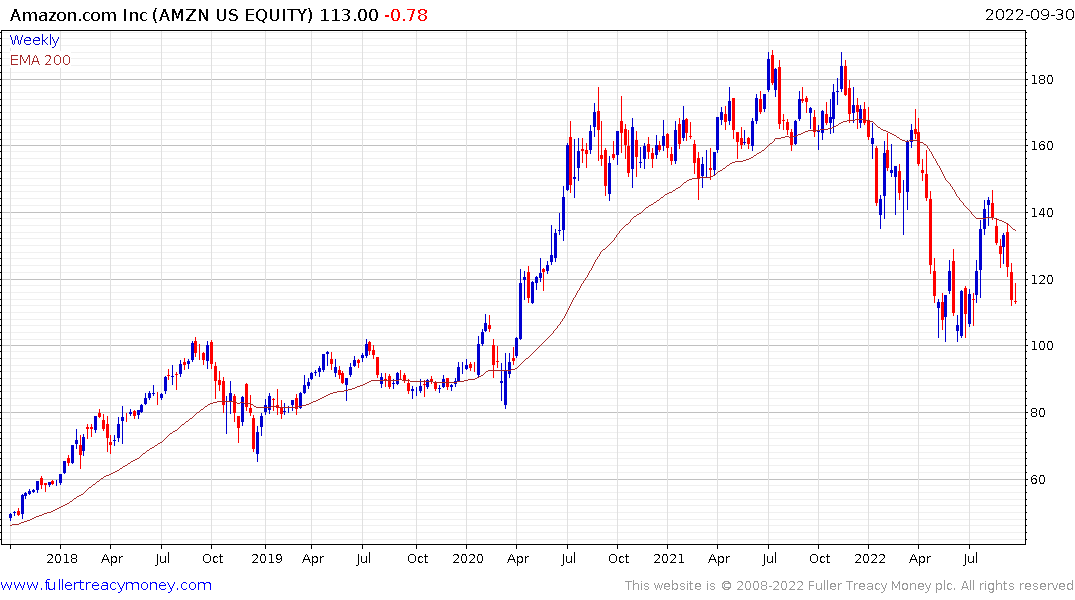

The First Trust Cloud Computing ETF peaked at the end of 2021 and has now fully unwound its pandemic surge. This is a point of potential reassessment but prolonged ranging, rather than trending, appears to be the most likely scenario. That recipe suggests scope for some short-term rallies that will impress but failure to sustain new highs for the lengthy medium term.

The sector can be divided into two halves. The software companies and the data warehouses. Companies like Lumen, Twilio and Rackspace offer software solutions for the cloud but it is hard to differentiate between their offerings. The challenge for these companies is eventually the software becomes commoditized and a price war will compress margins. Only a few will ultimately thrive and I don’t see clear evidence just yet which will be the winners.

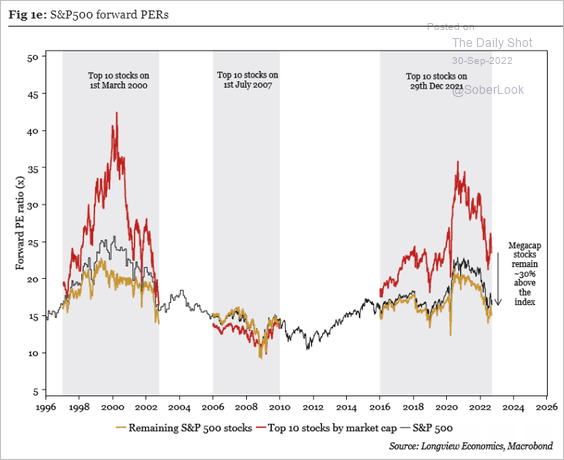

The data warehousers like Amazon, Microsoft, Alphabet etc. continue to trade at an excessive premium to the wider market. That outperformance has been predicating on their ability to grow without limits. The compression of market scaling capacity suggests that market premium will be eroded. Support in the region of the 1000-day will be the test of whether these shares are still in secular bull markets.