Bridgewater Executive Says Markets Pricing In "Magical Scenario"

This article from Bloomberg may be of interest to subscribers. Here is a section:

stock and bond markets are betting on a “magical scenario” where economic expansion continues even while the Federal Reserve raises rates to combat inflation, said Bridgewater Associates executive Karen Karniol-Tambour.

“If you look at history, that looks pretty unlikely,” Karniol-Tambour, the firm’s co-chief investment officer for sustainability, said Thursday in a Bloomberg Television interview.

She recommended that investors buy Treasury inflation-protected securities as well as commodities to hedge against rising prices and said nominal bonds are the “worst possible thing” investors can hold.Last month, Karniol-Tambour said the Fed would struggle to contain inflation even if it decided to raise rates five times this year. The central bank hiked by a quarter of a point Wednesday and signaled it would raise rates at each of its six remaining meetings this year.

She added that current economic and financial conditions echo those of the 1970s, when high inflation was coupled with a geopolitical shock.

“It’s just not pleasant to be in the Fed’s shoes and tighten into an exogenous supply shock in commodities that has to do with geopolitical events,” she said.

If the Fed begins to reduce the size of its balance sheet next month at a faster pace than the last time they attempted it, deflation will follow. There have only been a couple of examples of central banks reducing the size of their balance sheets. Every one has resulted in deflationary fears and sharply lower growth.

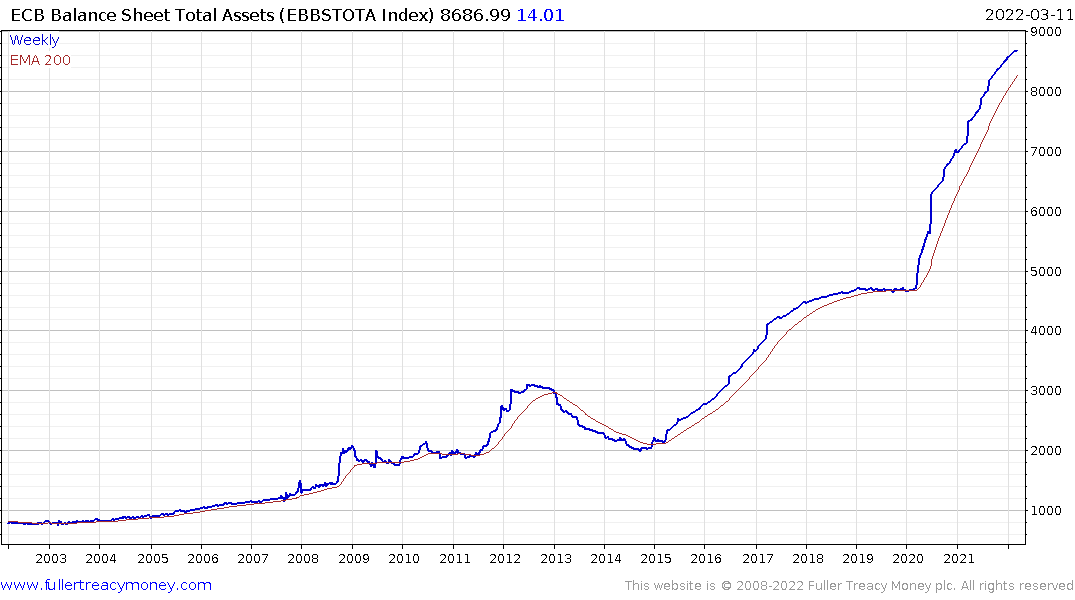

The ECB took €1 trillion out of circulation between 2012 and 2014. That contributed to widespread fear of deflation. When the central bank reversed course they had to double the size of the balance sheet just to get back to par.

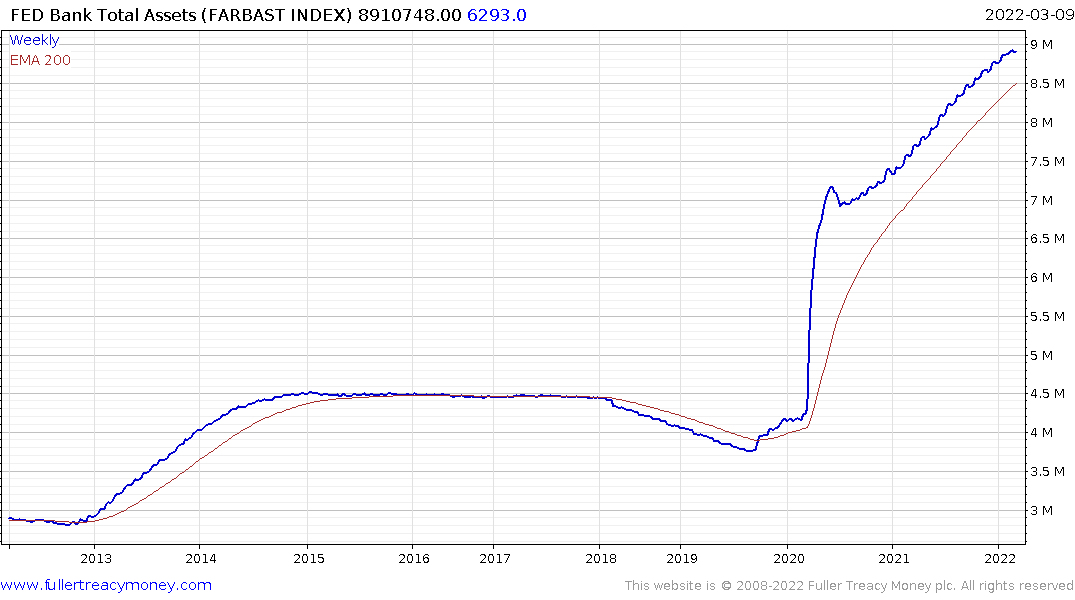

The Federal Reserve took about $750 billion out of circulation between 2017 and 2019. That caused liquidity issues first in the high yield market, then the repo market. They were already on the way to loosening against when the pandemic hit. The size of the balance sheet has more than doubled since.

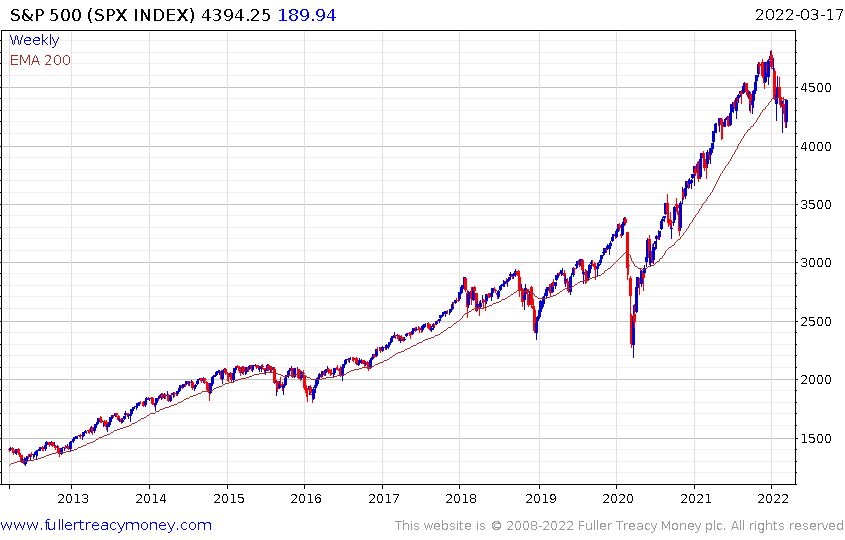

The pattern is clear. Stock markets will have trouble sustaining rallies while the Federal Reserve is reducing the size of its balance sheet. During a recession the balance sheet can be expected to double from the trough value, as the liquidity spigot is pushed to full bore. The Fed’s standing repo facility will undoubtedly play a part in that process.

The stock market continues to steady and quantitative tightening is not going to start until next month.

While we can expect liquidity measures to continue to tighten, it is also worth reminding ourselves it takes time for the full effect of tight liquidity to become apparent in the broad averages.

The absence of an April Fed meeting also suggests the Fed may be considering a 50-basis point hike in May if they are to keep to the seven hike forecasts.

Market enthusiasm is very much tied to the belief China is going to flood the market with liquidity. If instead they only do what is necessary to avoid a rout, that will contribute to global tightening. The fact the Renminbi remains steady suggests this is a possibility.

Back to top