Bullard Sees Weak Data Contradicting FOMC's Rate-Hike Path

This article by Steve Matthews for Bloomberg may be of interest to subscribers. Here is a section:

Since March, “longer-term yields have declined, inflation expectations have weakened, and market expectations of the policy rate path have declined,” Bullard said Friday in St. Louis. “This may suggest that the FOMC’s contemplated policy rate path is overly aggressive relative to actual incoming data on U.S. macroeconomic performance.’’

Fed officials left interest rates unchanged at their meeting earlier this month, indicating that a disappointing start to the year wouldn’t stop them from raising rates twice more in 2017 following a hike in March.

In their statement, policy makers described as “transitory” a slowdown in first-quarter growth, while emphasizing that inflation was running close to their 2 percent goal and the labor market continued to strengthen.

Bullard, who does not vote on the FOMC this year, is one of its most dovish officials. In March he projected just one hike in the target range for the federal funds rate until end-2019.

The median estimate among his colleagues is for two more hikes this year and for the benchmark rate, currently 0.75 percent to 1 percent, to be 3 percent by the end of 2019. His argument is that the U.S. economy has been saddled with persistently low growth, so there is little need to raise rates by much.

The Dollar experienced another sharp decline today to cap off the week as one of its worst in a number of years. It is falling for a number of reasons but two stand out. The bond market and at least some at the Fed believe the pace of interest rates will not be as aggressive as had been priced in earlier this year by the stock market. The second is that the uptick in political uncertainty is an additional factor because of the jeopardy talk of an impeachment puts the Republican’s legislative agenda in.

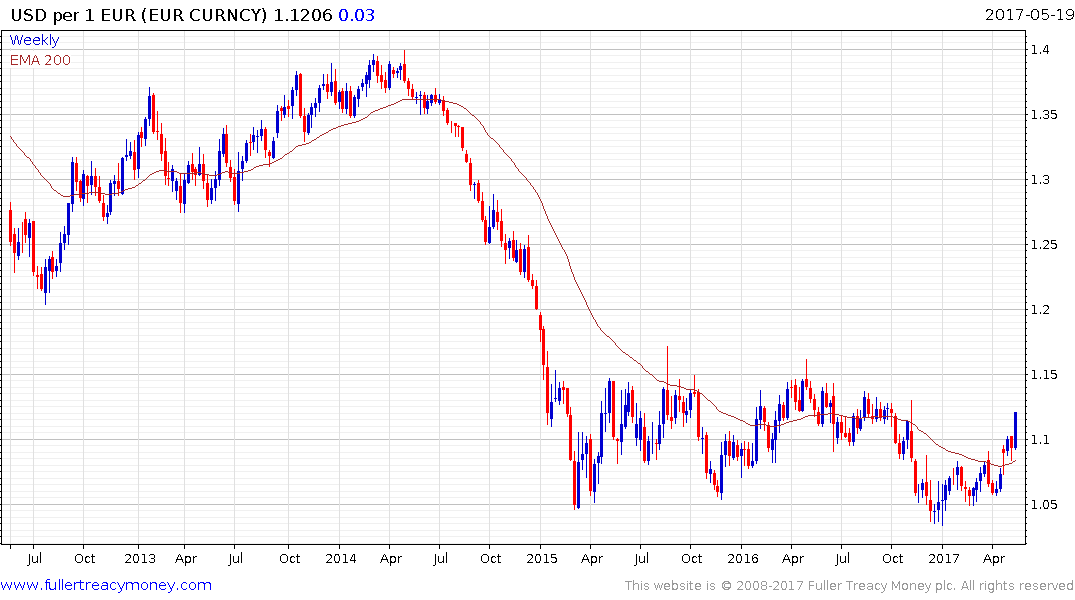

The Euro is extending its move above the trend mean. With a confirmed failed downside break in December, the next area of potential resistance is in the region of $1.15.

The Pound also closed above the psychological $1.30 level today to extend its breakout and break of the medium-term progression of lower rally highs.

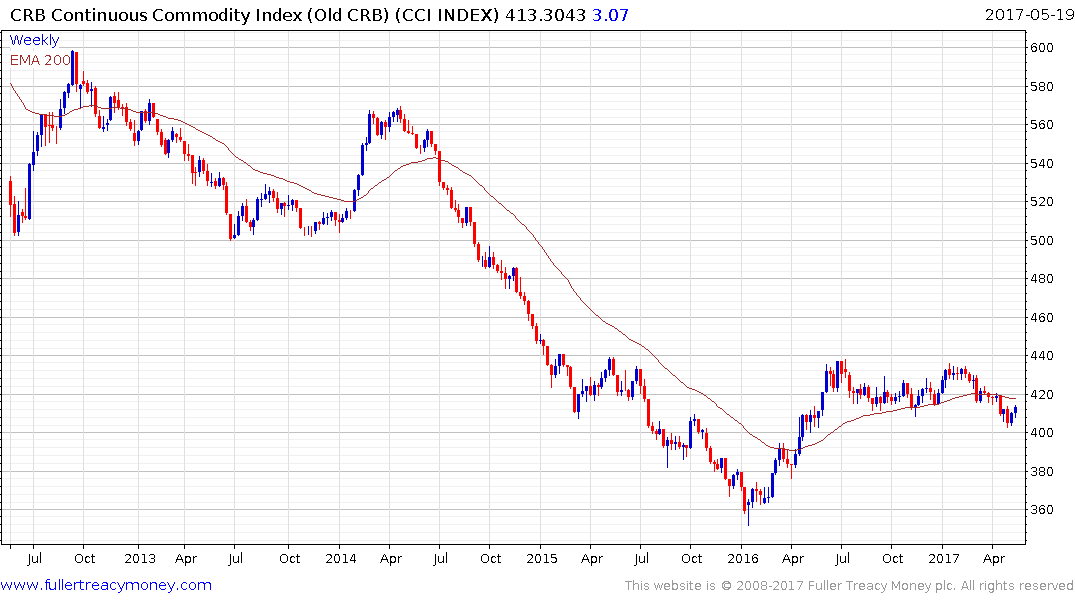

The Continuous Commodity Index may now be in the process of breaking a progression of lower rally highs evident since early this year as it bounces from the region of 400.

Meanwhile the S&P500 continues to range below 2400. So far two stabs to the downside in the span of two months have not had much impact on what has been an inert period for traders. The disparity between the leaders and laggards within the market remains as stark as at any time in the last couple of months with the retail sector leading decliners. Meanwhile it is only a matter of time before wide overextentions relative to the trend mean are unwound by the leaders.