China Plans Income-Tax Overhaul to Bolster Consumption

This article from Bloomberg News may be of interest to subscribers. Here is a section:

Underscoring the need to keep spending on track, Premier Li Keqiang’s work report unveiled Saturday included plans to "adapt to the trend toward high-end consumption." China will "remove policy barriers, improve the consumer environment, and safeguard the rights and interests of consumers," Li said.

Buoyed by healthy wage gains, consumer spending has proven resilient so far to the slowdown in old growth drivers like manufacturing and housing investment, helping underpin the world’s second-largest economy. Lou said salary increases have risen faster than labor productivity in recent years, which he said is "not sustainable in the long run."

China is also overhauling business taxes, by introducing value-added levy in their stead. Lou said that revenue for both central and local governments will fall as the reform spreads across business sectors. He added that fiscal revenue as a whole last year "was not good."

The shift to a VAT system is scheduled to take effect in May. The pace of the conversion to a value-added levy has been slower than expected, Lou said. The delay was due to the complexity of the new system, he said. The new system will make new investment in unmovable assets, such as real estate, tax-deductible, and thus encourage more spending, Lou said.

The introduction of a mortgage interest rate deduction for housing represents perhaps the most pressing reason why property prices have risen so abruptly over the last six months. In an environment where supply cannot be increased quickly, the introduction of a measure to improve affordability creates demand and prices rise to meet it. Since this represents more technical buying than outright demand growth from family formation prices are likely to stabilise once equilibrium is found.

The move to encourage consumption through the tax code is central to the Chinese administration’s ambitious plan to create a counterweight to the infrastructure/property development/export model it is now attempting to restructure.

The S&P/Citic300 Consumer Staples has posted a higher low and moved to a higher high today. A sustained move below 4600 would be required to question current scope for additional higher to lateral ranging.

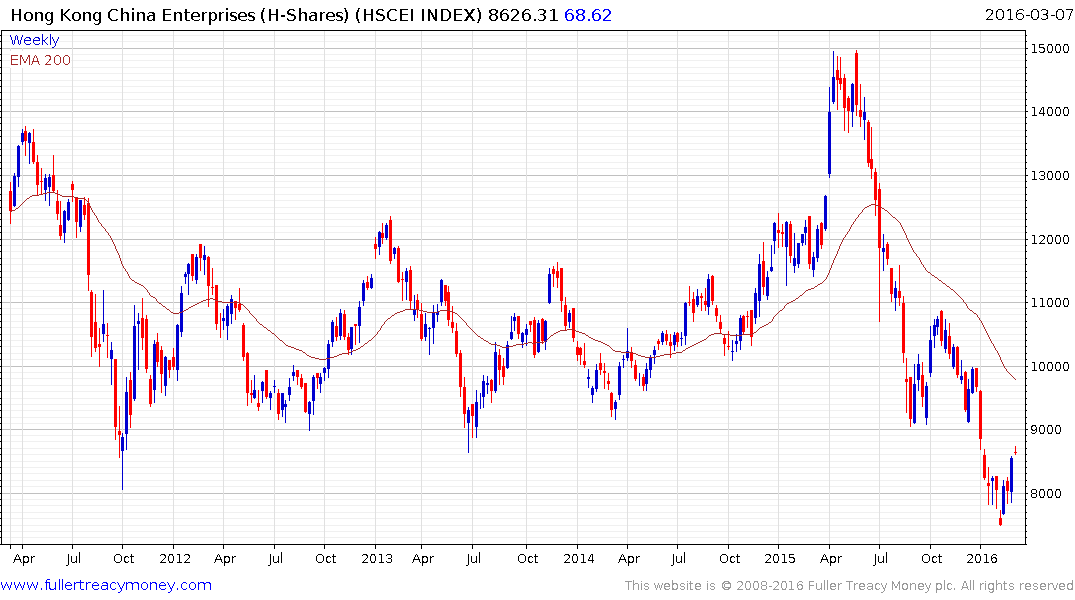

The Hong Kong listed China Enterprises Index (H-Shares) rallied impressively last week to signal mean reversion is an increasingly likely scenario. The 8000 will need to hold on the first significant pullback to signal demand regaining the upper hand beyond the short term.

Back to top