China health care Pharma sector comes of age

Thanks to a subscriber for this highly educative heavyweight report from Standard Chartered focusing on China’s healthcare sector. The embedded audio visual summary is well worth taking 3 minutes to watch. Here is a section:

We would explain the smiley curve pattern in this way:

Innovators: At one end of the smiley curve are innovators, including pharma companies that have accumulated vast knowledge and expertise over long periods. Others are laboratories and CROs (contracted research organisations), which specialise in innovation and benefit from the outsourcing of other companies’ main functions, from diagnosis and biologics manufacturing to R&D.

Health-care service providers: Hospitals, clinics, doctors are the main points-of-sales for the medicine and services sub-sectors. They exert an important influence on sales and have first-hand intelligence on large numbers of patients. These companies should be able to capitalise on strengths to generate returns for investors.

?Consumables and distributors: We find these sub-sectors in the value chain less attractive. Despite entry barriers related to scale, knowledge or regulations, their business is too distant from the areas where real innovation is fostered or services are rendered. While they employ the latest technologies to improve efficiency, newer technologies could disrupt their value proposition. For instance, smart medical devices containing diagnostic sensors, such as Dexcom’s continuous glucose monitoring devices, facilitate information flow between patients, physicians and pharma companies; their use diminishes the value of the middle man ¡V distributors.

Will China’s health-care market trend be similar to the US? If so, it would strengthen our case for investing in both ends of China’s smiley curve. Comparing the composition of China’s listed health-care companies with market caps above USD 500mn against the S&P500 Health-care Index, China’s device sub-sector is under-represented (8% in China vs. 15% in the US), suggesting its strong growth potential. In comparison, distribution is over-indexed (14% in China vs. 6% in the US), implying less headroom for growth.

Here is a link to the full report.

When people move from a subsistence life style to one of plenty they tend to focus on buying consumer goods that make their life easier and on the trappings of wealth in order to display their success. There is no use in accumulating wealth unless one is fit enough to enjoy it, so demand for healthcare goes hand in hand with a higher standard of living.

This is particularly the case in China where access to healthcare is not universally available beyond the cities. Rolling out services and insurance plans represents a growth trend not least because it helps demonstrate the administration is succeeding in delivering a higher living standard.

The S&P/Citic 300 Healthcare Index found support near 4000 from May and continues to rally from that area. A sustained move below it would be required to question further potential for additional upside.

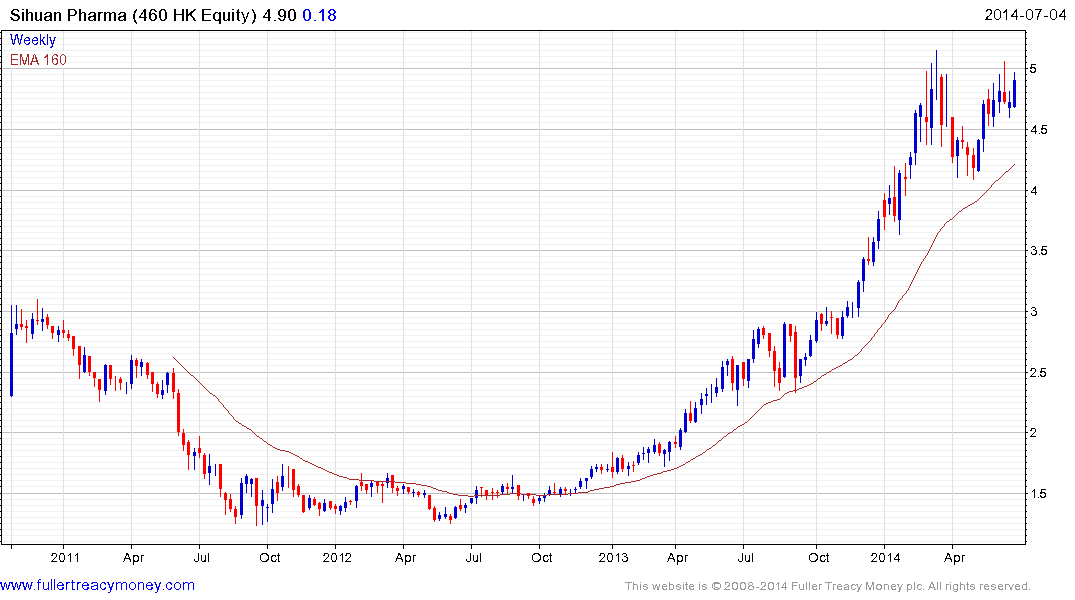

Hong Kong listed Sihuan Pharma continues to find support in the region of the 200-day MA on pull backs.

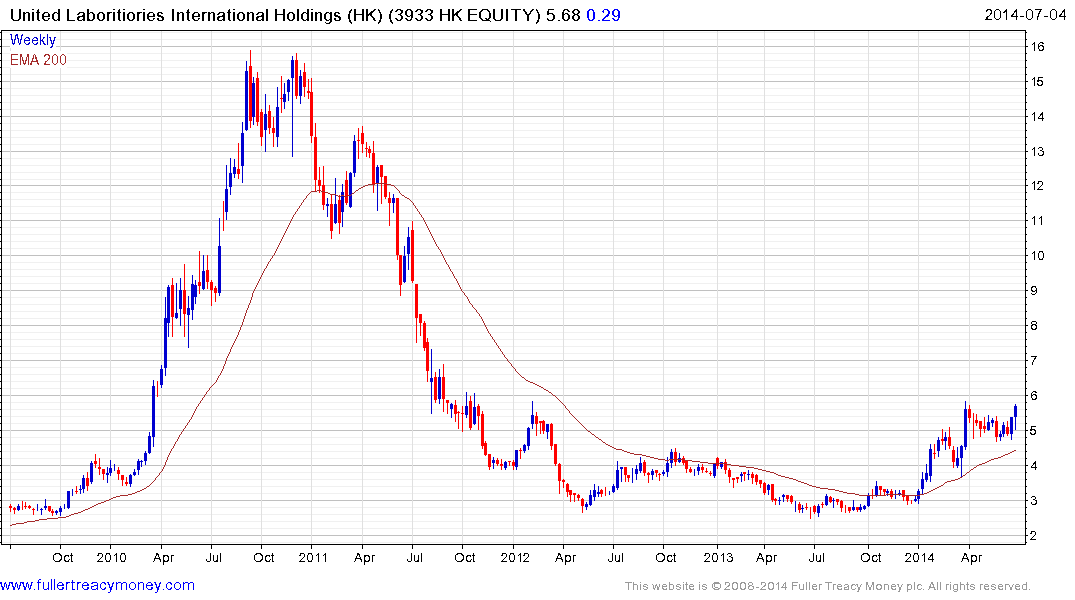

The United Laboratories Holdings completed a two-year base in January and continues to hold a progression of higher reaction lows.

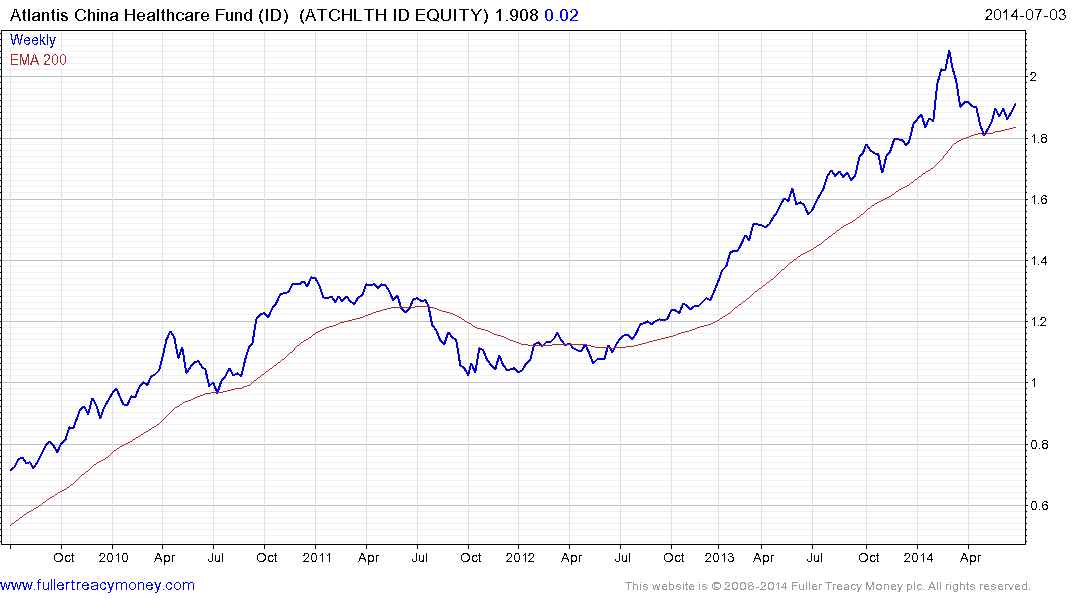

The Atlantis China Healthcare Fund found support in May in the region of the 200-day MA and a sustained move below the trend mean would be required to question the consistency of the medium-term uptrend.

Back to top