Chinese Property Titan Says Housing Market Has Reached Bottom

This article from Bloomberg may be of interest to subscribers. Here is a section:

“In the short term, the market has bottomed out, but the recovery is a slow and gentle process and will take time,” China Vanke Co. Chairman Yu Liang said at the company’s annual general meeting Tuesday, according to a transcript posted on its WeChat account.

Yu cited a mild sales increase in May from April in first- and second-tier cities, adding that the recovery may become more distinct in June. That would be welcome news for developers, which are counting on a sales rebound to ease a crippling cash crunch that triggered a wave of defaults.

A Bloomberg Intelligence gauge of developer stocks climbed as much as 2.7% to the highest in a month after Yu’s comments. Signs of improvement in the housing market have emerged after local governments eased some buying curbs and authorities cut mortgage rates. New-home sales in 17 cities monitored by China Index Holdings surged 89% so far in June from a month earlier, also helped by a loosening of Covid restrictions.

China Vanke is so well connected it may as well be part of the government. The fact its CEO is stepping out in front of the media and speaking up for the property market is a clear signal the government believes prices have fallen enough to begin remedial action.

China Vanke put in a higher reaction low three weeks ago and is now testing the region of the 200-day MA. A sustained move above $HK20 would break the downtrend.

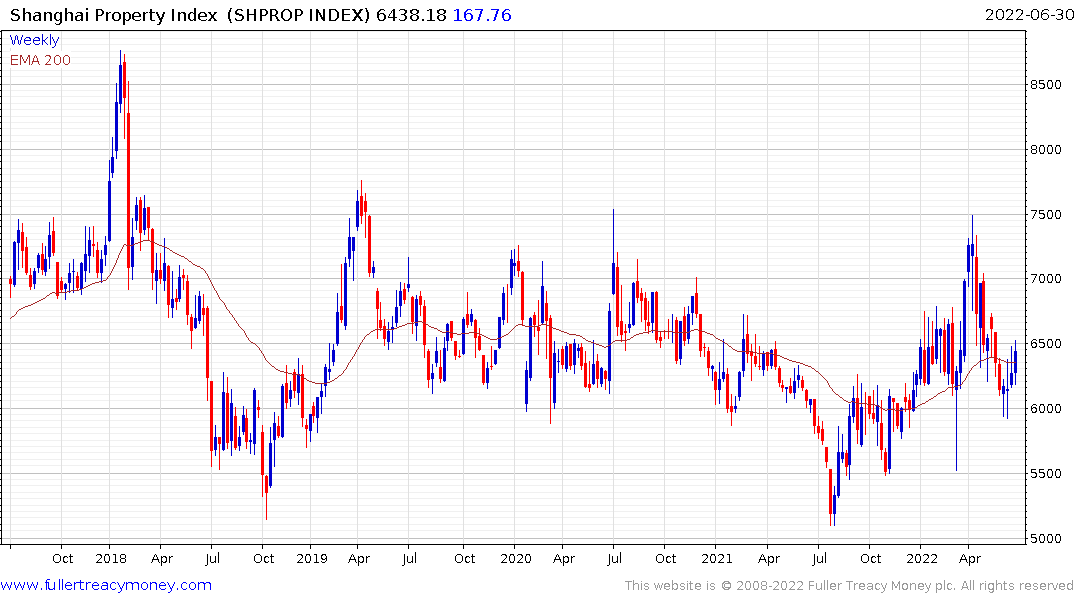

The Shanghai Property Index continues to firm from the region of the 200-day MA and has broken its downtrend.

China’s commitment to stimulating the economy has been less than enthusiastic but the credit impulse has clearly turned. That’s in sharp contrast to other global markets.

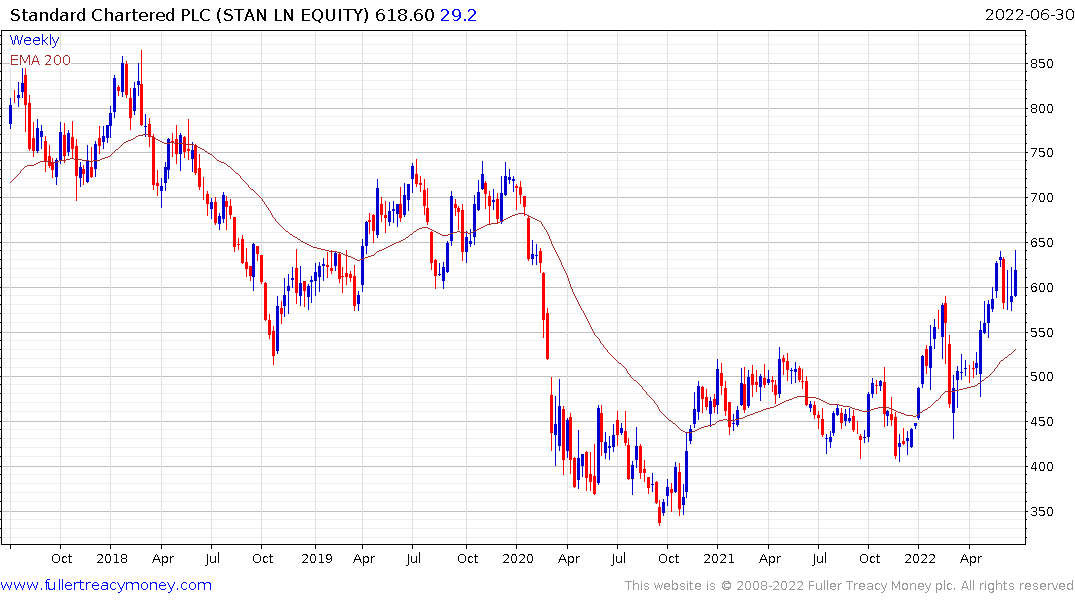

Both HSBC and Standard Chartered have been standout performers in the UK financial sector. Their exposure to Hong Kong may be part of the reason for that.