Buy the dip?

In a bull market buying the dips is a winning strategy and is a policy that gains ever more credence as evidence compounds that it generates outsized returns. Investors and traders with orders in the market well below Friday’s close had favourable short-term buying opportunities today, which lent further evidence to the view that buying the dips works. However we also know that at some point buying the dips will not work so the big question is whether this is one of those occasions?

At The Chart Seminar we define a Type-2 top as a massive reaction against the prevailing uptrend. It often occurs following a loss of momentum or a wedging characteristic but the massive reaction is the defining characteristic. The speed of the decline is unnerving because participants have so little time to react. Many are often left casting around for reasons to explain the move. Those using mental stops are left asking whether it is better to sell at a potential bottom or to wait for a rally. Many people with stale bull positions are less likely to participate in bargain hunting because the impact on their average buy prices would be too much of burden.

Short-term oversold conditions resulting from reactions result in traders moving in to take advantage of distressed events in their favoured sectors and sharp rallies can occur as shorts are pressured. However the big question is how much stress the really big holders of stock, namely pensions funds, insurance companies and ETF investors have experienced and how willing they are to commit new money to the market. Often they will conclude that caution is warranted so they will wait for more evidence. This robs the market for a potent source of demand and contributes to it encountering resistance in the region of the 200-day MA, lower side of the overhead trading range or another area which had been a previous area of support.

The S&P 500 traded in a very tight range from January. We have often described ranges as explosions waiting to happen and on this occasion the break has been to the downside. The Index found at least short-term support today in the region of the October low and bounced. In the course of the bull market from early 2009, the only pullback of the similar magnitude was that seen in 2011. Now as then, the biggest question is not how well the Index will rally but whether the 2050 area now represents an area of resistance for what looks like a completed top formation.

Not every market that has a massive reaction against the prevailing trend behaves in the same way which is why we have to attempt to discern what the problem is. In this case there have been a lot of headlines about fully valued companies, leverage at record highs, the cessation of the Fed’s QE program but China’s ham-fisted response to its stock market’s surge, subsequent decline and the recent revaluation of the Yuan have acted as the catalysts for this downdraft. In asking which shares are most likely to exhibit typical Type-2 top formation characteristics we will probably find the most likely candidates among shares with strong ties to the Chinese market.

Australia’s ASZ 200 has fallen for four consecutive weeks to test the psychological 5000 level. Following today’s bounce on Wall Street the Index has the potential to follow suit but the large medium-term question remains whether any rally will be potent enough to sustain a close above 5500 beyond a few sessions.

Coach has been deteriorating for three years and today’s move pushed it to an even deeper overextension relative to the MA within the context of a still reasonably consistent medium-term downtrend.

For Disney the steep pullback from the August 7th peak represents a major trend inconsistency and a period of support building will likely be required before the medium-term bullish environment can be sustained.

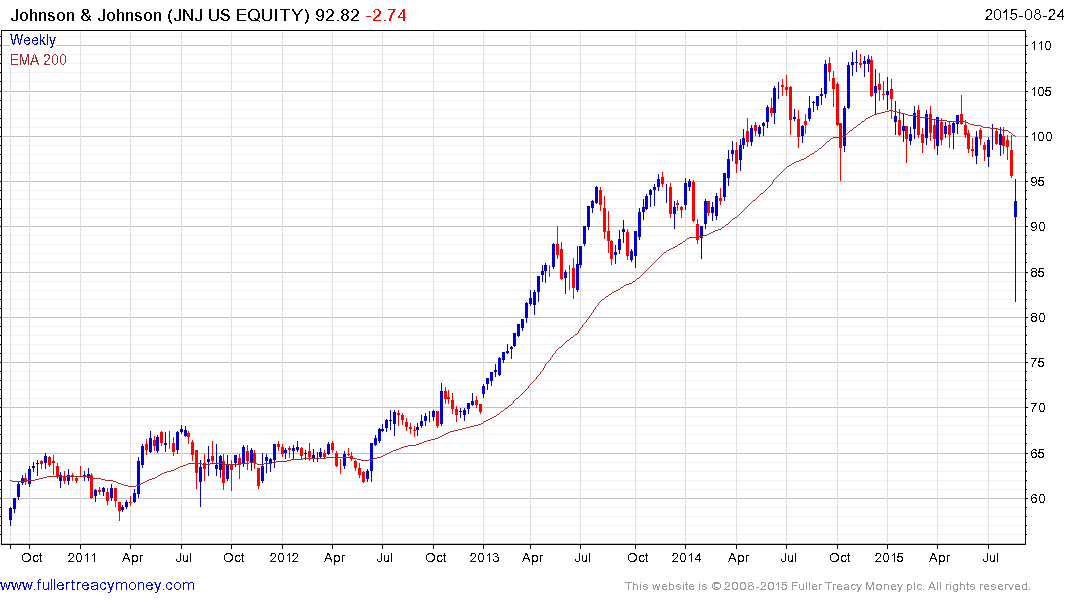

Johnson & Johnson has encountered resistance in the region of the 200-day MA on successive occasions since January and plummeted to an intraday low of -16.89% based on Friday’s close. It recouped the majority of the decline by the cessation of trading but this has been a sufficiently large reaction to suggest a potentially lengthy period of support building will be required to signal a return to demand dominance beyond short-term steadying.

Elsewhere, Mondelez International has now unwound its overbought condition relative to the 200-day MA and bounced today from the upper side of the underlying trading range.

Google very publically pulled out of China a number of years ago and bounced today from the level it traded at before its impressive earnings and corporate restructuring announcement.

Amazon has also almost completely unwound its overbought condition relative to the trend mean.

Even Netflix which as of 2 weeks ago was almost 50% overextended relative to the trend mean found at least near-term support today in the region of the MA.

Starbucks and Nike also bounced today to push back above their respective 200-day MAs.

Tesla bounced today from the $200 level and a sustained move below that level would be required to signal a move to supply dominance beyond the short-term pullback.

Back to top