Chip Globalization Is Over and Sanctions Work, Says TSMC Founder

This article from Bloomberg may be of interest. Here is a section:

Taiwan Semiconductor Manufacturing Co. founder Morris Chang declared globalization for the chip industry over and expressed support for US efforts to limit China’s tech advancement through export curbs and company sanctions.

“In the chips sector, globalization is dead. Free trade is dead,” Chang said at an event in Taipei Thursday. “Just look at the way China has been embargoed and the entity list. I agree with that.”

The 91-year-old industry pioneer said that the global chip supply chain will grow even more bifurcated as the US acts to curtail China’s access to the most advanced technology, and “I certainly support that part of American industrial policy to slow down China’s progress.”

Chang said China is at least five to six years behind Taiwan in chipmaking technology, but he also cautioned Taiwan should not be naive about its position relative to the US. When American leaders speak of “friend-shoring” high-tech manufacturing, Taiwan is not included in that policy, Chang said, as they’ve repeatedly voiced concerns about relying on Taiwan.

The war in Ukraine is running down NATO arsenals. Poland is getting ready to send 4 Soviet-era MiGs. The unspoken after thought is they are going to their ultimate fate of being destroyed. NATO is rapidly running down the inventory of conventional weapons required to hold an advancing force in check. Meanwhile China is sitting on the sidelines with its arsenal both intact and expanding. The conclusion is clear, investment in new inventory is inevitable.

That also implies significant investment in duplicating Taiwan’s ecosystem of chip component manufacturing; to the extent that is even possible. The rapidly advancing artificial intelligence and automation sectors have particular military applications that represent additional funding for capital investment.

![]() The Philadelphia Semiconductors Index has broken its downtrend and rebounded impressively from the region of the 200-day MA today. The Nasdaq-100 has a similar pattern.

The Philadelphia Semiconductors Index has broken its downtrend and rebounded impressively from the region of the 200-day MA today. The Nasdaq-100 has a similar pattern.

![]()

This relative performance also suggests investors have concluded the end of the hiking cycle is upon us and the central banks will have no choice to flood the market with liquidity once more.

Bitcoin is trading back above $25000 today which also confirms that hypothesis.

Bitcoin is trading back above $25000 today which also confirms that hypothesis.

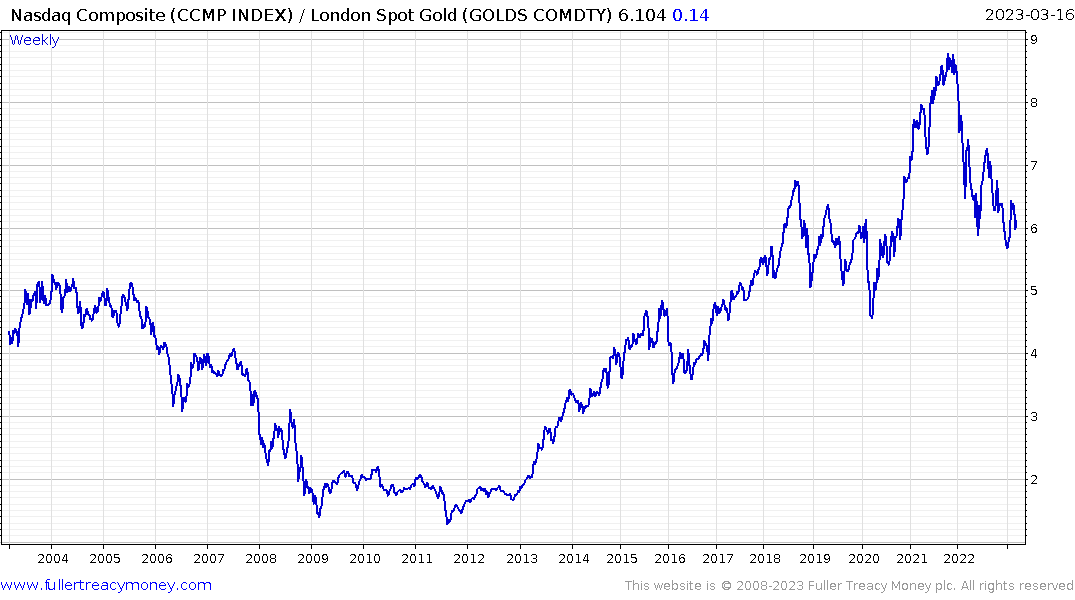

The Nasdaq Composite/Gold ratio is firming from the upper side of 2018-2020 range as it tests the 18-month downtrend. This is a major decision point from a secular trend perspective. If the sector outperformance technology is to be sustained the ratio will hold the 6 level and will ultimately rebound back above the 200-day MA.

The Nasdaq Composite/Gold ratio is firming from the upper side of 2018-2020 range as it tests the 18-month downtrend. This is a major decision point from a secular trend perspective. If the sector outperformance technology is to be sustained the ratio will hold the 6 level and will ultimately rebound back above the 200-day MA.