Caterpillar Sees No Sign of Mining Upturn as Outlook Misses

This article by Elena Popina for Bloomberg may be of interest to subscribers. Here is a section:

Mining companies have cut billions of dollars of capital spending amid surplus commodities production and a drop in prices for coal, iron ore and other metals. Caterpillar, which completed a string of mining-related acquisitions when the market was stronger, said today the industry remains “weak” and order levels are still low.

The “mining slump is the No. 1 headwind for Caterpillar,” Matt Arnold, a St. Louis-based analyst with Edward Jones, said by phone. “It won’t last forever, but the question is, how well can the company harness improvement in its other segments in the meantime?”

?Caterpillar’s sales of mining machinery through dealers dropped 38 percent in the second quarter, with declines in every region except North America.

Miners had little choice but to curtail spending on expansion as commodity prices deteriorated and investors fled to more attractive sectors. The situation has been mitigated by this year’s rally in industrial metal prices and the realisation that tight market conditions can boost the allure of mining companies. Here is a section from an additional article quoted Rio Tinto’s CEO suggesting investors are beginning to worry about how miners are going to replace reserves as their fortunes improve.

Rio Tinto Group, the world’s second- biggest miner, sees renewed investor appetite for spending as it seeks to balance shareholder returns with capitalizing on growth opportunities from Australia to Peru.

“A year ago the market was talking about returns, returns, returns and stop investing,” Chief Executive Officer Sam Walsh told reporters in Perth today. “Now people are taking a long- term view and recognizing the fact there has to be a balance.”

Caterpillar is unlikely to be a lead indicator for the mining sector. The share has been largely rangebound since 2011 and encountered resistance today near the upper boundary. A sustained move to new highs will be required to reconfirm a return to medium-term demand dominance.

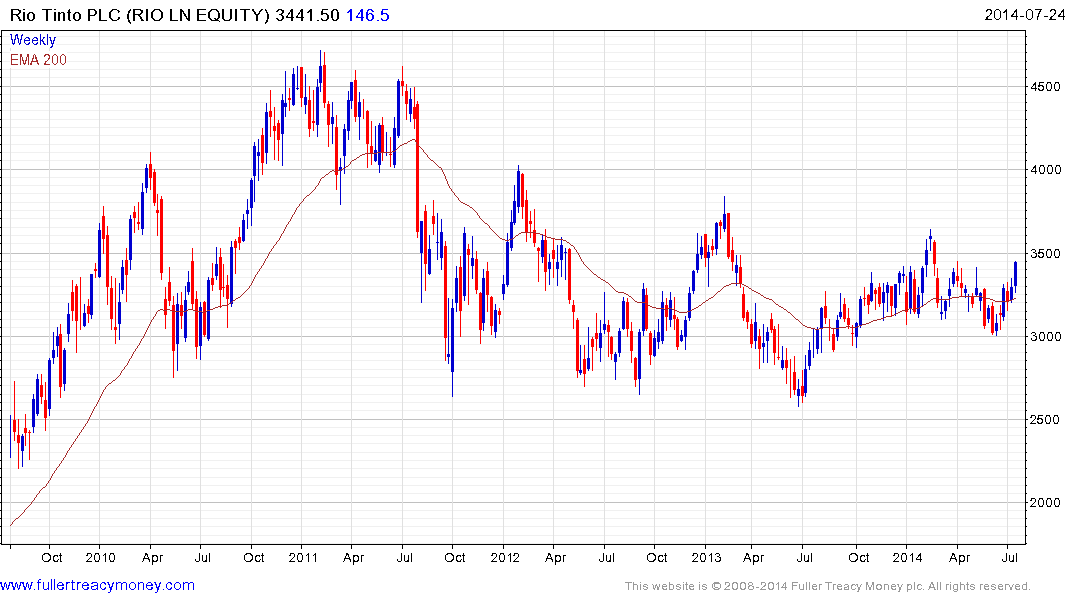

Rio Tinto is rallying towards the upper side of a three-year base and a clear downward dynamic will be required to check current scope for additional upside.

Back to top