China' Politburo Likely to Shift Focus From Stimulus to Reforms

This article from Bloomberg may be of interest to subscribers. Here is a section:

With China’s economic recovery well on track, top leaders will likely turn their policy focus now to boosting business confidence, increasing jobs and strengthening the property market without adding extra stimulus.

AndThe People’s Bank of China has already signaled it will begin dialing back the pandemic stimulus used to funnel loans to small businesses in recent years. Local governments are also saddled with record amounts of debt, reducing their capacity to increase fiscal support.

“The People’s Bank of China could switch to a wait-and-see mode once the economy is back on track, and prepare for policy normalization,” said Yu Xiangrong, chief China economist of Citigroup Inc.

The one thing investors are paying attention to is China’s willingness to inject liquidity into the economy. Capital is both global and mobile and China’s willingness to flood the market with liquidity after the credit crisis helped to re-float the global economy. This time around China is more interested in keeping inflationary pressures contained and avoiding reflating the housing bubble. That suggest much more targeting economic support.

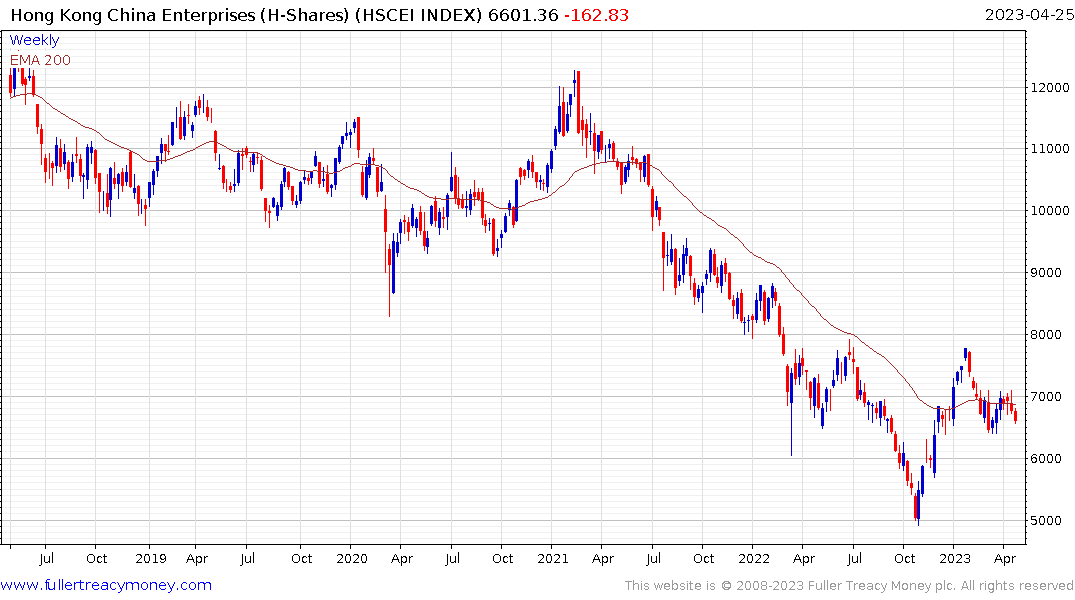

The lack of overt policy support is weighing on the stock market. Both the mainland and H-Share markets remain in medium-term downtrends.

That begs the question how sustainable the reboot of Chinese consumer demand is going to be. The overextension of luxury goods shares continues to widen. The first clear downward dynamics will signal a peak of at least near-term significance.