Capital Trends Towards Consolidation

The best, most innovative, and flexible companies continue to grow and erode the competitive edge of their less significant rivals. Those that cannot compete go into long relative and eventually absolute declines.

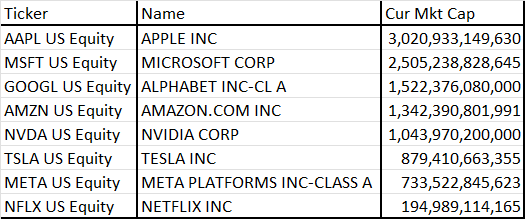

When the FANGMAN acronym was first created it did not include Tesla. Then Tesla became so significant it was added in. Now Netflix has failed to keep pace with the appreciation in the fortunes of the largest companies so the group is back to seven constituents. That reordered group now occupies more than half the Nasdaq-100.

A lot has to go right for companies to be granted high valuations. It’s not only a story, but there also has to be a fundamental basis too. For Apple, navigating the Chinese market, where they manufacture and sell without falling foul of the government censor is one of the most significant diplomatic success stories in history. For Microsoft, the embrace of subscriptions was a landmark event. Amazon’s foresight in dominating the datacentre market and disintermediating the reseller market were equally impressive. Tesla has mastered the art of regulatory arbitrage. Carbon taxes its competitors buy, help pay for the company’s factories.

For investors the big question is whether this run of good fortune will persist. The topic of capitalism trending towards consolidation was central to our argument for focusing on the largest companies in 2012. There is no doubt there is survivors bias in the performance of stock market indices.

3M has declined to retest the same level it traded at in 2012 as the burden of litigation weighs on enthusiasm. Bayer has had a similar ordeal following its ambitious acquisition of Monsanto. Casino Guichard-Perrachon is flirting with default.

As the trend of consolidation plays out the logical conclusion is the number of successful companies will continue to contract. Their power and influence will increase as well and so will the concentration of wealth in the hands of small numbers of people. These trends are intimately related. This is an example of how Hegel’s master/slave dialectic is observed in markets.

The pinnacle of power for the most significant companies, when they can create markets for their products and influence regulation to ensure they experience no boundary, when they have used their influence to reduce the tax they pay and when workers are disenfranchised and are unwilling to take any further loss of living standards. That’s the point of maximum risk because antitrust is the logical conclusion of consolidation.

Alibaba is currently being split up into six companies. That is more to do with ensuring a competing power base does not emerge to threaten the dominance of the Party but it is foretaste of what we can expect in other jurisdictions. The polarization of the political sphere is a symptom of the wider issues in the macro environment. As the willingness of the government to “pander to the mob”/”address inequity”/”protect families” etc. increases the greater the threat to the power of the largest companies.

With valuations at current levels, this is the time to be particularly vigilant to the consistency of trends.

Back to top