China H-Shares Advance as Industrial Output Rises, Inflows Climb

This article from Bloomberg News may be of interest to subscribers. Here is a section:

China’s industrial output and fixed-asset investment beat estimates for the first two months of the year, adding to recent data suggesting that the nation’s economic recovery is holding up. Depreciation pressures on the yuan have prompted Shanghai investors to buy Hong Kong stocks as well, with net southbound purchases in the past eight sessions rising to 9.8 billion yuan ($1.4 billion). The odds of a Federal Reserve interest-rate increase this week have climbed to 100 percent.

“The market is extending a rebound after some consolidation in the past two weeks and as mainland funds continue to pile in to hedge against the risk of yuan depreciation after a possible Fed rate hike," said Linus Yip, a strategist at First Shanghai Securities in Hong Kong.

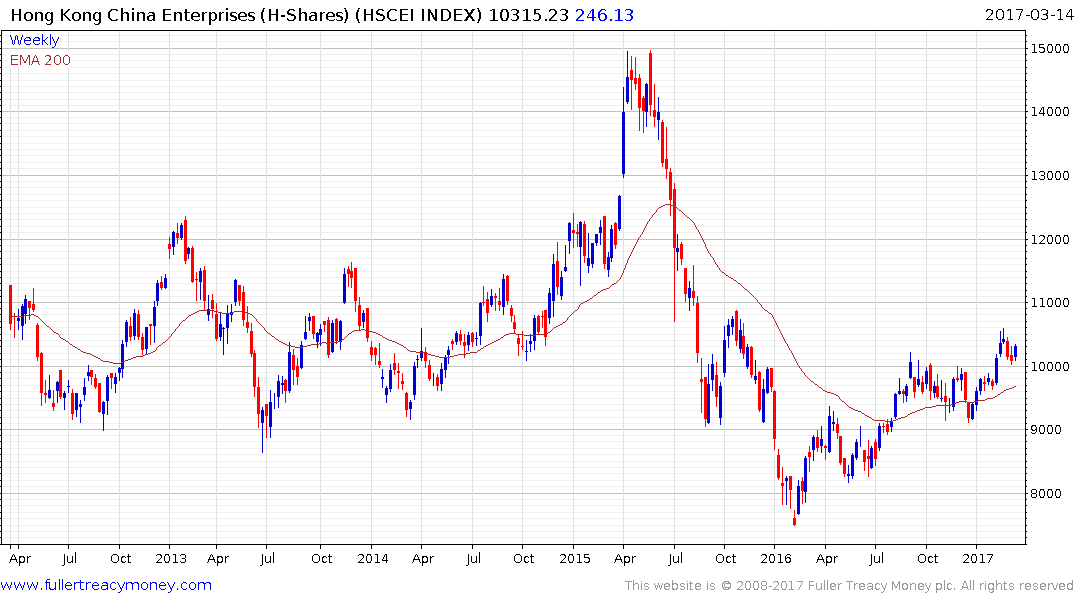

The Hong Kong listed China Enterprises Index has some of the lowest valuations for a major index in the world, at an historic P/E of 8.5 and a yield of 3.5%. Investors are nonetheless fearful it is a value trap because there are so many concerns about the quality of earnings, how long stimulus will be sustained; the trajectory of the Yuan and the outcome of the Party Congress which is taking place this week.

The Index found support yesterday in the region of the psychological 10,000 level and a sustained move below that area would be required to question medium-term scope for additional higher to lateral ranging within what is a seven-year broad congestion area.

Part of the reason Hong Kong listed shares are doing better is because of positive flows through the Shenzhen and Shanghai Stock Connects which reflect mainland desires to shift money into Dollar assets.

The US Dollar remains in a consistent medium-term uptrend against the Renminbi and a sustained move below the trend mean would be required to begin to question potential for additional outperformance.

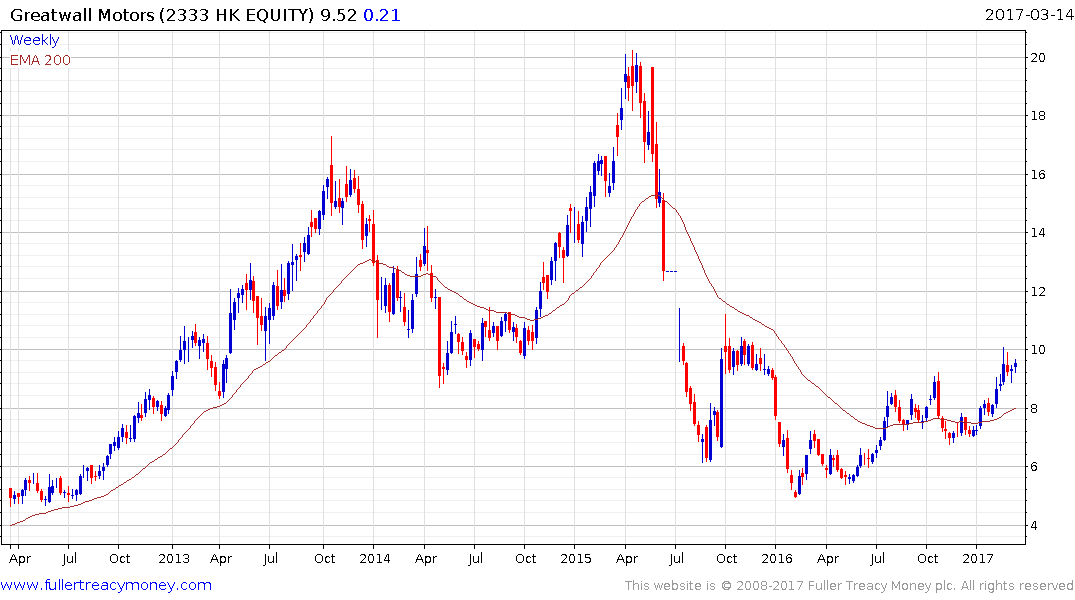

Great Wall Motor has doubled over the last 12 months and is the best performing share on the Index this year. A sustained move below the trend would now be required to question medium-term recovery potential.

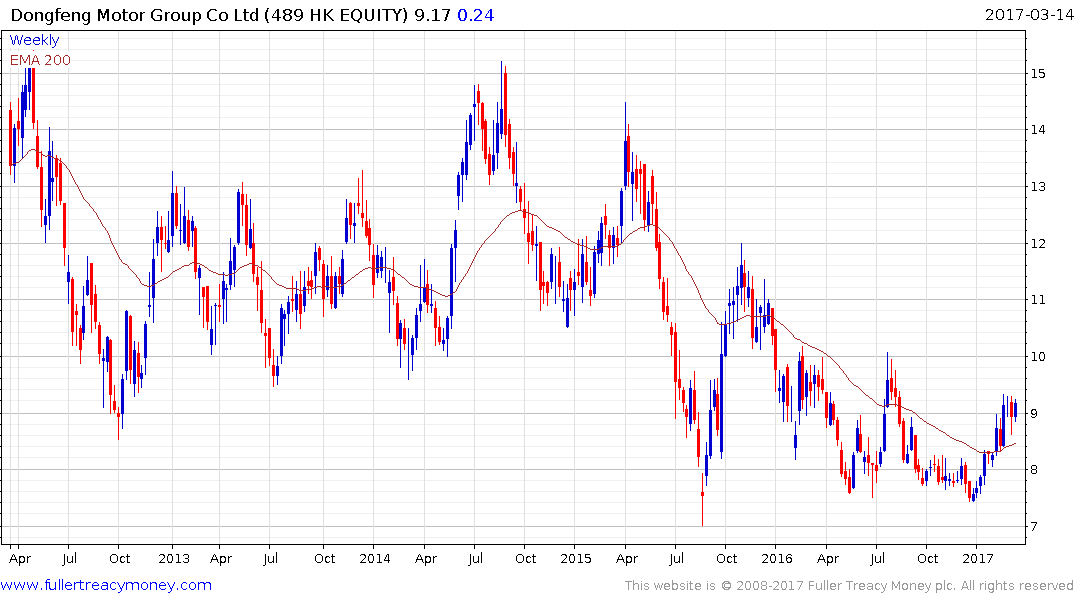

Elsewhere in the automotive sector Dongfeng Motor has rallied to challenge a medium-term progression of lower rally highs.