Campbell Drops After Bleak Outlook Follows Blow From Buffet

This article by Craig Giammona for Bloomberg may be of interest to subscribers. Here is a section:

Over the past three years, the 10 largest packaged-food companies have seen about $16 billion in revenue evaporate as consumers change how they eat and shop. Shoppers are seeking out more natural and organic food, shifting away from the staples that have dominated supermarket shelves for decades.

Whole Foods Deal

Amazon.com Inc.’s deal to buy Whole Foods also has fueled pessimism about packaged-food giants, with analysts predicting that the e-commerce titan will favor private-label products and squeeze the profit margins of its suppliers. In June, when that deal was announced, the 10 largest U.S. food companies lost almost $8 billion in market value combined.In a bid to add more natural products, Campbell agreed to buy Pacific Foods of Oregon, a maker of organic soup and broth, for $700 million in June. Campbell also acquired Bolthouse -- a producer of carrots, juices and salad dressings -- for $1.55 billion in 2012. That business, now part of the Campbell Fresh unit, has struggled with poor harvests and a drink recall.

Leaner and fitter isn’t just a maxim for personal health but is increasingly being foisted upon consumer goods companies as the supermarket sector comes under pressures from low cost new entrants willing to compete on razor thin margins. Amazon’s focus on Whole Foods’ own brands coupled with Aldi and Lidl’s low cost own- brand focus represent challenges for other supermarket chains which are inevitably going to be passed on to their suppliers.

The S&P500 Consumer Staples Index is comprised of supermarkets, processed foods, cosmetics, alcohol and non-alcoholic beverage companies. There has so far been sufficient variance in the aggregate performance of the sector to sustain a relatively consistent uptrend but it is worth monitoring for signs of deterioration because it was such a powerful and consistent performer off the lows in early 2009.

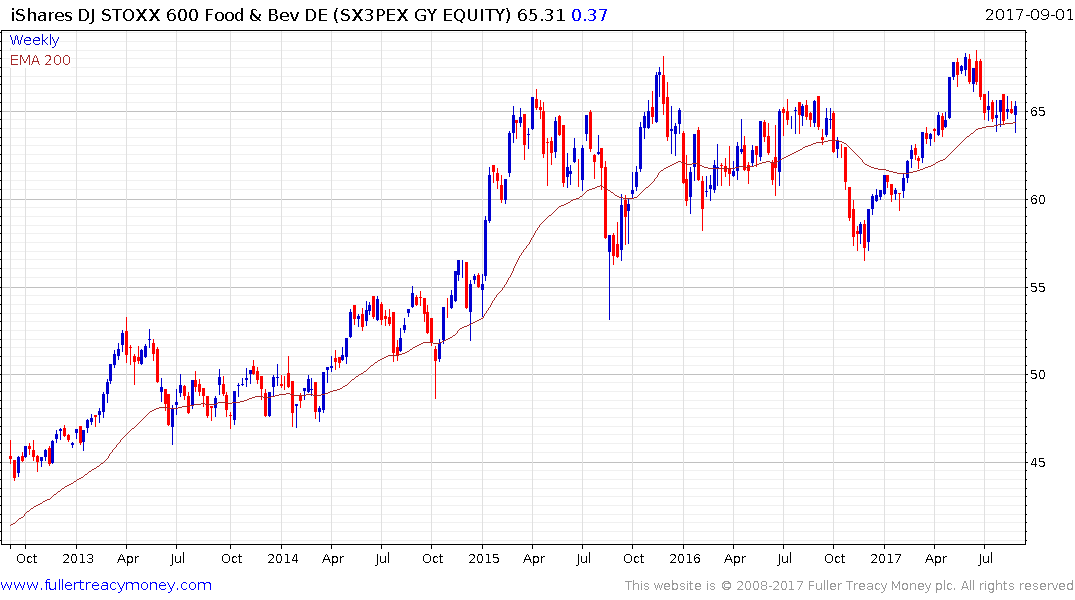

The Dow Jones Europe STOXX 600 Food & Beverage Index hit a medium-term peak in 2015 and ranged for 2 years. It broke successfully above 65 in May and has returned to test that level and the region of the trend mean. It will need to continue to demonstrate support in this area if the benefit of the doubt it to continue to be given to the upside.

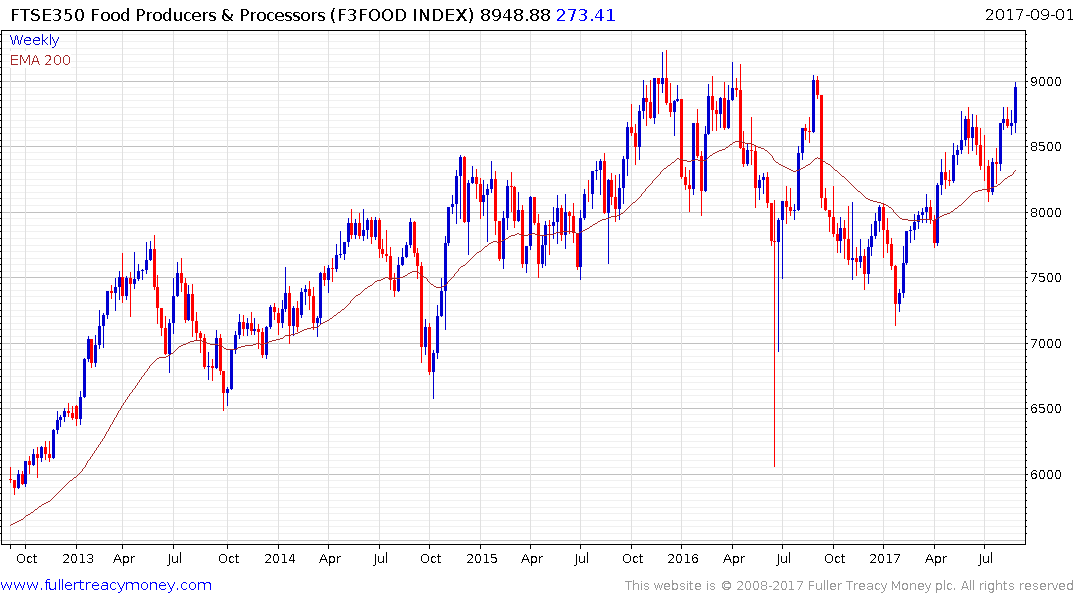

The UK also splits out Food Processors & Producers from retailers so it is easy to compare and contrast their differing fortunes. The FTSE350 Food Processors and Producers index has rebounded from the post Brexit vote slump and is now testing its peak near 9000.

The FTSE350 Food & Drug Retailers Index has been ranging above its 2014 low and will need to sustain a move above 3500 to signal a return to medium-term demand dominance.

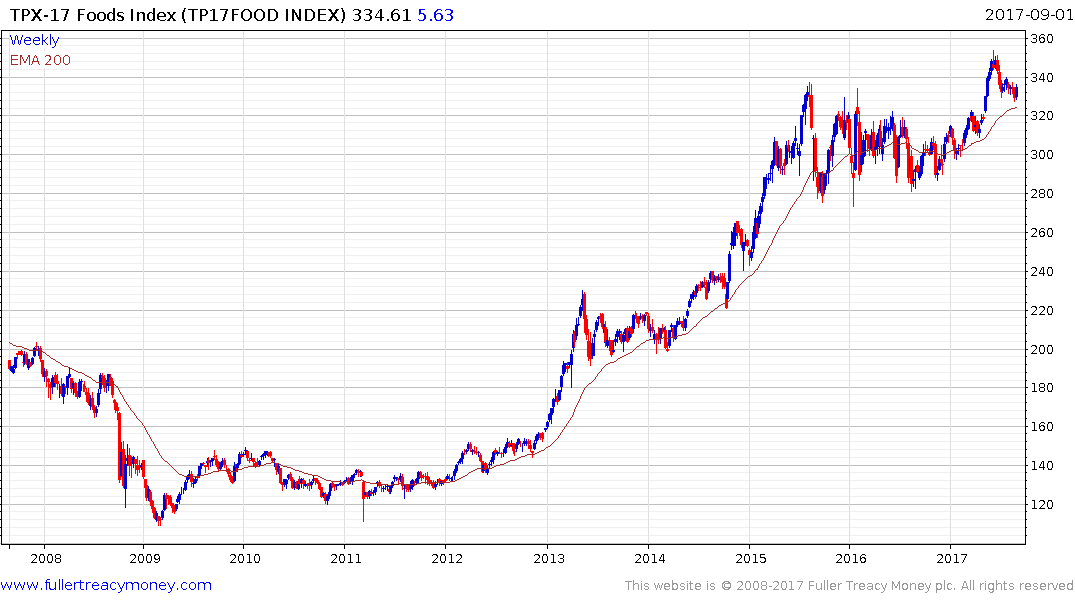

Japan’s Topix Foods Index has fallen back to test the upper side of its underlying range and the region of the trend mean.

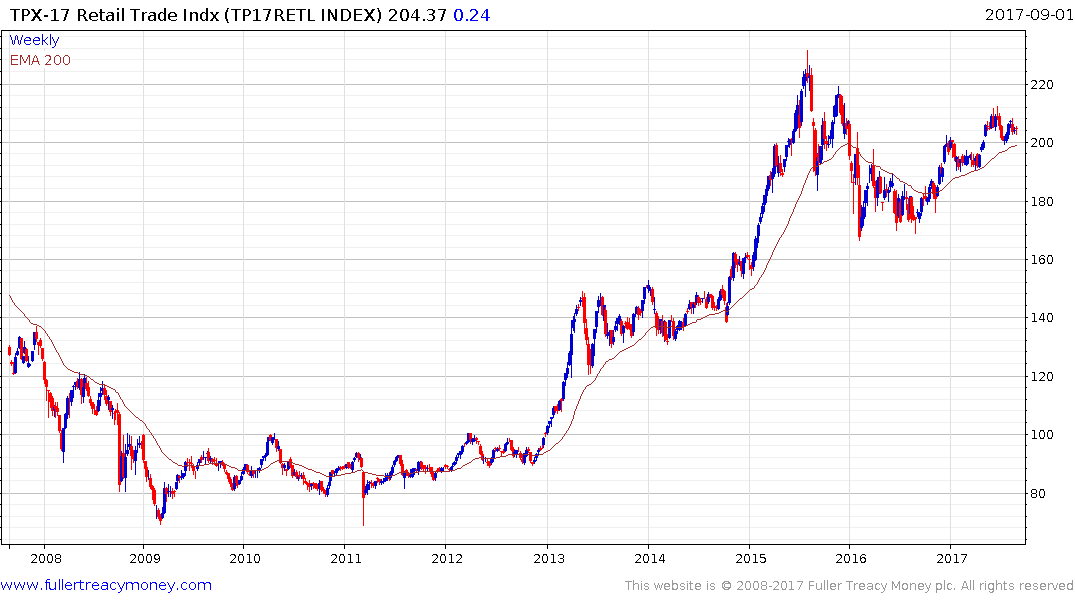

Meanwhile the Topix Retail Trade Index found support in early 2016 and continues to hold a progression of higher reaction lows.

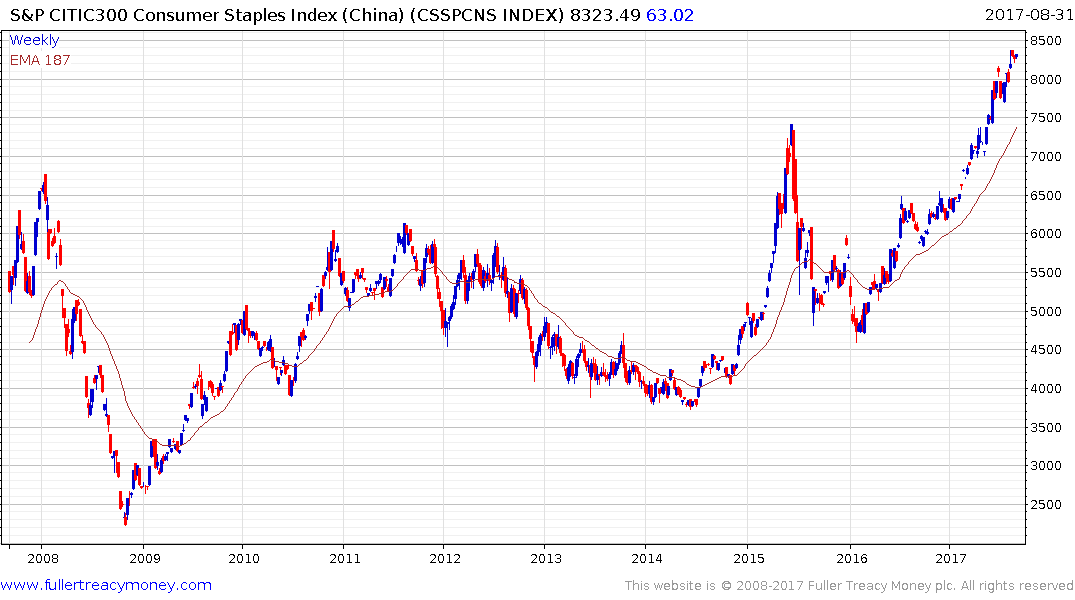

The Chinese CSI300 Consumer Staples Index has been trending steadily higher since early 2016 and continues to hold a progression of higher reaction lows.

Amazon has just started up in Australia which represents another challenge for the already embattled Myer Holdings. The S&P/ASX Consumer Discretionary Index dropped below the trend mean today and will need to demonstrate support soon if medium-term potential for additional upside is to be given the benefit of the doubt.

The S&P/ASX Consumer Staples Index has been led higher by A2 Milk but the Index’s performance has been more modest. It bounced in July from the region of the trend mean and a sustained move below it would be required to question medium-term scope additional upside.