Chinese Caution on U.S. Debt Clouds Financing for Trump�s Tax Cut

This article by Saleha Mohsin and Liz McCormick for Bloomberg may be of interest to subscribers. Here is a section:

At the same time, though, China is so heavily invested in U.S. public debt that it has an interest in keeping the market healthy, said Nathan Sheets, chief economist for PGIM Fixed Income, who served as Treasury undersecretary for international affairs in the administration of former President Barack Obama.

“If China were to do something that created uncertainties in the government securities markets, China is a major foreign holder of U.S. Treasuries, so it’s deeply invested in that market” and wouldn’t want to make any moves that could hurt its own position, Sheets said.

Sheets said the U.S. has withstood similar tests before over the past 15 years. China and Japan are the two largest holders of U.S. Treasuries and each have ramped up purchases due to currency interventions, only to slow down and cause market jitters. China most recently spurred concern in 2015 when it slowed investments. “That leads me to be pretty relaxed about this,” Sheets said. “There’s lots of demand for Treasuries from the U.S. and abroad.”

Nonetheless, China’s position as a major purchaser of Treasuries gives it some leverage to try to shape U.S. responses -- including the Trump administration’s tough talk on trade policy.

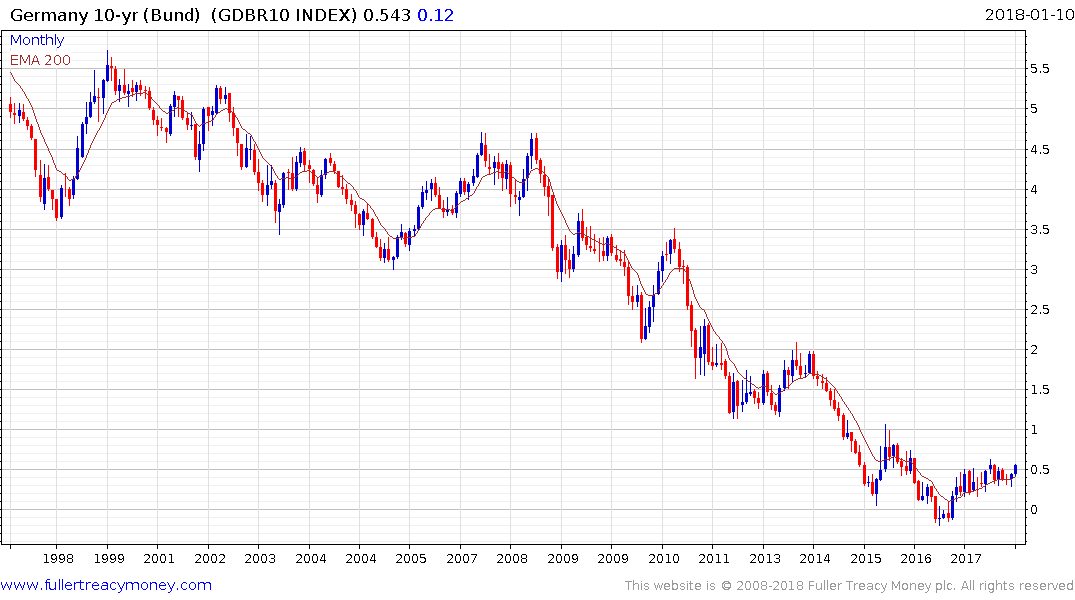

Why does China buy so many Treasuries? The simple answer is they need to sanitise the constant inflow of funds from the nation’s myriad exporting businesses lest the Renminbi soar. So, if the Chinese were to stop buying Treasuries, are they about to invest in Bunds at close to zero yields? That seems unlikely so this statement sounds like politicking rather than substantive action.

The ban on bitcoin mining is aimed both at sustaining state control and removing an avenue for citizens to move funds overseas. The fact that it was enacted so close to the announcement of a re-pegging of the currency is hardly a coincidence. Today’s overtures in the debt markets suggest the Chinese administration is engaged in some tactical repositioning and does not want the Renminbi to strengthen while that is going on.

These actions are all part of a broader long-term strategy to develop China’s financial independence from the rest of the world. Starting work on a third aircraft carrier in the last few days is simply an additional aspect to that aim.

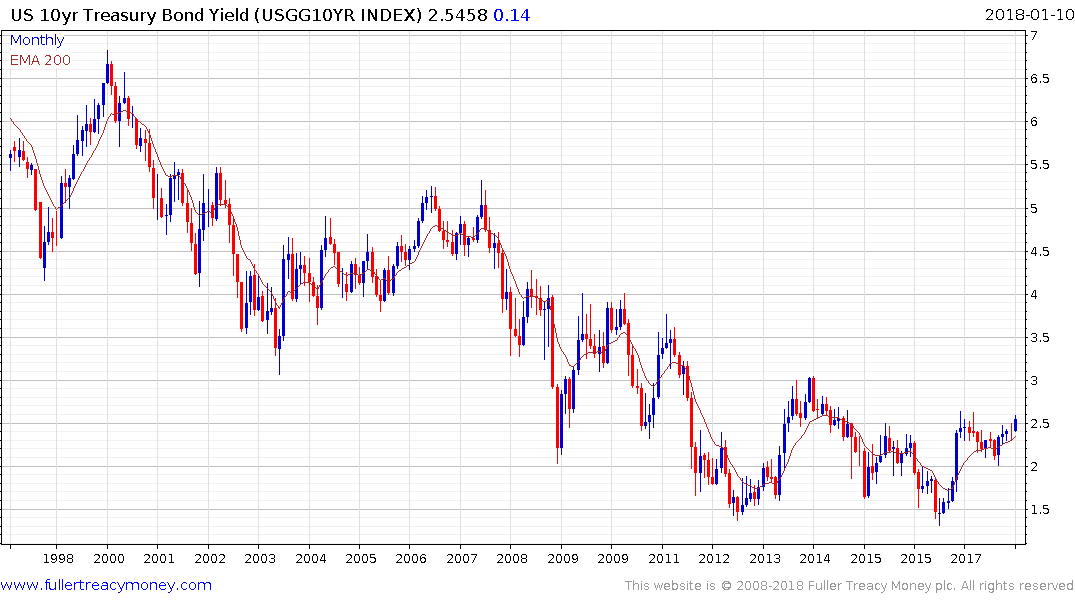

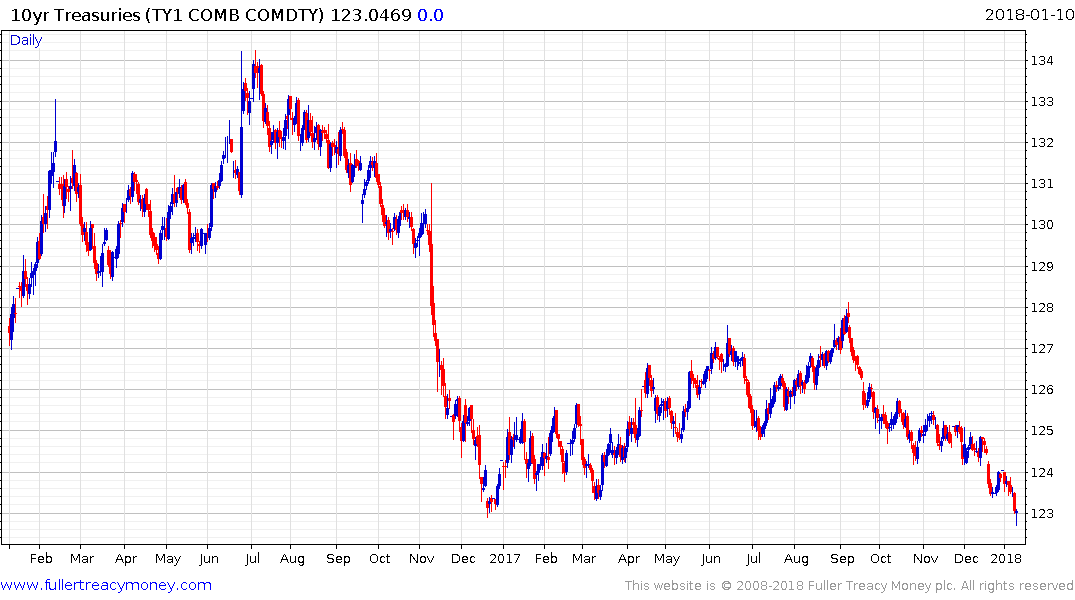

US 10-year yields are close to testing the region of the January and March 2017 highs, from which a powerful price rally started. There is room for some consolidation and potentially a reversionary rally in the short term, but a sustained move above the 125 area, on the futures contract, would be required to question medium-term supply dominance.

Gold continues to steady above the $1300 area and a sustained move below the trend mean near $1275 would be required to question current scope for a retest of the upper side of the 18-month range near $1385.

The Yen also strengthened today as desire for a safe haven picked up and the ¥111 level will need to hold if potential for additional strengthening is to be avoided.