Chaotic Treasury Selloff Fueled by $50 Billion of Unwinding

This article by Stephen Spratt for Bloomberg may be of interest to subscribers. Here is a section:

Market detectives looking to explain the fury of Thursday’s Treasuries selloff will find most of the evidence pointing to technical rather than fundamental reasons.

A combination of supply indigestion, a potential $50 billion position unwind and vanishing liquidity exacerbated moves as traders aggressively repriced the Federal Reserve rate-hike outlook, despite no major economic developments or shifts in tone from policy makers.

“It wasn’t an orderly selloff and certainly didn’t appear to be driven by any obvious fundamental continuation or extension of the reflation thesis,” wrote NatWest Markets strategist Blake Gwinn in a note to clients. A number of more “technical-style” factors were in the mix, against a backdrop of a good-old-fashioned buyers strike, he said.

In a bull market buying the dips always works. When buying the dips stops working, the bull market is over. That might seem tautological but it is the strategy every investor ends up following because buying the dips is the best risk-adjusted way of buying in an uptrend. That question will be discussed in every emergency meeting at fixed income fund management houses today and over the weekend.

The US 10-year yield is now 1.47% and the CPI rate is 1.4%. One could arguably generate a positive return if the outlook for the currency is stripped out and the position is traded rather than held to maturity.

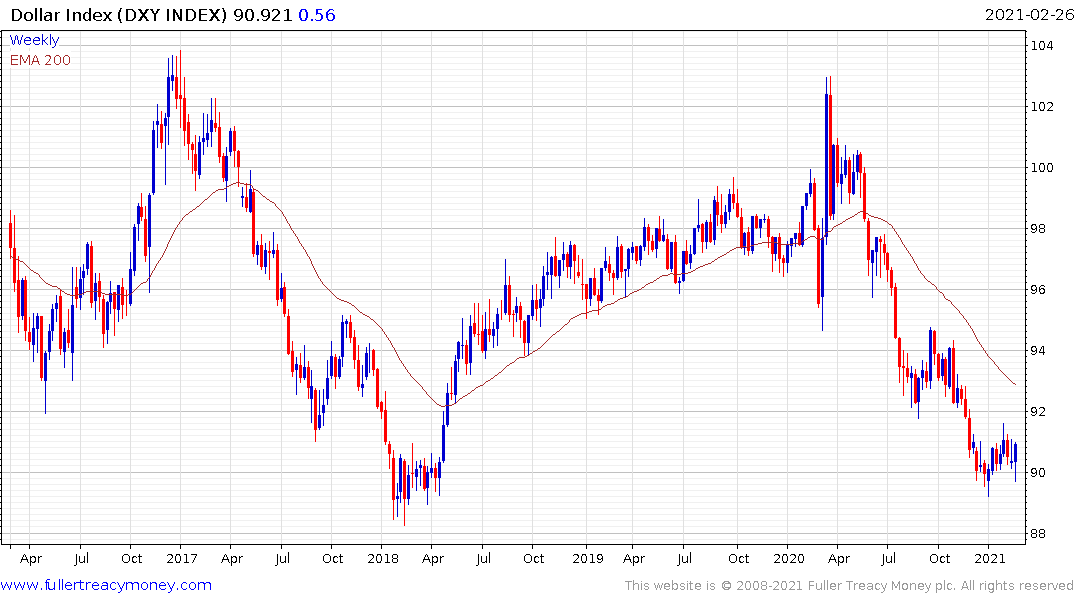

The Dollar also rebounded as demand for bonds picked up.

The Dollar's rebound was also a factor in gold extending its decline.

Of course, there are a whole slew of arguments about how the USA is mired in a perpetual cycle of quantitative easing and the new money is only funding consumption instead of building productive assets. That’s also been true for the much of the last few years.

Therefore, we are likely to see at least a bounce over the coming days because the level will attract buyers desperate for a positive yield. The true mark of a change of trend would be a failure to push back below the trend mean. The distance it currently trading from the MA supports the view we are due a bounce. As we approasch the point where the Fed will have to decide what to do about liquidity constraints on banks, the next bullish commodity catalyst may occur in mid March.

That should also act to help placate nerves in the stock market where the risk of mean reversion has been increasing.

Back to top