China's central bank cuts rates for sixth time since November

This article from Reuters may be of interest to subscribers. Here is a section:

China's central bank cut interest rates for the sixth time since November on Friday, and it again lowered the amount of cash that banks must hold as reserves in another attempt to jumpstart a slowing economy.

China's monetary policy easing is at its most aggressive since the 2008/09 global financial crisis, underscoring concerns within Beijing about the health of the world's second-largest economy.

The People's Bank of China (PBOC) said on its website that it was lowering the one-year benchmark bank lending rate by 25 basis points to 4.35 percent, effective from Oct. 24."The People's Bank has delivered another jolt of stimulus," analysts at Capital Economics said in a note to clients, but added that they were "still waiting for clear evidence of an economic turnaround".

"We are retaining our forecast that benchmark rates and the reserve requirement ratio will both be cut once more before the end of the year, with a further move in both early in 2016."

This has been a big week in monetary policy and is a further example of how central banks react to deteriorating economic statistics. They ease policy because they fear deflation much more than inflation. In fact the entire system is set up to encourage inflation. With the ECB making dovish comments and substantive action from the PBoC, risk-on trades have been boosted.

The assets held on the balance sheets of the Fed, ECB, PBoC, BoJ and BoE total $15.6 trillion.

With this week’s news the potential for them to contract is even lower than it was previously.

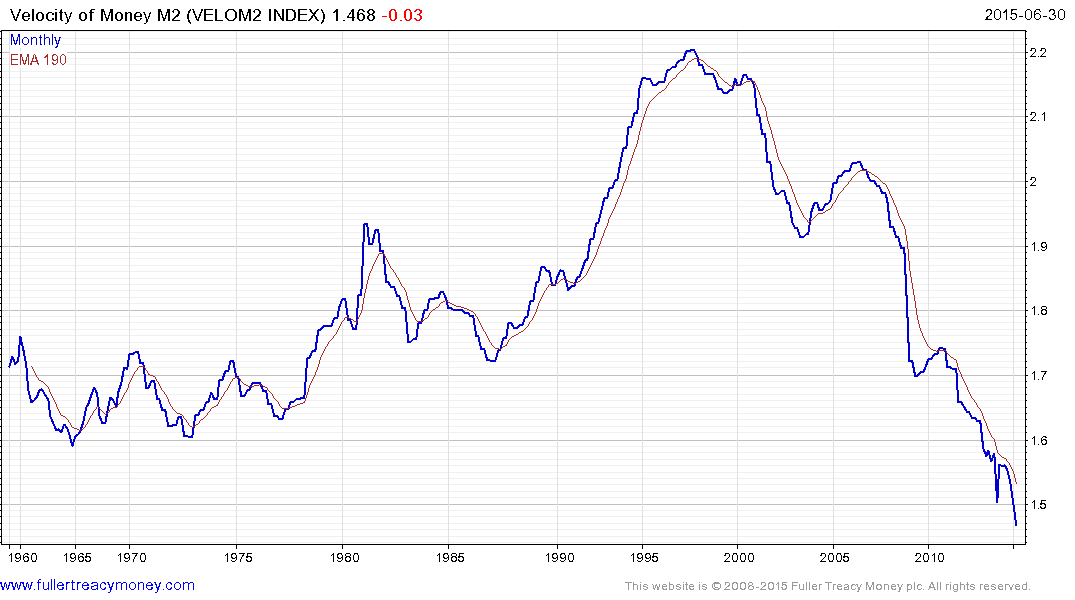

We have long pointed that quantitative easing is unlikely to produce inflation, of the kind central banks measure, as long as the velocity of money is trending lower. Unfortunately velocity of money data is not issued on a reliable basis by the majority of central banks. The USA’s data is posted quarterly with a one quarter lag, was last updated in June and has been trending lower since 1997. It’s an open question, and I don’t have a well-researched answer, but the streamlining effect of the internet on supply chains is probably a major contributor to this trend.

Against that background we can have a better understanding of why the Fed is still cautious about raising rates despite the fact asset prices have increased considerably, full employment is within reach and economic activity continues to trend moderately higher.

The Shanghai A-Share Index has been in a reversionary rally for nearly two months and has now almost closed the overextension relative to the trend mean. A pause in this area is possible but a sustained move below 3250 would be required to question medium-term scope for continued higher to lateral ranging.

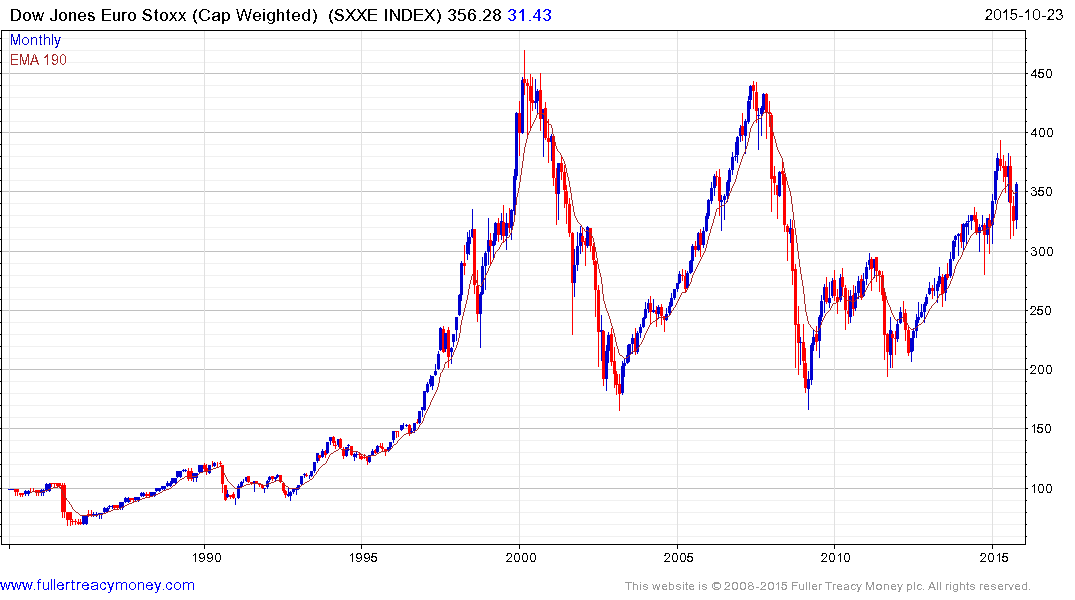

The Euro STOXX Index has held a progression of higher major reaction lows since 2012 and continues to trend towards the upper side of the 15-year range, albeit in a volatile manner. It is somewhat overextended in the short term but a clear downward dynamic would be required to check momentum.

The Nasdaq-100 retested its 2000 highs in July before experiencing its deepest pullback in at least six-years. It has since rallied back to test the 4500 area and is being led higher by some of its largest constituents. There is potential for an additional pause in the region of the peak but a sustained move below the August low will be required to question the ranging consolidation hypothesis.

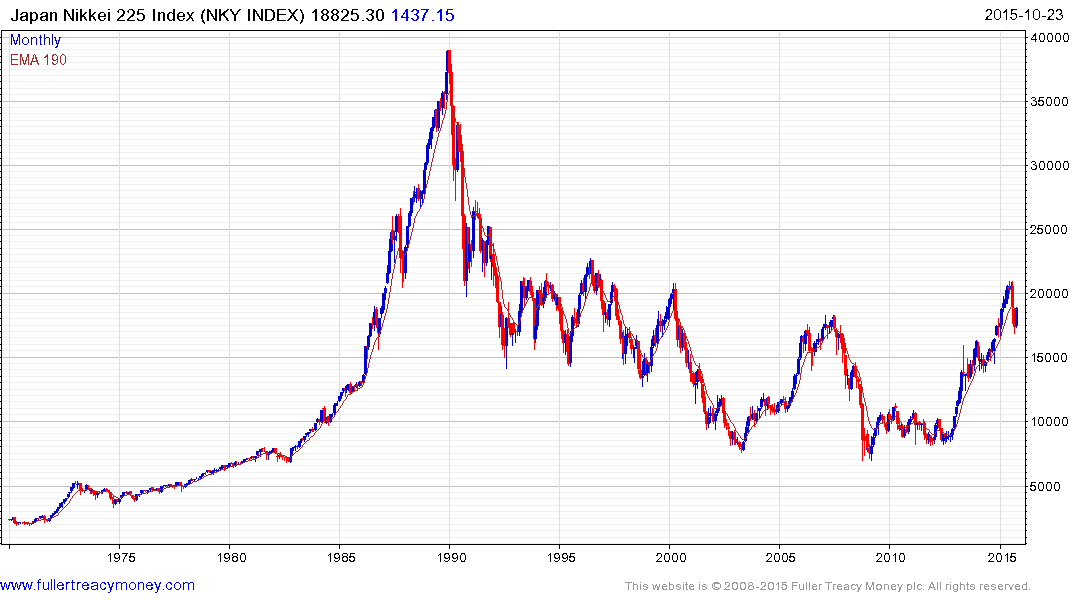

The Nikkei-225 has also been boosted by the Yen's renewed weakness and found at least near-term support.

Back to top