Buffett Says a Deal for Mondelez Would Be Difficult to Envision

This article by Katherine Chiglinsky for Bloomberg may be of interest to subscribers. Here is a section:

Warren Buffett said buying Mondelez International Inc., the maker of Oreo cookies and Ritz crackers, would be difficult for him and his partners at 3G Capital because they’re still working on last month’s purchase of Kraft Foods Group Inc.

“It’s quite unlikely that Kraft Heinz will be doing a big acquisition in the next couple of years,” Buffett said Monday in an interview on CNBC. “We’ve got our work cut out for us for a couple of years.”

H.J. Heinz acquired Kraft last month with the backing of 3G Capital and Buffett’s Berkshire Hathaway Inc.Activist investor Bill Ackman revealed last week that he has built a 7.5 percent stake in Mondelez valued at $5.6 billion. Shares of Deerfield, Illinois-based Mondelez climbed after the announcement, contributing to a 12 percent gain since July 3.

“Most of the food companies sell at prices that would be very hard for us to make a deal even if we had done all the work needed at Kraft Heinz,” Buffett said.

Warren Buffet and 3G Capital paid an all-time high for Heinz in 2013 which was ultimately the correct decision. Capitalism trends towards consolidation as the strong acquire the assets of the weak and become stronger. Nestle, Unilever, Colgate Palmolive, Mondelez and Kraft Heinz represent heavy weights in the global processed foods sectors which continue to benefit from the growth of the global consumer and the desire for quick snack foods as the pace of life accelerates with the demands of a modern economy.

Mondelez International (Est P/E 26.19, DY 1.47%) surged on speculation that it would be reacquired by the new Kraft Heinz but is now susceptible to consolidation of that gain as speculative interest moderates. Nevertheless, a sustained move below $35 would be required to question medium-term potential for higher to lateral ranging.

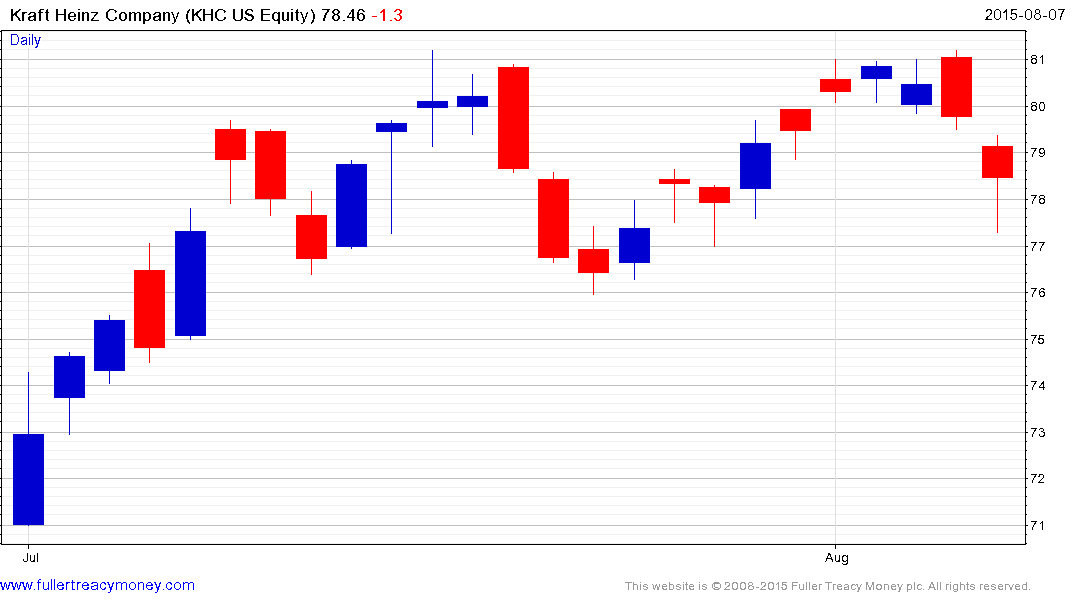

Kraft Heinz (Est P/E 30.36, DY N/A) has been ranging with a mild upward bias since shortly after its IPO.

.png)

Nestle (Est P/E 21.98, DY 2.98%) has experienced a more volatile environment since the Swiss Franc appreciation in January but continues to hold its progression of higher reaction lows.

.png)

Unilever (Est P/E 22.69, DY 3.28%) spent almost two years ranging before breaking out to new highs in January and a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

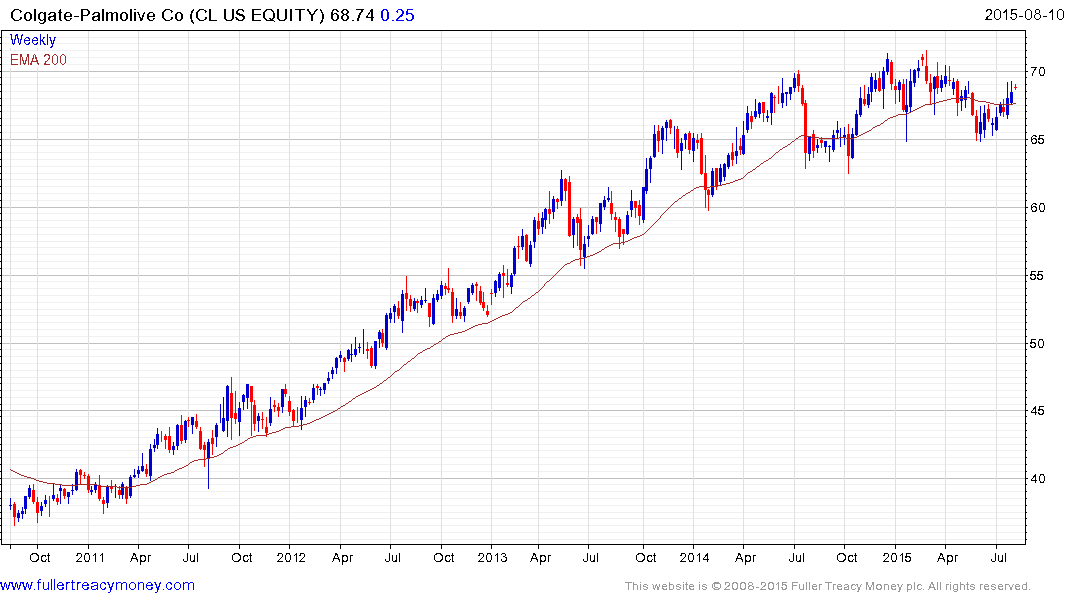

Colgate-Palmolive (Est P/E 34.03, DY 2.21%) lost momentum somewhat last year but continues to hold a progression of higher reaction lows.