China property hard sell intensifies in bid to lift sagging sector

This article from Reuters may be of interest to subscribers. Here is a section:

Lu Yanzeng, a property agent, said he had not sold a single home in two months. Business this year "is very so-so, it's not as good as last year," he said. "Sales of second-hand homes are slow, but new home sales are brisk."

China's property market, where prices surged to all-time highs for five consecutive years, is experiencing its sharpest slowdown in around two years.

Average new home prices fell for a fourth consecutive month in August by 1.1 percent, meaning the market is now close to wiping out gains seen over the last year. Compared to a year ago, sales as measured by floor space were down 12.4 percent.

While the slowdown in a heated market has benefited millions of Chinese, for whom soaring house prices have made home ownership a distant dream, slackening activity has also raised concerns about the health of China's economy.

It is straining already softening domestic demand and pushing overall fixed-asset investment to lows not seen in nearly 14 years on a cumulative basis between January to August.

In an effort to avoid a bubble, the Chinese authorities engineered a property slowdown. They succeeded in that objective and will now need to act in order to avoid a crash. Easing restrictions on property purchases, particularly in tier 1 cities, making more mortgages available and easing credit conditions will all help stoke demand but the question remains as to whether buyers can be encouraged into a declining market.

With the surety of the property market shaken, the government has a vested interest in a strong stock market to act as an alternative investment destination. The creation of the Shanghai Free Trade Zone and the opening up of the mainland-Hong Kong stock market connection represent attempts to boost the capital available for investment in the stock market.

The FTSE/Xinhua A600 Banks Index has been trading above its 200-day MA since July and firmed from that level again today. A sustained move below the trend mean would be required to question medium-term recovery potential.

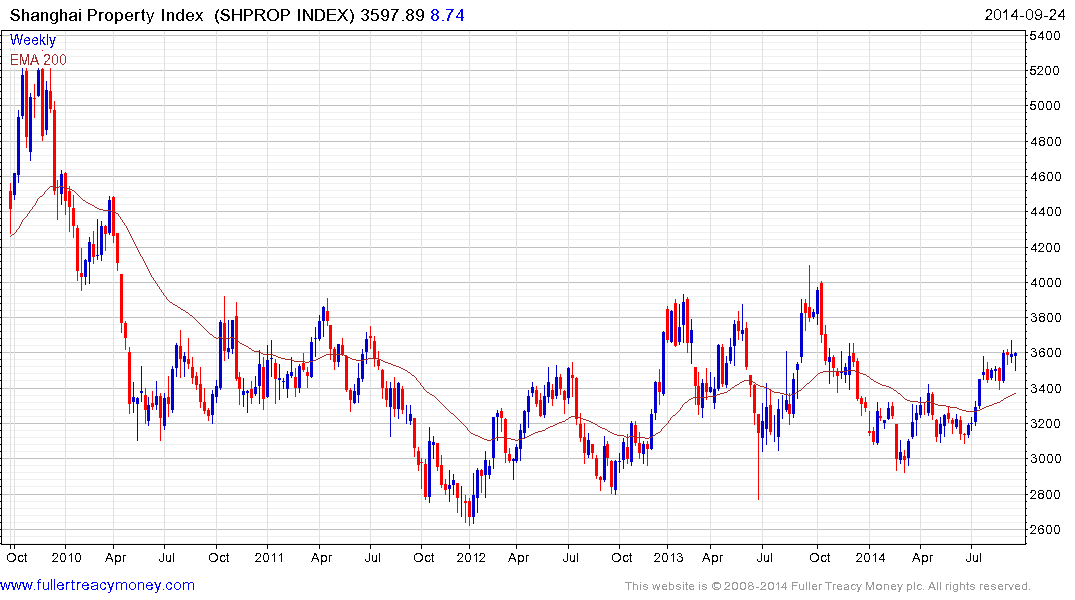

The Shanghai Property Index has been ranging mostly between 3000 and 4000 since 2010 and is currently rallying towards the upper boundary. A sustained move above 4000 will be required to complete the developing base formation.