China's $23 Trillion Local Debt Mess Is About to Get a Lot Worse

This article from Bloomberg may be of interest to subscribers. Here is a section:

“Many cities will become like Hegang in a few years’ time,” said Houze Song, an economist at US think tank MacroPolo, noting that China’s aging and shrinking population means many cities don’t have the workforce to sustain faster economic growth and tax revenue.

“The central government may be able to keep things stable in the short term by asking banks to roll over local governments’ debt,” Song said. Without loan extensions, he added, “the reality is that over two thirds of the localities won’t be able to repay their debt on time.”

In Heilongjiang province, where Hegang is located, bond investors are already wary of the risks. The province’s outstanding seven-year bond had an average yield of 3.53%, 18.8 basis points higher than the average nationwide, ranking it among the top four most expensive.

The big question for everyone is just how much pain is the Chinese government willing to tolerate? The modest official debt to gdp ratio posted by the government does not include the debt owed by states, counties, or cities; all of which have a quasi-guarantee from the central government. When those debts are included China has one of the highest debt burdens of any major economy.

The aim of deflating the property bubble is laudable but it is a major part of the economy and there is nothing to take its place. With a shrinking population, youth unemployment around 20% and massive overbuilding of everything from residential to commercial real estate and infrastructure, China needs to both move up the value chain and have willing trade partners who will buy its products. Doing that without resorting to additional stimulative measures will be difficult and that is before rising geopolitical tensions are accounted for.

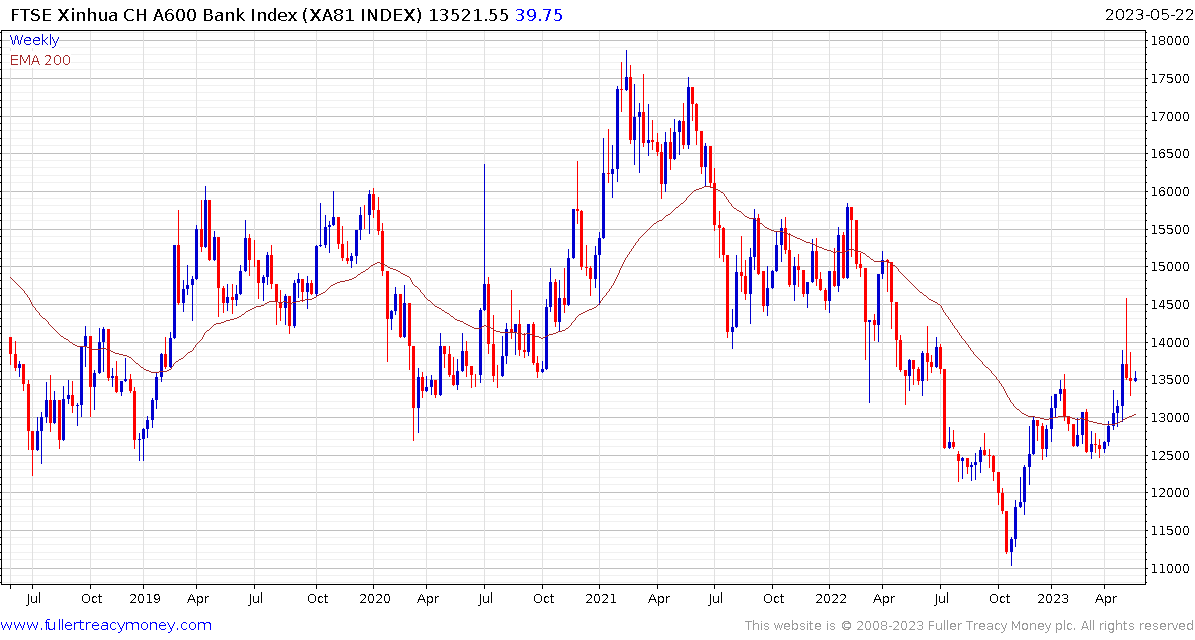

The Xinhua A600 Banks Index continues to pause in the region of the upper side of its underlying range as traders wait for some evidence state-owned banks will encouraged to play a greater role is refloating the economy.

The Xinhua A600 Banks Index continues to pause in the region of the upper side of its underlying range as traders wait for some evidence state-owned banks will encouraged to play a greater role is refloating the economy.