ChatGPT Can Decode Fed Speak, Predict Stock Moves From Headlines

This article from Bloomberg may be of interest to subscribers. Here is a section:

To Marinov, while there’s no surprise machines can now read almost as well as people, ChatGPT can potentially speed up the whole process.

When Man AHL was first building the models, the quant hedge fund was manually labeling each sentence as positive or negative for an asset to give the machines a blueprint for interpreting the language. The London-based firm then turned the whole process into a game that ranked participants and calculated how much they agreed on each sentence, so that all employees could get involved.

The two new papers suggest ChatGPT can pull off similar tasks without even being specifically trained. The Fed research showed that this so-called zero-shot learning already exceeds prior technologies, but fine-tuning it based on some specific examples made it even better.

“Previously you had to label the data yourself,” said Marinov, who also previously co-founded a NLP startup. “Now you could complement that with designing the right prompt for ChatGPT.”

Needing to label every individual clause in a run-on sentence was a big limiting factor for early AI. That’s equally true of the labelling of photos required to teach computers to identify items. Now that labelling is no longer required the use of AI will experience a step change in usage which is what has been priced into related stocks over the last few months.

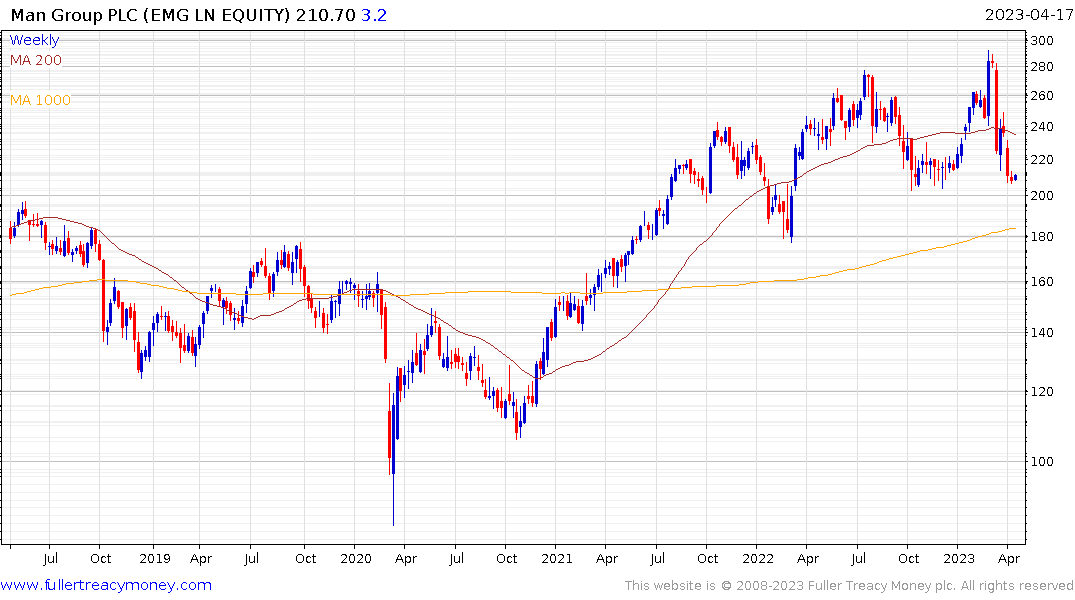

Very short-term traders will have an interest in parsing the outcome of a statement which is public information in as short a time as possible. Man Group has been exceptionally volatile over the last six weeks as tightening financial conditions played havoc with leverage ratios. The share is back in the region of both the 1000-day MA and the upper side of the 2015-21 range. This is a key area where support needs to be reasserted if potential for higher to lateral ranging is to be given the benefit of the doubt.

It's a market truism that doing the same thing as everyone else guarantees average results. That’s the basis for simply investing in an S&P500 ETF. At the other end of the scale, the significant underperformance of the VanEck Social Sentiment ETF since inception suggests AI is best used in very short-term trading.

It's a market truism that doing the same thing as everyone else guarantees average results. That’s the basis for simply investing in an S&P500 ETF. At the other end of the scale, the significant underperformance of the VanEck Social Sentiment ETF since inception suggests AI is best used in very short-term trading.