China reopening playbook

Thanks to a subscriber for the report from Goldman Sachs which may be of interest. Here is a section:

The light at the end of the tunnel?

China’s Zero-Covid Policy (ZCP) has kept Covid cases at low absolute levels but at rising economic costs as the virus becomes more transmissible. Reported cases are rising but more signs of Covid policy relaxation have been made available post the Party Congress, and our economists expect China could start to reopen in 2Q23 on political and public health considerations.China could rally 20% on (and before) reopening

Cross-country empirical analysis shows that equity markets tend to pre-trade reopening (as defined by the peak of activity disruptions) about a month in advance and the positive momentum typically lasts for 2-3 months. We estimate that a full reopening could drive 20% upside for Chinese stocks based on empirical, top-down, and historical sensitivity analyses. Importantly, equity markets usually react more positively to local policy relaxation than to international reopening, with Domestic Cyclicals and Consumer sectors outperforming.

Here is a link to the full report.

The prospect of China opening up has enlivened risk appetites among traders who are tempted by the low absolute valuations on Chinese stocks listed in Hong Kong. The Beijing marathon went ahead as planned over the weekend and is being taken as evidence of some easing of COVID restrictions. It will be interesting to see if the Shanghai and Chengdu marathons pass off as planned later this month.

China is unlikely to abandon the COVID-zero policy suite and the number of cases continues to trend higher in several locations. That suggests there is still clear scope for continued uncertainty around economic activity.

The basis for bullishness is Chinese demand could rebound emphatically, like it did everywhere else, when the COVID restrictions were dropped. The difference is China has been relatively free from restrictions on movement until quite recently and the government did not spend in the profligate manner during the pandemic.

Nevertheless, stocks are oversold and bouncing from the region of the 2008 lows. That suggests at least some scope for an unwinding of the short-term oversold condition and not least as a confidence boosting measure in the new administration.

The China Fund Inc trades at a discount to NAV of 17.5% and tends to pay outsized dividends in December.

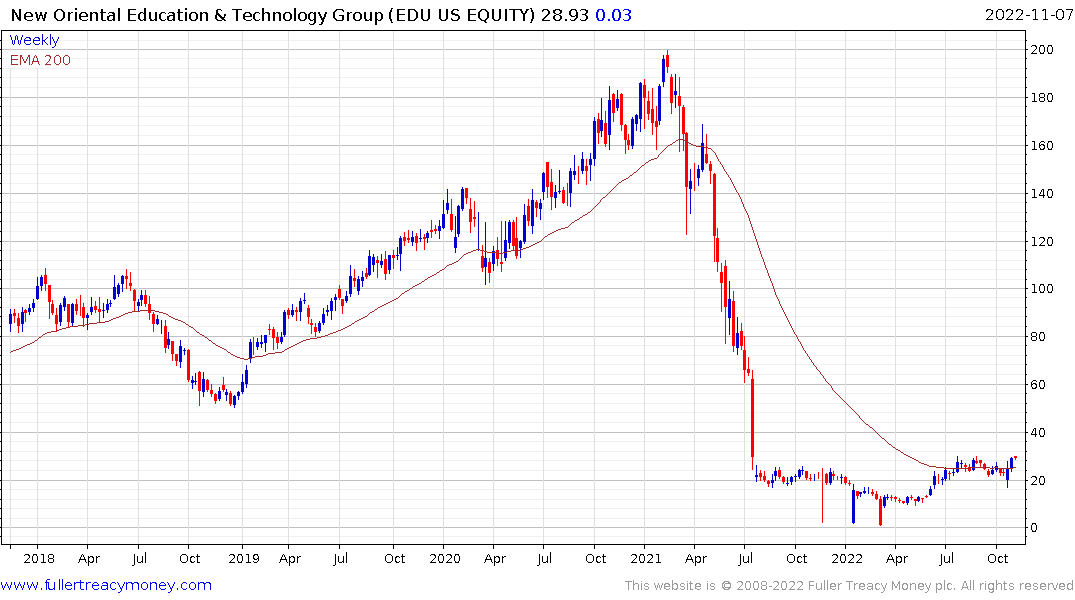

Even the benighted for profit tutoring stock, New Oriental is testing the upper side of a yearlong base formation.

Back to top