Chile fires the starting gun on EM easing cycle

This article from Schroders may be of interest. Here is a section:

The decision by policymakers to cut rates by a consensus-busting 100bp to 10.25% on Friday made Chile the first major EM to lower its key policy rate since the aggressive post-pandemic tightening cycle across the emerging world. With the economy struggling, a marked improvement in the outlook for inflation encouraged policymakers to get on with the job of reversing past hikes that saw Chile’s policy rate climb from just 0.5% in mid-2021 to a peak of 11.25% in late-2022.

As we noted earlier this year, further steep declines in inflation, led by food, should make space for additional easing in the months ahead.

Who’s next?

Attention now turns to which EM central banks are likely to be the next to start cutting rates. Prior to lowering rates on Friday, the CBC was one of a handful of EM central banks that had already been on pause for longer than usual. Others in that category include Brazil and the Czech Republic, where monetary policy announcements are due this week on Wednesday and Thursday respectively.

Brazil’s central bank is expected to cut by at least 0.25% tomorrow. With a positive real rate in excess of 10% they have ample room to cut rates to support flagging economic activity.

Since several Latin American countries were both early and aggressive in their efforts to tame inflation. The trajectory of their policy offers a picture of what we can expect from countries that were slower to act.

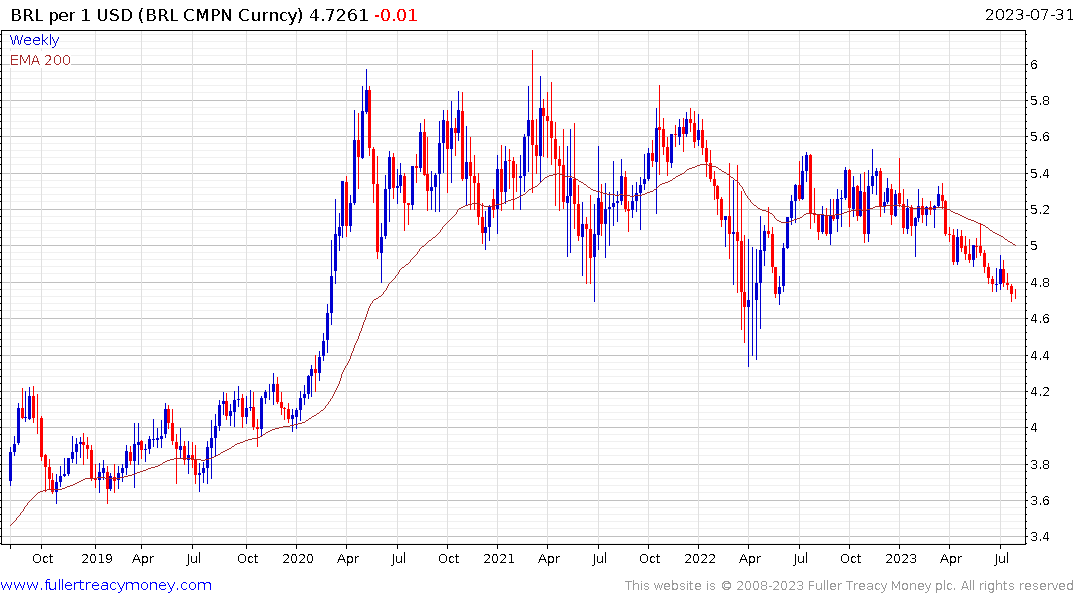

The Brazilian Real has held a sequence of higher reaction lows over the last three years. The favourable interest rate differential has helped support the currency but that trend is now reversing. As it reduces, economic activity will need to recover in order to support the currency.

The Brazilian fintech/digital payments sector was hit hard by the pace of rate hikes and the shares collapsed. Nevertheless, the trend of using one’s phone to conduct financial affairs remains a growth trend and particularly for younger people.

PagSeguro and StoneCo exhibit clear base formation characteristics and reductions to the Selic rate could act as a catalyst for a breakout.