Britain Comes to Terms With Its New Water Poor Reality

This article from Bloomberg may be of interest. Here is a section:

By 2050, the UK’s Environment Agency expects the gap between available water and what’s needed by homes and businesses to reach 4 billion liters per day in England — enough to fill 1,600 Olympic size swimming pools. Leaks are part of the picture, but so is a neglected network, some of which was built more than 150 years ago, that doesn’t store enough for times of drought, and water consumption that outstrips many other parts of Europe.

The crisis has become a national obsession. The public is furious with a privatized English water industry that has paid out millions to executives and shareholders while failing to keep pace with population growth and climate pressures, and the government and regulators that have allowed it to happen. As well as the threat of water shortages, underdeveloped pipes and treatment plants mean raw sewage is frequently dumped in rivers and the sea, causing environmental damage.

Now, after years of delays, the UK is racing to fix its broken water system before it’s too late. “The worst risk has not materialized yet,” says Jim Hall, a professor of climate and environmental risk at Oxford University and a member of the government’s official infrastructure adviser. “There is some sense until now that we’ve got away with it,” he says, but “a severe and prolonged drought could materialize at any time.”

The population of Greater London declined between the 1950s and early 1980s but then jumped around 50% over the last forty years. There was no incentive to invest in water infrastructure during a time of declining population growth and it takes a long time for institutional mindsets to change. Today, there is urgency to the investment case because urgent remedial action in both storage and usage are necessary.

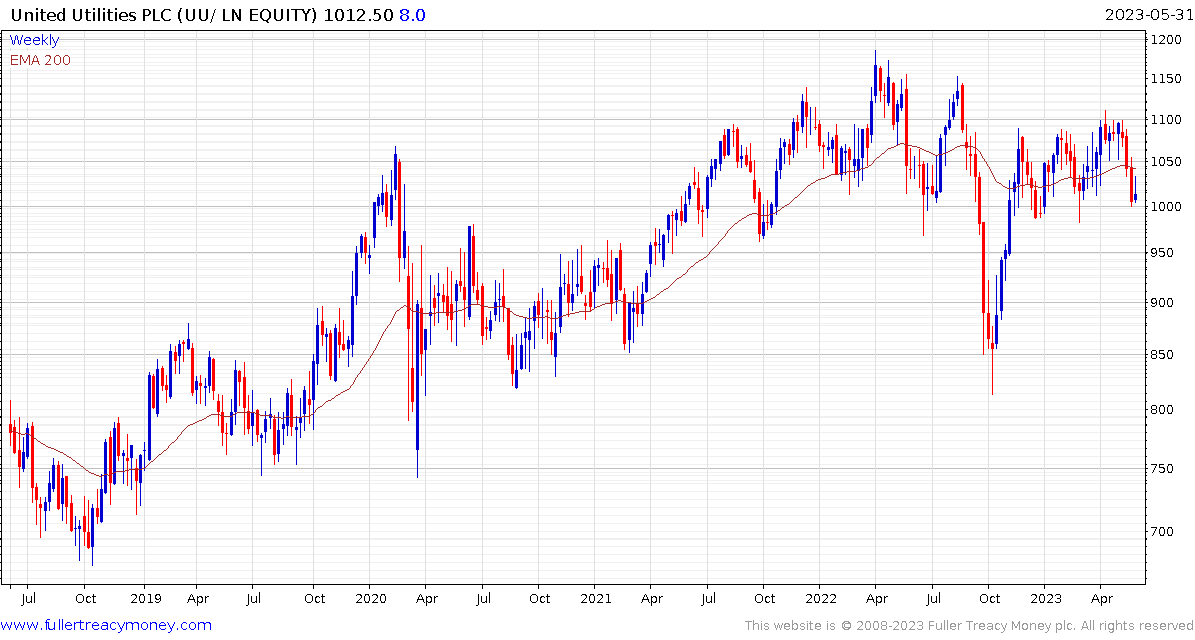

Both Severn Trent and United Utilities are already highly leveraged businesses and trading at rich valuations. That’s despite the wider UK equity market trading at a valuation discount to global peers. The implication is water bills will have to rise or the UK government will need to offer low-cost loans to ensure the companies remain solvent.

Both have been ranging in a volatile manner for the last two years and are testing potential areas of support that will need to hold if the benefit of the doubt is to be given to higher to lateral ranging.

Back to top