China Inflation Heads Off in Two Directions

This article from the Wall Street Journal may be of interest to subscribers. Here is a section:

China's consumer-price index in February was up just 0.8% from a year earlier, Beijing reported Thursday, slowing from January's 2.5% pace, while the producer-price index--which measures production costs at the factory gate--was up 7.8%, its biggest jump since September 2008.

It is the CPI, which eased largely due to food prices, that most economists see as more indicative. The sharp rise in input costs for manufacturers reflects how low commodity prices were a year ago, and should moderate as that factor fades. Both consumer and producer prices will soften if the overnight plunge in global oil prices proves to be the beginning of a longer slide. Oil's biggest one-day drop in more than a year followed news of record U.S. stockpiles, though prices recovered a touch during Asian trading hours Thursday.

Still, going even further down the rabbit hole, it seems unlikely that China's surprisingly weak inflation reading will lead the central bank to relax. CPI inflation may be far short of the government's 3% target, but the People's Bank of China has a more urgent task than goosing prices: preventing financial risk, from ballooning debt to asset bubbles, from wrecking the economy.

"Despite lower-than-expected inflation, the PBOC will continue to raise money-market interest rates because the overarching theme for China this year is deleveraging," said Liu Dongliang, senior economist at China Merchants Bank.

China’s producer prices have been rising because of the weakness of the yuan, higher energy prices and the trend of higher wages without commensurate improvements in productivity.

It’s looking increasingly likely that oil has rolled over so that will remove some pressure from both the CPI and PPI figures over the coming months in both absolute and year over year comparisons. However the renminbi is still trending lower and wages are still rising. Against that background the central bank’s attempts to control the shadow banking system while also encouraging the domestic economy highlights just how fine a line it is treading in terms of monetary and fiscal policy.

The Shanghai A-Share Index, which remains dominated by the banking sector, remains in a modestly positive uptrend and a break in the progression of higher reaction lows would be required to question potential for continued higher to lateral ranging.

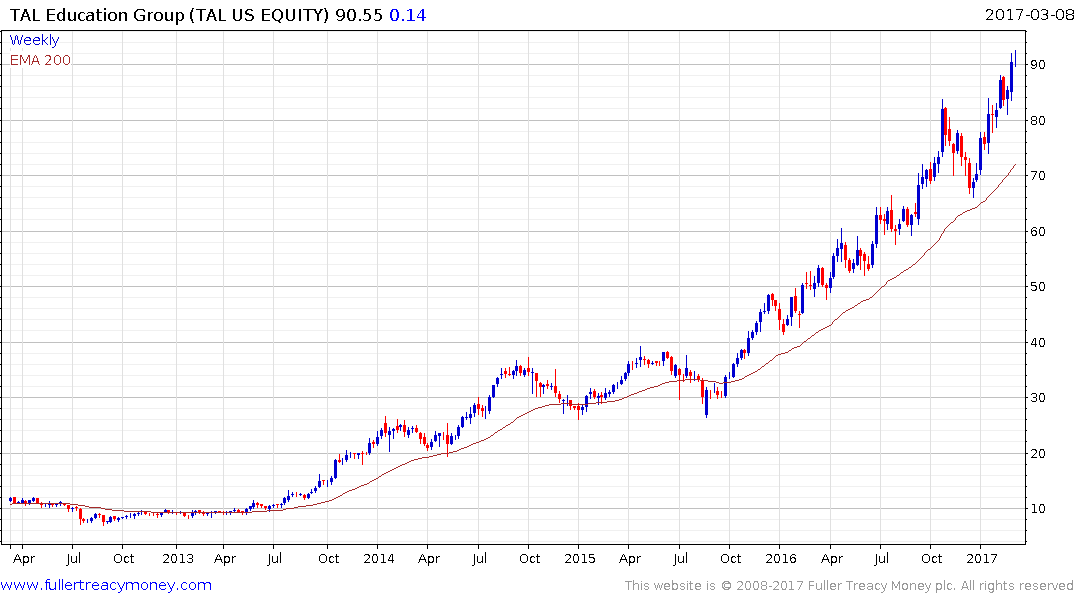

The education sector remains above the best performing among US listed Chinese shares with TAL Education now quite overextended relative to the trend mean and susceptible to some consolidation.