China Stocks Drop Most in a Month on Covid Flareups, Tech Fines

This article from Bloomberg may be of interest to subscribers. Here is a section:

Chinese stocks had their worst day in about a month as a Covid resurgence, combined with fresh fines for the country’s tech giants, sent investors running for the door.

The Hang Seng China Enterprises Index, a gauge tracking mainland firms listed in Hong Kong, slumped 3.1%, its biggest loss since mid-June. Tech heavyweights, property developers and electric-vehicle makers were among the biggest drags.A slew of bad news hit the Chinese market over the weekend and Monday morning, including regulatory fines on past transactions done by Alibaba Group Holding Ltd. and Tencent Holdings Ltd., a rejection by China Evergrande Group’s bondholders on a proposal to extend debt payment, and a warning by a prominent investor’s wife that a key lithium maker’s stock is overvalued.

The selloff is a reminder that the nation’s Covid Zero policy and lingering uncertainty toward tech crackdowns remain key risks for investors betting on a sustained rebound in Chinese shares. The Hang Seng China gauge has recorded just one positive session in the last eight after rallying nearly 30% from a March low.

The pandemic continues to be a major factor in the daily life of China, even as the rest of the world moves on. The reality of a large population with little immunity and the threat of rapidly evolving strains are growing more infectious suggests the quarantine system will slow the advance but can never overcome it.

This is a useful fact for the Communist Party as they approach the next Congress where Xi Jinping will be confirmed as leader for life. Exerting total control over the population is highly effective in ensuring compliance with government dicta. It’s not great for economic growth.

The Hang Seng pulled back sharply today as Macau was locked down. Having unwound the overextension relative to the 200-day MA, the Index is now pausing. A sustained move above the trend mean will be required to confirm a return to medium-term demand dominance.

The Hang Seng pulled back sharply today as Macau was locked down. Having unwound the overextension relative to the 200-day MA, the Index is now pausing. A sustained move above the trend mean will be required to confirm a return to medium-term demand dominance.

Riots outside banks in Zhengzhou because of frozen deposits suggest the underperformance of the mainland’s banking sector is not an aberration. There is a real risk that lockdowns will be a permanent feature of Chinese society as the leverage bubble in property and infrastructure is unwound.

Another new railway opened in June. This time it was over the sand dunes between sparsely populated regions of Xinjiang. https://www.seetao.com/details/164976.html Meanwhile China Railway’s outstanding debt is approaching $1 trillion as passenger numbers fall.

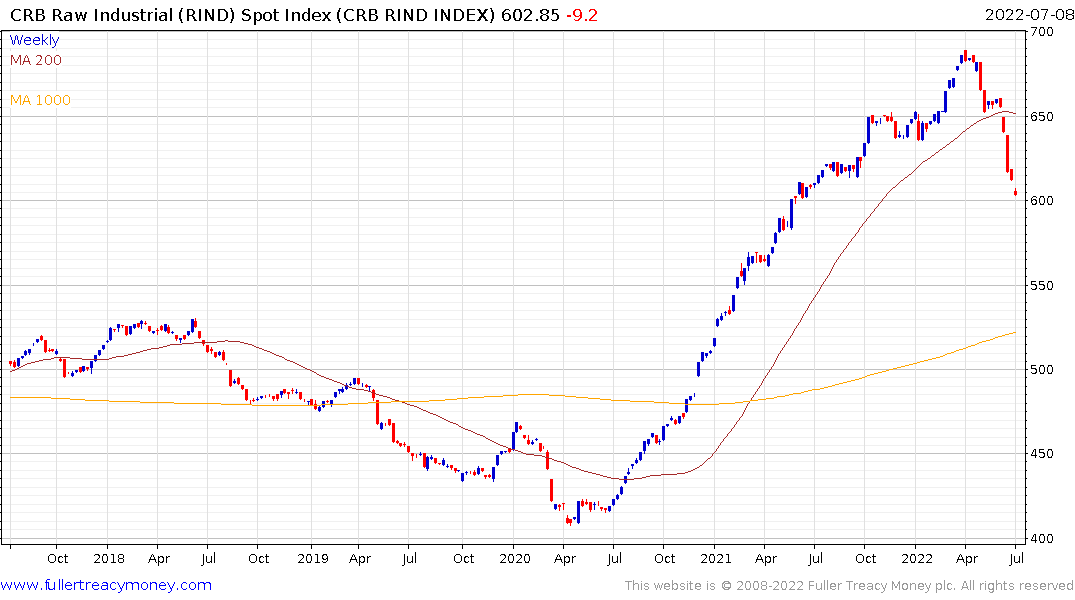

The risk of China’s growth dealing a significant blow to the commodity market is nontrivial.

The S&P/ASX Materials Index is back testing the region of the 100-day MA and will need bounce soon and emphatically to check momentum.