China Verbally Props Up Yuan, Claims It's Not Trade-War Weaponry

This article by Bloomberg News may be of interest to subscribers. Here is a section:

“The PBOC is sending a verbal warning and intervention that the recent slump in the yuan was too quick,” said Zhou Hao, an economist at Commerzbank AG in Singapore. “In the short term, the yuan could strengthen as traders take profit from the recent slide. But if the market ignores the PBOC and keeps pushing the yuan weaker quickly, the central bank may conduct heavy intervention to send a stronger signal.”

While there were no heavy-handed actions in the market, there were some signs of mild, suspected intervention during morning trading on Tuesday. Some major Chinese banks sold the dollar after the yuan slid past 6.7 per greenback, a move that strengthened the currency above that level, according to four traders who asked not to be named.

“The market sentiment is very one-sided, all the hedging and trading flows are all pointing to further weakening of the yuan," said Ryan Lam, head of research at Shanghai Commercial Bank Ltd. "The yuan is going through a very bad cycle now."

The Chinese banking sector is labouring under renewed measures to contain property market speculation and the shadow banking sector. That makes raising interest rates difficult because it would act as a headwind to the economy at a time when high yield defaults are already rising.

At the same time, the country has banned Dollar loans but that means companies that had to resort to overseas funding now have to come back on shore against a background where the banks are inhibited from lending. That is contributing to the rising default rate particularly for the property sector.

Against that background the central bank is understandably reticent to raise interest rates so it has two choices. It can either start an outright buying program which would reduce foreign exchange reserves or it can talk it up. The latter is almost always the favoured option since it is free and that is what we saw today from the PBoC.

The Renminbi looks likely to unwind its oversold condition relative to the trend mean as a result. However, the central bank said it was unhappy with the speed of the decline, not the decline itself, so it will need to sustain a move above the trend mean to confirm more than near-term steadying.

The banking sector is also oversold in the short-term so there is scope for steadying but its rally today was in no way dynamic suggesting a lukewarm response to the PBoC’s jawboning.

The China Enterprises Index (H-Shares) in Hong Kong closed well off its lows but down on the day. It is deeply oversold in the short-term but a sustained move above 12,000 would be required to question the medium-term downward bias.

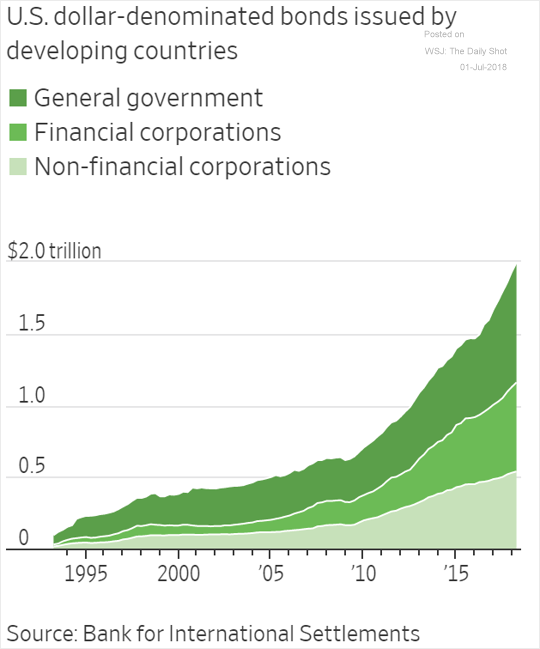

The issue with US Dollar strength and the absolute quantity of US Dollar denominated debt globally is making headlines not least because it has grown so much. One partially mitigrating factor is that the maturity profile of the sector has been stretched over the last couple of years. Nevertheless, any time the Dollar rallies it is going to put the sector under pressure.

Back to top