Carney Has More Patience Than Yellen as BOE Ponders Pound Surge

This article by Simon Kennedy may be of interest to subscribers. Here is a section:

About 45 percent of the U.K.’s trade in goods is also with the euro area, against whose single currency the pound has been trading near a seven-year high after rising 9 percent in 2015.

Versus the dollar, the pound’s 5 percent drop is half that of the euro’s. When the Bank of England last sounded uneasy about the exchange rate in November, it estimated that the currency’s past gains were enough to remove 75 basis points from inflation.

Those sums imply a 6.5 basis point slowing of inflation for every 1 percent gain in sterling, said Geoffrey Yu, a senior currency strategist at UBS Group AG in London. That leaves him estimating more than 30 basis points weakening of inflation since January, quite a hit given consumer prices rose just 0.3 percent from a year earlier.

?“If this faster pace of appreciation were to persist for some time, it would argue for either the first hike to come later or the pace of increase during 2016 to be more gradual,” said Dominic Bryant, an economist at BNP Paribas SA.

The Bank of England has repeatedly demonstrated that the Pound will be used as a policy tool when needed. Both the BoE and Fed have made clear that they are closer to raising rates than just about any other central bank and as a result their respective currencies have rallied on the expectation of favourable interest rate differentials.

It would be tempting on seeing the Pound fall through $1.50 and conclude the currency is weak but this only serves to highlight the relative strength of the Dollar.

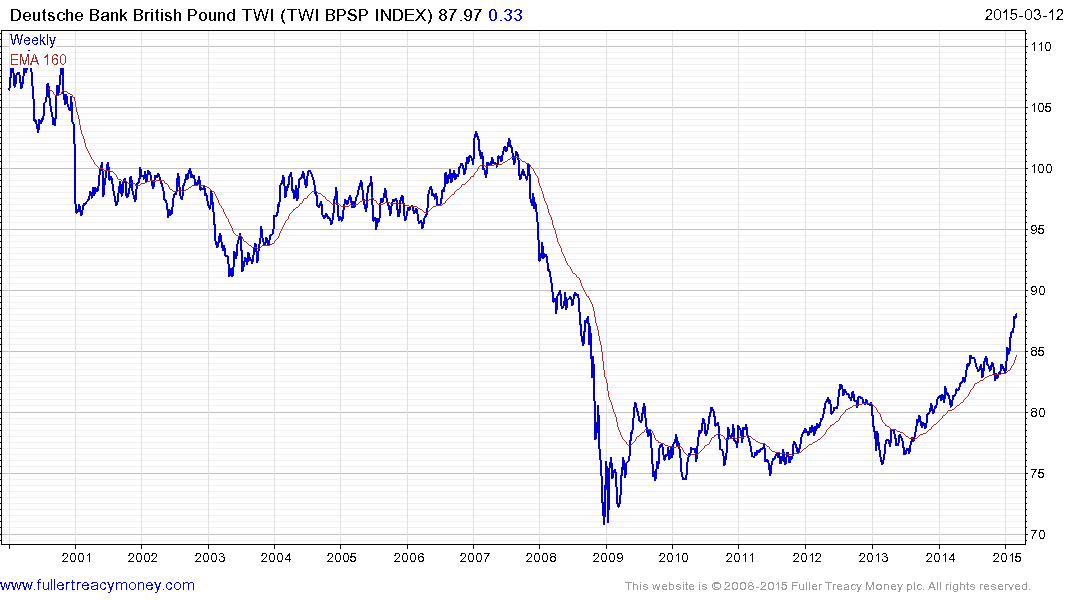

The Deutsche Trade Weighted Pound Index has held a progression of higher reaction lows since early 2013 and has surged higher over the last two months, following the Euro’s depreciation. A sustained move below 85 would be required to question the consistency of the medium-term uptrend.

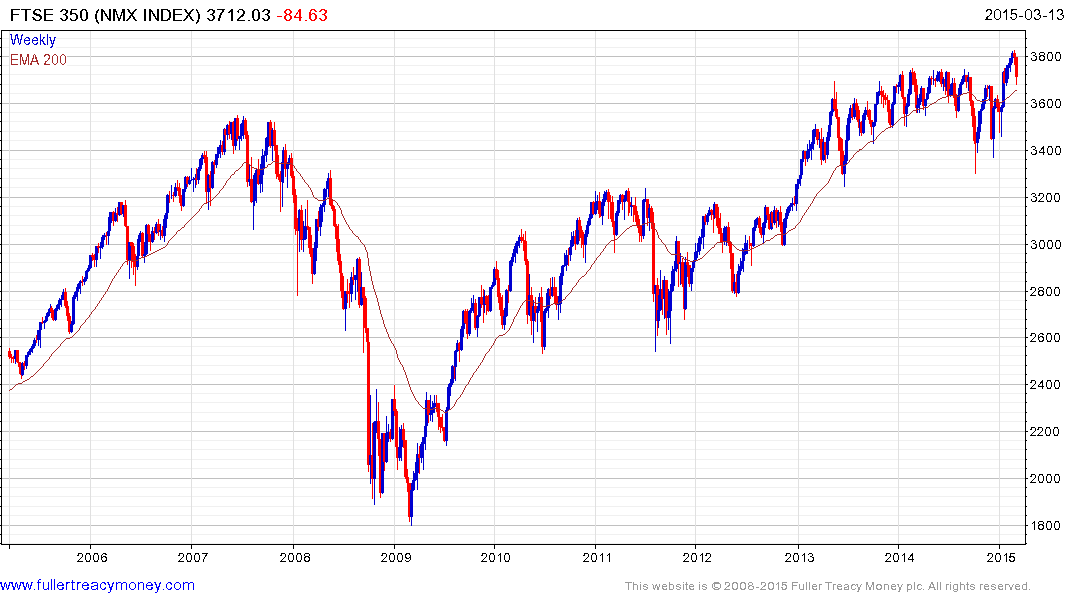

The relative strength of the Pound against the Euro in particular has contributed to the underperformance of the FTSE-100 and FTSE-350 in nominal terms. Both indices pulled back sharply this week to test the region of their respective 200-day MAs and will need to demonstrate support in this area if potential for a further test of underlying trading is to be avoided.

Back to top