Buy the rumour sell the news?

The stock market is a discounting mechanism which takes expectations for future potential and gives them a present value. That’s pretty much an accepted truism in any markets. The big question is always just how much future potential has been priced in?

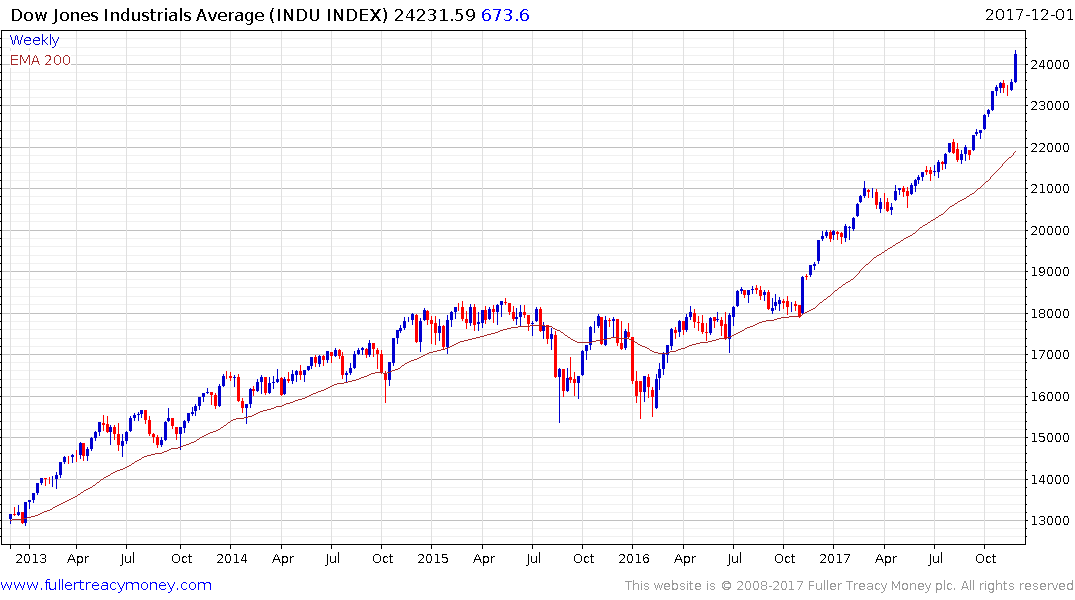

The S&P500 just turned in its 13th consecutive monthly advance, for the first time in 80 years. When we address the 10-year chart the trend from the middle of 2016 is much more consistent that at any time since the 2009 low. More than any other factor that tells us the imbalance between supply and demand has grown wider over the last year with the result that reactions have become shallow and the pace of the advance has picked up.

That is exactly what we expect in a maturing market; that the bullish crowd grows more confident as the argument for why markets should rise is more widely accepted.

At today’s intraday peak the Index was trading at an 8% premium to the trend mean which in the context of an impressive bull market is not overly taxing. However, it highlights the potential for another pause and consolidation within the context of what is still a reasonably consistent advance.

The Dow Jones Industrials Average was 11% overextended relative to the trend mean at yesterday’s peak which reflects the swift advance seen over the week as it surges towards the psychological 25,000 level.

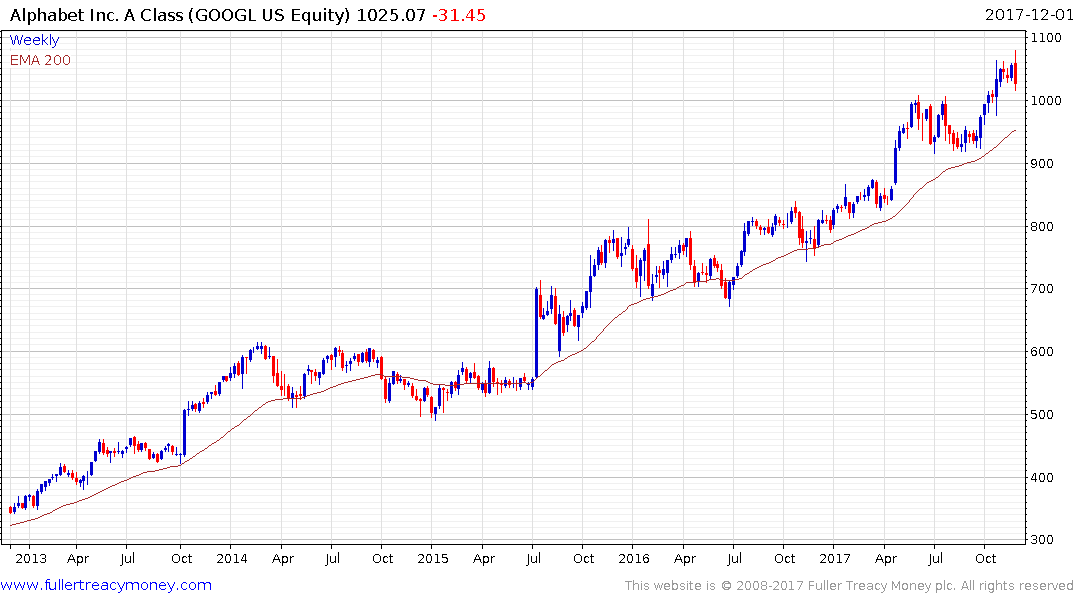

The Nasdaq-100 was 10.2% overextended at the peak on November 28th and has paused following the drawdown on technology shares earlier this week.

The above shares highlight how low volatility has been, with consistent steady advances for the most part, amid growing enthusiasm about the potential for corporate tax cuts and fiscal stimulus. With the potential for the Senate to push through a vote later today or tomorrow the question now is what can be priced in for next month since a lot of the good news relating to tax cuts is probably already in the price? There is certainly room for a pause as investors figure out that question.

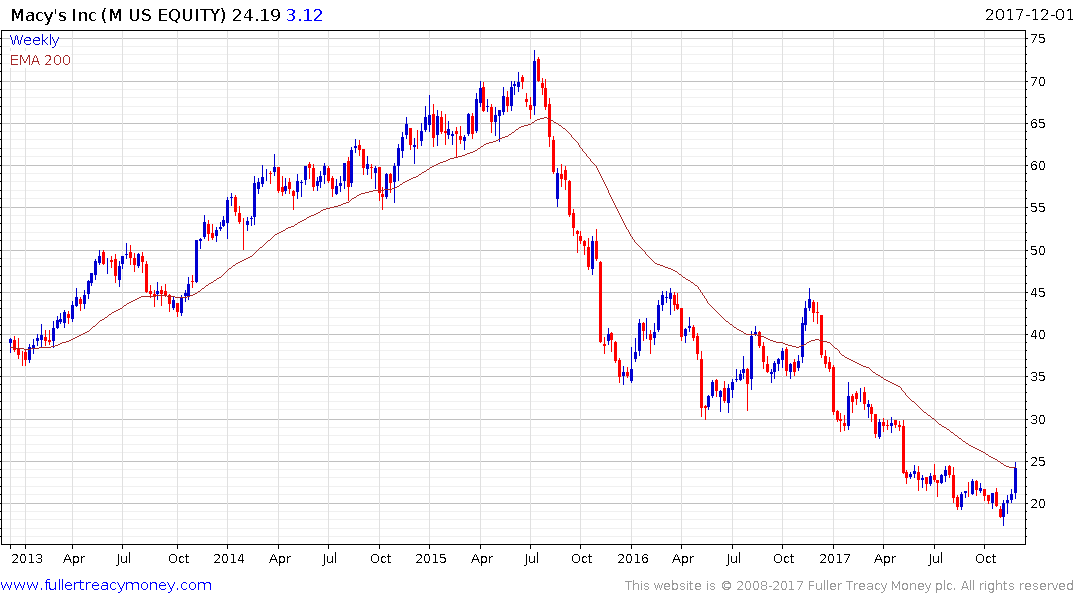

One of the reasons technology shares pulled back sharply this week is because many mega-cap globally oriented companies have already spent a great deal of time optimizing for taxes and pay less than the proposed new rates. On the other hand, the beleaguered retail sector should benefit from the incoming tax regime.

Kroger bounced emphatically this week on cost cutting and now needs to hold the $20 area if support building is to be given the benefit of the doubt.

Macy’s rallied this week to break a progression of lower rally highs and to pressure the region of the trend mean.

Meanwhile Autodesk registered a massive reaction against the prevailing uptrend this week, with a large downside weekly key reversal, suggesting a peak of at least near-term significance.

Facebook and Alphabet/Google also posted downside weekly key reversals this week.