China's Banks Need More Capital After Credit Boom, IMF Says

Thanks to a subscriber for this article from Bloomberg News which may be of interest to subscribers. Here is a section:

President Xi Jinping has highlighted financial stability as a top priority. People’s Bank of China Governor Zhou Xiaochuan warned in October about the risk of a ‘Minsky moment,’ or a sudden collapse of asset values. Financial watchdogs last month promised to overhaul regulation of asset-management products, which hold about $15 trillion and are seen as a key threat to stability.

Speaking to media on Thursday on a video call, the IMF’s deputy director of monetary and capital markets, Ratna Sahay, said China’s financial system held three main risks. She pointed to an increase in credit that in other countries has been linked to financial distress. An increasingly complex and opaque financial system makes it hard to identify risks, and implicit guarantees encourage excessive risk-taking, she said.

Credit growth needs to slow, guarantees should be gradually removed, and banks need more capital during that process, Sahay said. “Banks need to have some buffers in order to protect against any possible distress that might happen,’’ she said.

Financial stability is a priority for every country and just about everywhere has its own version of implicit guarantees. We can only imagine what would happen in the USA if the now explicit guarantee behind Fannie Mae and Freddie Mac were removed. What state would the financial sector be in now if the EU and UK had not stepped in to backstop it during what was dubbed a sovereign debt crisis but was in fact a cross border banking sector calamity?

The issue for China is that every bank, asset manager and investor expects a guarantee and that condition is unsustainable. The longer it persists, and it has persisted for a long time already, the greater the problem is eventually likely to be. This article highlights how the problem of bad loans is probably understated by the fact that property prices have continued to rise.

.png)

The big question is whether the declining pace of expansion in M2 and Shibor rates illustrated in the above chart from BMI is a signal of more than short-term tightening. Increasingly overt population control measures, such as the insistence technology companies toe the Party line, the clearing out of migrants from Beijing and the use of facial recognition software to track citizens potentially suggest Xi’s 2nd term may tackle the risky problem of rationalizing the banking/real estate/infrastructure triumvirate?

While the above questions are important, they would represent a massive change for the Chinese government and many of the party cadres benefit enormously from the banking and real estate bull markets. The Shanghai Property Index is currently testing the upper side of a more than yearlong range. As long as it continues to find support in the region of the trend mean, the benefit of the doubt can be given to continued higher to lateral ranging.

The FTSE/Xinhua A600 Banks Index is unwinding a short-term overbought condition and the reaction to date does not have top formation characteristics.

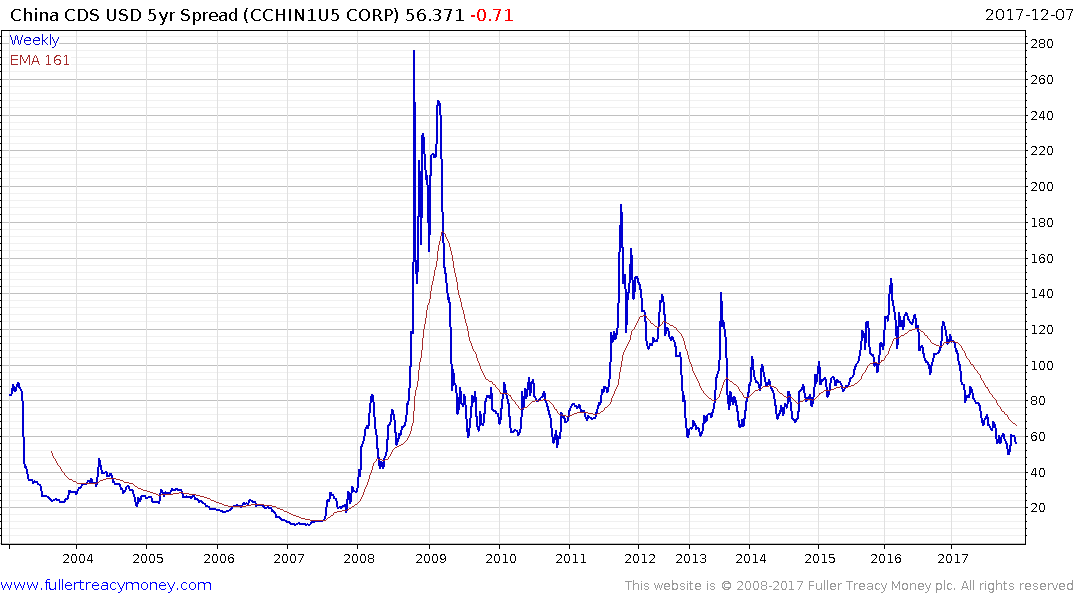

China’s CDS spreads are at lows not seen since 2008.

Meanwhile the FTSE-350 Mining Index whose constituents in large part depend on Chinese demand growth is testing the region of the trend mean.

What these charts suggests is that the threat of a deleveraging is real but it does not appear imminent.

Back to top