Brookfield to Purchase CDK for $6.4 Billion in All-Cash Deal

This note from Bloomberg may be of interest to subscribers. Here is a section:

Brookfield Business Partners agreed to buy CDK Global Inc., a provider of software for auto dealerships, in an all-cash deal with an equity value of $6.4 billion.

The investment company said it will pay $54.87 a share for Hoffman Estates, Illinois-based CDK, according to a statement Thursday. The price was 12% higher than CDK’s closing price Wednesday, and 30% above where CDK traded on Feb. 18, just before speculation surfaced regarding a potential sale of the company. CDK shares rose 11% to $54.50 at 9:45 a.m. in New York.

“CDK’s board of directors carefully evaluated a range of strategic and financial alternatives over several months and determined that this transaction is superior to all other available alternatives,” Chief Executive Officer Brian Krzanich said in the statement.

Brookfield, which has about $690 billion of assets under management, said the CDK transaction is expected to be completed in the third quarter. The deal’s enterprise value is $8.3 billion, according to the statement.

There are two parts to every private equity company. The first is what they already own and how the valuation for those holdings has been arrived at. The second is availability of fresh capital to make new purchases and the valuation of what they are in the market for acquiring.

The US listed Invesco Global Listed Private Equity ETF is currently pulled back from the region of the 1000-day MA and falling back into the underlying pre-pandemic range.

The US listed Invesco Global Listed Private Equity ETF is currently pulled back from the region of the 1000-day MA and falling back into the underlying pre-pandemic range.

That’s representative of the pressure higher rates and tighter financial conditions have on unlisted asset valuations. Investors are also wary of the common practice of loading businesses with debt to refund the cost of purchase. As economic activity wanes those companies are at risk of failing.

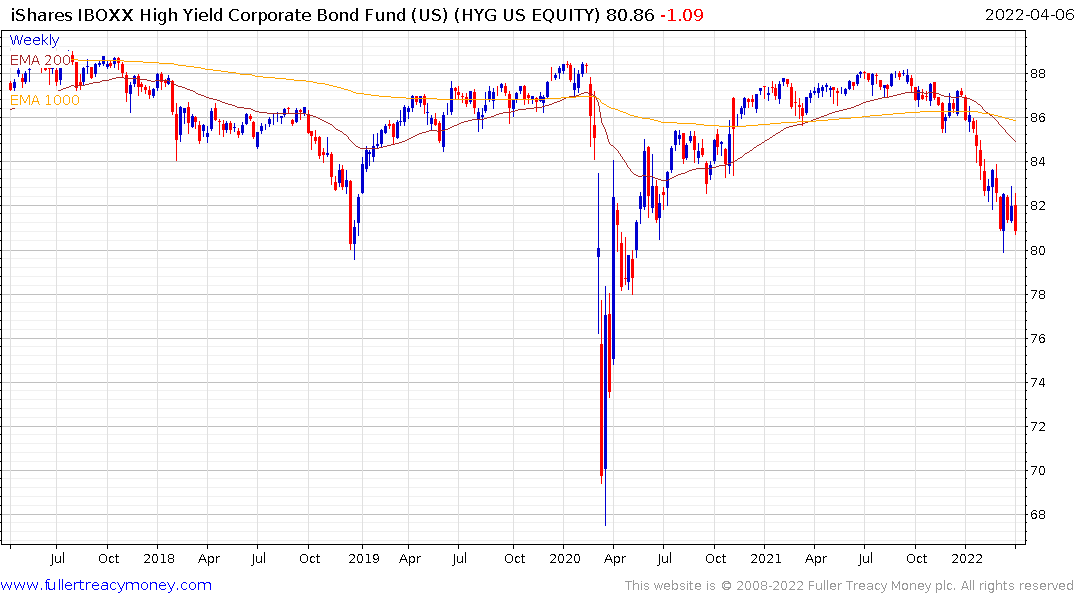

I still remember the look on my children’s faces when Toys R Us went bust. The next recession will weigh heavily on zombie companies. The iShares iBoxx High Yield ETF also continues to trend lower. At present high yield spreads are relatively well contained because Treasuries are falling at a similar pace.

Rising yield reintroduce a discount rate to valuation calculations and the net result is valuations have to come down.

The banking sector is losing revenue streams as rates rise. With mortgage rates at decade highs, refinancing revenue is drying up. The uncertainty over the economic outlook makes issuing loans riskier and the flat yield curve reduces profitability.

The KBW Nasdaq Global Bank Index failed to hold the breakout above 1000 again. The massive reaction against the prevailing uptrend confirms a medium-term peak. It is testing the region of the 1000-day MA and will need to bounce in a dynamic manner to question potential for the evolution of a new downtrend.

Banks tend to be lead indicators, so the growing global commonality of underperformance is a warning that global financial conditions are tightening.

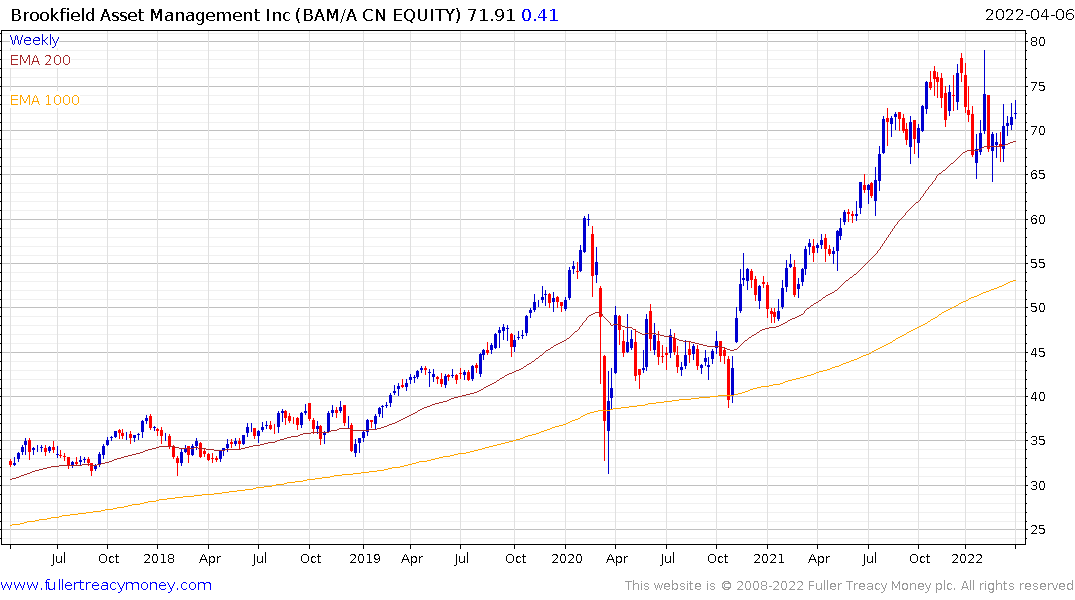

Brookfield Asset Management is much admired for its success in securing prime real estate at attractive prices. Nevertheless, it is exposed to the fact much of its valuation is attached to high property prices. The share has lost momentum and failed to hold breaks above C$75. It’s at risk of further weakness given the downward pressure on bank stocks. The UK listed iShares Listed Private Equity ETF has a similar pattern.