China's Economy at a Glance

Thanks to a subscriber for this report from from NAB which may be of interest.

Here is a link to the full report and here is a section:

In contrast, growth in non-bank lending continues to contract – down by 78% yoy in the first seven months of the year. Corporate bond issuance has been the standout within this category – totalling RMB 1.2 trillion (compared with an net contraction over the same period in 2017). In contrast, issuance of trust and entrusted loans and banker’s acceptance bills has plunged – down 159% yoy and 250% yoy respectively – as tighter regulation of these shadow banking sectors has curtailed activity.

Monetary policy in China has continued to ease in recent weeks – with the 7-day Shanghai Interbank Offered Rate (Shibor) dropping below 2.5% in early August. These are the lowest rates since mid-2016, and represents a loosening of around 35 basis points since June.

The big question mark is the direction of policy and lending going forward. Late last week, the China Banking and Insurance Regulatory Commission stated that it would guide financial institutions to expand financing – particularly to small businesses and infrastructure – noting that banks should make full use of current liquidity and current low funding costs. It is unclear at the moment if this would mean a slowing in, or the end of, deleveraging (at present we expect the former).

An end to deleveraging would provide a short-term boost to China’s economy, but would be a medium term negative, given its high debt levels (our estimate is around 325% of GDP).

The SHIBOR interbank rate is perhaps the clearest indicator that the process of deleveraging has either ended or is at least taking a breather. One of the clearest takeaways from my family’s recent visit to China was the abiding sense of unease many people were exhibiting and that was no doubt a reflection both of the tightening of credit and the increasingly overbearing position adopted by the administration.

The FTSE China A600 Banks Index has found at least a near-term low and is now testing what could be its first higher reaction low. It has unwound about half its overextension relative to the trend mean but will need to sustain a move above it to confirm a return to demand dominance beyond a reversionary rally.

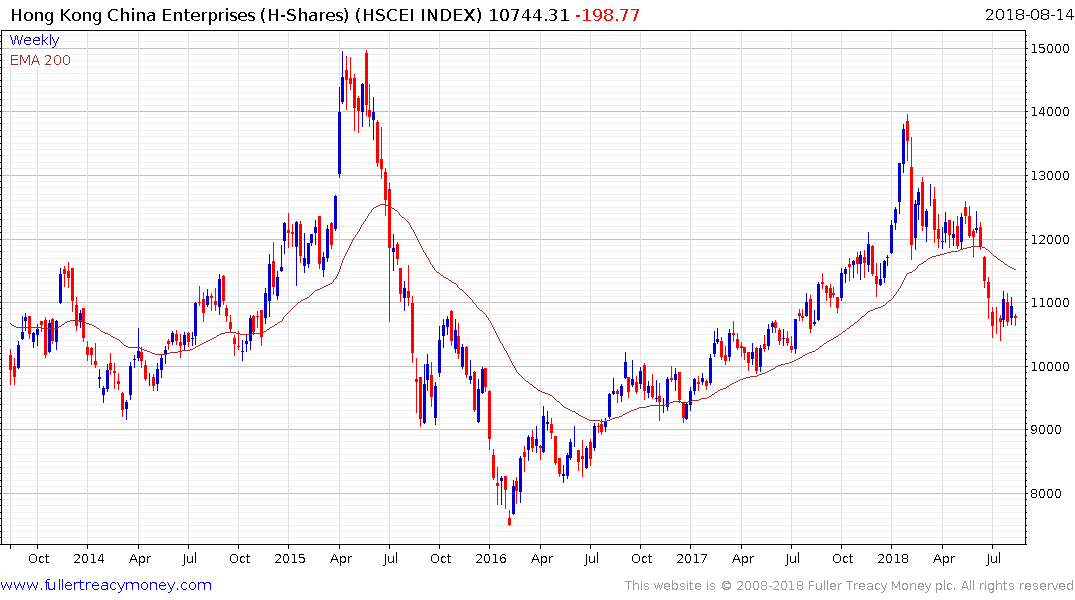

The China Enterprises Index (H-Shares) has stabilised above 10500 since early July and also has scope for a reversionary rally but the real challenge will be whether it can sustain a move back above the trend mean.

The Hang Seng Index pulled back sharply today on Sunny Optical’s surprise earnings miss but is being led lower by Tencent Holdings. The Index needs to bounced from a new reaction lows today but needs to follow through on the upside to confirm a low of more than short-term significance.

China, as the last paragraph quoted above highlights, has a lot of debt and there is no clear way to identify where the greatest risks lie because of the opaque nature of cross ownership between connected individuals, banks, regional administrations and the central government. China’s external debt as a percentage of its GDP is nowhere near as onerous as Turkey, but a full accounting of how much has been spent on the Belt and Road initiative is not forthcoming either.