British Land bags £900m of property sales

This note from the Financial Times may be of interest to subscribers. Here it is in full:

British Land, one of the largest London-listed landlords, has sold over £900m of properties in the past nine months, taking advantage of investors' strong demand for real estate assets.

The company made £365m from residential sales - including its flagship luxury housing development, Clarges Mayfair - and £220m from retail property sales, it said in an update on trading on Tuesday.

Chief executive Chris Grigg said British Land had "continued to take advantage of strong investment markets to recycle capital, reports Kate Allen, property correspondent.

British Land's debt has dropped by £200m to £4.5bn in the three months to the end of December.

Its office skyscraper the Cheesegrater - officially known as the Leadenhall Building - is now 70 per cent let, while the 30-acre Broadgate estate is now fully let after flexible office space provider WeWork took 62,000 sq ft earlier this week.The supply of London office space is "constrained" and as a result "rents are responding well to strong demand", Mr Grigg said.

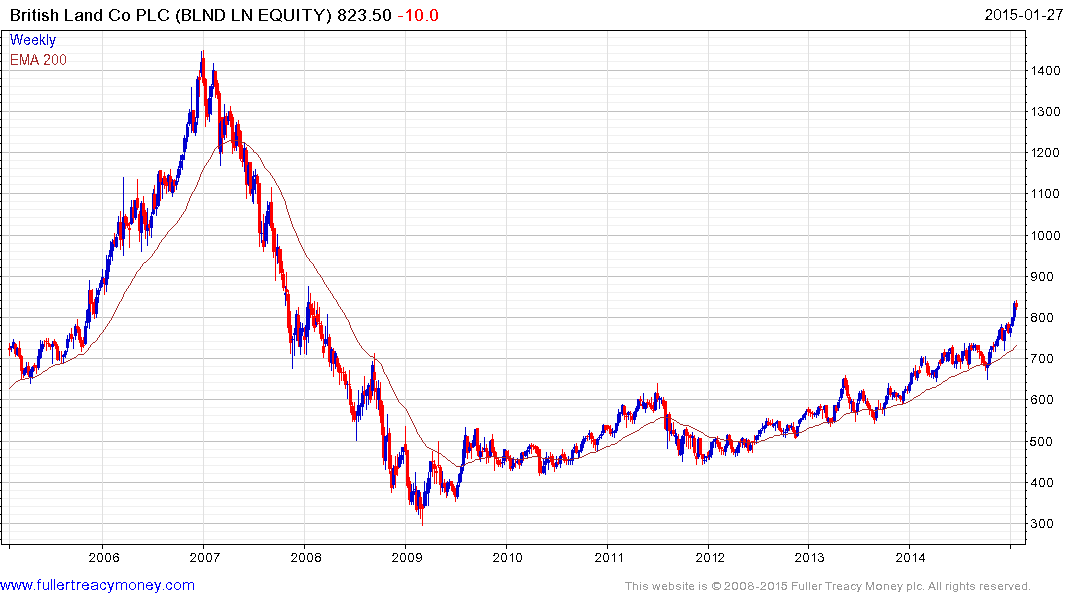

In my review of UK companies on Friday I mentioned the REITs sector and said I would return to it yesterday. On seeing British Land was due to post results I thought it might be better to wait an additional day.

The sector has been among the best performing in the UK over the last year with attractive yields and expanding P/Es. While the performance has been impressive the expansion of the sector’s P/E is nontrivial. The FTSE All Share REIT Index has an historic P/E of 5.85 but the vast majority of its constituents Estimated P/E for the current year is north of 20.

The Index, which yields 2.82%, has been trending steadily higher since early 2012 and is somewhat overbought relative to the trend mean as its tests the 3000 level. Some consolidation of recent gains is looking increasingly likely but a sustained move below the 200-day MA, currently near 2675 would be required to question medium-term uptrend consistency. Land Securities, British Land and Hammerson represent more than 50% of the Index and all share a similar pattern.

Property prices are well off their lows and in London above their peaks, while interest rates are still low and liquidity abundant. Much of this news has already been priced in but with the ECB about to embark on a record stimulus the liquidity fuelled environment could persist for another year or two. In addition to their reliable yields this should act as a support to prices following pullbacks.

With the prospect of asset price inflation in the Eurozone Hansteen Holdings (Est P/E 16.34, DY 4.97%) with its Euro focus (Germany 62.6%, UK 21.9%, Netherlands 11.1% and France 2.3%) may represent a catch up play relative to some of the large constituents in the Index. The share found support in the region of 100p from the middle of last year and a sustained move below it would be required to question medium-term recovery potential.