Bunge Is Said to Near Deal to Buy Glencore's Viterra

This article from Bloomberg may be of interest to subscribers. Here is a section:

Combining the two will create a trader big enough to take on the industry’s elite: Minneapolis-based Cargill Inc. and Chicago’s Archer-Daniels-Midland Co. The deal is the culmination of Bunge Chief Executive Officer Greg Heckman’s transformation of the once troubled St. Louis-based crop trader into a cash-rich oilseeds champion.

The size and influence of large soft commodity traders means they have a great deal of power to shape the market to their liking. That implies creating new markets for the commodities they trade, like ethanol or biofuels, and ensuring there are ready markets for those products through lobbying efforts. That’s the definition of an oligopoly.

Bunge has been ranging for the last year below the 2022 peaks and above the 2009-2021 range. The region of the 1000-day MA continues to hold and a sustained move below it would be required to question scope for higher to lateral ranging.

Bunge has been ranging for the last year below the 2022 peaks and above the 2009-2021 range. The region of the 1000-day MA continues to hold and a sustained move below it would be required to question scope for higher to lateral ranging.

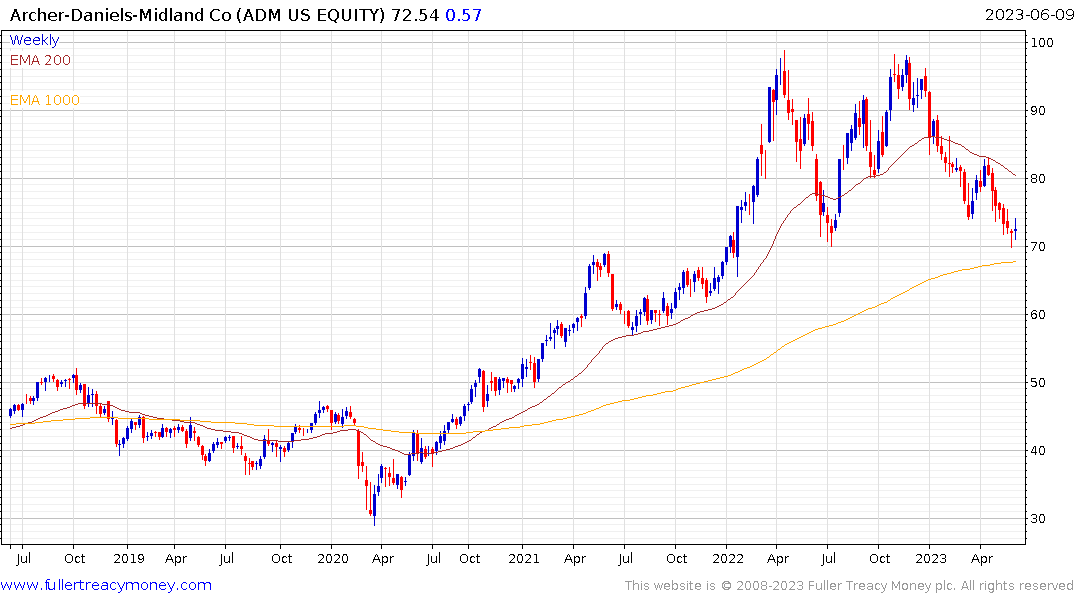

ADM has returned to test the region of the 1000-day MA and will need to continue to hold support if the medium-term uptrend is to be given the benefit of the doubt.